Report Code: 11686 | Available Format: PDF | Pages: 106

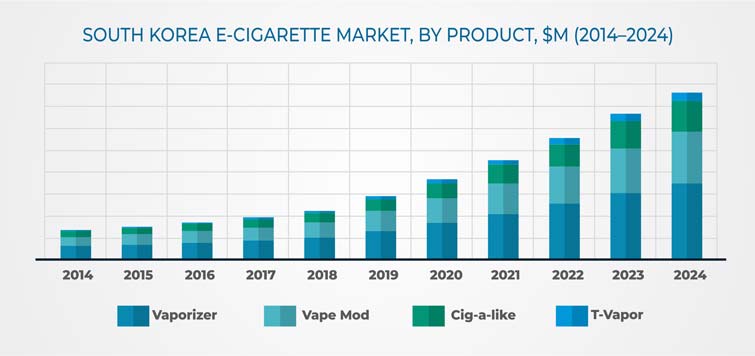

South Korea E-Cigarette Market Research Report: By Product (Cig-a-like, Vaporizer, Vape Mod, T-Vapor), Gender, Age-Group, Distribution Channel (Vape Shops, Online, Hypermarket/Supermarket, Tobacconist), Regional Insight (Chungcheong, Gangwon, Gyeonggi, Gyeongsang, Jeolla) - Industry Size, Share, Competition Analysis, and Growth Forecast to 2024

- Report Code: 11686

- Available Format: PDF

- Pages: 106

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

The South Korean e-cigarette market revenue stood at $874.3 million in 2018, and the market is expected to grow at a CAGR of 24.3% from 2019 to 2024. The key factors fueling the expansion of the market are the rising public preference for e-cigarettes, technological advancements in their product design, and increasing health consciousness.

The male category is dominating the e-cigarette market in South Korea, under the gender segment. This is credited to the fact that women are not allowed to consume tobacco products due to the religious values and conservatism of the country. However, with the rising urbanization rate and education level and launch of targeted marketing campaigns by companies, the female category is predicted to register rapid expansion in the coming years.

The 16–24 category, within the age group segment, led the market in 2018. Furthermore, the 25–34 category is set to exhibit the highest growth rate in the market from 2019 to 2024.

The Gyeonggi region held the largest market share between 2014 and 2018. The high disposable income of the people residing in the region due to the large-scale urbanization, including major infrastructural development in and around Seoul over the last two decades, is the major factor driving the South Korean e-cigarette market growth in this region. The household income of the populace in this region grew to $16,567.2 in 2018 from $15,335.4 in 2017, or by 8%.

Furthermore, the crackdown on the sales of cigarettes in the country by the government is predicted to continue in the coming years, thereby fueling the popularity of electronic variants. Moreover, consumers in the country have concerns regarding the quality of local and Chinese-made e-cigarettes. This perception is creating lucrative growth opportunities for global tobacco firms with established e-cigarette portfolios.

Trends

E-juice flavors, such as chocolate, bubble gum, fusions of several fruits and flavoring substances, mint, and menthol are trending in the South Korean e-cigarette market. For example, nearly 3 million adults are presently smoking e-cigarettes in South Korea as compared to only 1.7 million between 2014 and 2018 due to the introduction of various appealing flavors.

Drivers

The rapid advancements being made in the technology of such vaping devices are fueling the expansion of e-cigarette South Korean e-cigarette industry. Tobacco producers are increasingly focusing on developing new technologies and launching innovative products in order to penetrate the emerging market and gain an edge over their rivals.

For example, Japan Tobacco Inc. developed tobacco capsules in two new flavors, namely Pianissimo Aria Menthol and Pianissimo Pineapple Peach Yellow Cooler, under the Ploom TECH brand, in March 2019. Similarly, British American Tobacco p.l.c. developed two new cigarettes powered by the vaping technology — Vype iSwitch Maxx and Vype iSwitch — for replacing the conventional coil-and-wick heating system, in December 2018.

Competitive Landscape

The e-cigarette market players are increasingly focusing on strategic partnerships, mergers, and alliances to gain a market foothold. For instance, in December 2018, Altria Group Inc. purchased 35% stake in e-cigarette maker JUUL Labs Inc. at an amount of $12.8 billion. Its investment in JUUL Labs Inc. is the largest in the company’s history. This acquisition would enable the company to increase its presence in the e-cigarette market.

Some of the key players operating in the South Korea e-cigarette market include British American Tobacco p.l.c., Altria Group Inc., Japan Tobacco Inc., Imperial Brands PLC, Philip Morris International Inc., JUUL Labs Inc., Shenzhen iSmoka Electronics Co., Ltd., Shenzhen IVPS Technology Corporation Ltd., Innokin Technology Co. Ltd., Shenzhen Kanger Technology Co., Ltd, and Korea Tobacco & Ginseng Corporation.

.jpg)

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws