Report Code: 11542 | Available Format: PDF | Pages: 191

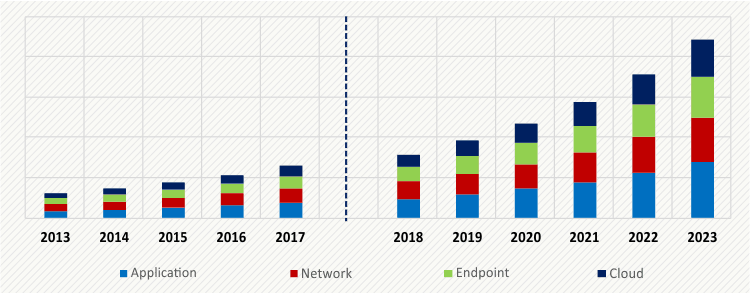

South America Cyber Security Market by Component (Solutions [Risk & Compliance Management, IAM, Firewall, Security & Vulnerability Management, Encryption, IDS/IPS, UTM, Disaster Recovery, Web Filtering, DDoS Mitigation, Antivirus/Antimalware, Data Loss Prevention], Services [Managed, Professional]), by Security Type (Application, Network, Endpoint, Cloud), by Deployment Type (On-Premises, Cloud), by Organization Size (Large Enterprises, SMEs), by Industry (Aerospace & Defense, Government, BFSI, IT & Telecom, Healthcare, Retail, Manufacturing), by Geography (Brazil, Argentina, Colombia, Chile, Peru) - Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11542

- Available Format: PDF

- Pages: 191

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

The South American cyber security market size was $6,582.7 million in 2017, and it is expected to exhibit a CAGR of 22.7% during 2018–2023. Digital transformation, with the integration of the internet of things (IoT) technology, a mushrooming demand for end-to-end network security and visibility, and rising adherence to government regulations are driving the market growth.

The solutions category, within the component segment, accounted for the larger revenue share, of 66.0%, in 2017, and it is expected to retain its dominance in the foreseeable future. Further, within the solutions category, risk and compliance management solutions accounted for the most-significant market share in 2017.

The on-premises category, under the deployment type segment, held the larger revenue share in the South American cyber security industry, of 56.7%, in 2017. The cloud category is expected to exhibit the faster growth in the coming years due to the surging deployment of cloud-based cybersecurity solutions by small and medium-sized enterprises (SMEs).

The aerospace and defense category held the largest share, of 21.0%, in 2017, under the industry segment. This was due to the soaring foreign investments in the cyber defense domain in South American nations.

SOUTH AMERICA CYBER SECURITY MARKET, BY SECURITY TYPE, $M (2013-2023)

Market Dynamics

The rising application of artificial intelligence (AI) and machine learning (ML) in cybersecurity has become a prominent trend in the South American cyber security market. Organizations across the region are deploying AI-enabled encryption models to detect and prevent potential cyber threats. AI tools automatically detect unusual patterns in the IoT and encrypted web traffic environments to enhance the network security infrastructure, as this technology can learn from the past encounters with malicious threats.

Whereas, ML is being deployed in such solutions to predict and identify anomalies, owing to the accelerating rate of data consumption and increasing data interoperability. This technology allows for the collection and processing of data for a better evaluation of cyberattacks and development of a strong defense system.

The increasing requirement for an effective cyber defense mechanism in South America can be credited to the rising degree of digital connectivity for sharing data. In this regard, the surging utilization of IoT is expected to drive the South American cyber security market in the coming years. IoT supports smart buildings for efficient building management and smart traffic light systems for real-time traffic management.

The expansion and evolution of the IoT domain have led to the emergence of IoT botnets. A botnet is a collection of internet-connected devices, including smartphones and computers, which are corrupted with malware and remotely controlled without the owner's knowledge. Cybercriminals are exploiting this security weakness of IoT devices to launch distributed denial of service (DDoS) attacks, to access critical information.

As a result, countries such as Chile, Brazil, and Colombia are continuously working toward the adoption of an integrated regulatory framework for cybersecurity. Thus, the rise in the implementation of such regulations and surge in the incidence of cyberattacks are the major growth drivers for the market.

The growth of the cyber security market in South America is hindered by the budget constraints of organizations and lack of an adequate workforce of skilled professionals for meeting the cybersecurity needs. The mitigation of malware attacks requires experts for the detection and blockage of potential threats. According to the World Economic Forum (WEF), South America has an almost 50% smaller skilled workforce, which is expected to obstruct the growth of the market in the region.

Additionally, the South American cyber security market growth is weighed down by the low budgetary allocation for the purpose by public and private organizations. The cybersecurity expenditure of organizations is often eclipsed by the spending on other areas, including marketing and training. This is due to the scarcity of knowledge about the calculation of the anticipated security threats faced by organizations and the subsequent investment required to deal with them.

Enterprises are increasingly switching from the traditional network architecture to cloud-based cyber security systems because of the latter’s lower cost. Cloud-based services are affordable for large enterprises, as well as SMEs. Additionally, such solutions enable smooth collaboration of data, intelligent gathering of data and threat modeling, and detection and blocking of cyberattacks with a minute delay between identification and remediation, which further leads to secure communications. The mounting demand for cloud-based solutions can be credited to the advancements in the AI, ML, and natural language processing (NLP) technologies. This is further providing extensive growth opportunities to the players in the cyber security market in South America.

Competitive Landscape

Rising cyberattacks in South America have impelled the government to formulate and adopt integrated regulatory frameworks, binding all aspects of cyberthreats, predominantly data privacy. The adoption of these integrated regulatory frameworks has, in turn, created a huge opportunity for the market players, such as IBM Corporation, Cisco Systems Inc., and Symantec Corporation.

Some of the other key players operating in the cyber security industry are BAE Systems plc, RSA Security LLC, Palo Alto Networks Inc., Fortinet Inc., FireEye Inc., Check Point Software Technologies Ltd., and Juniper Networks Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws