Report Code: 11070 | Available Format: PDF | Pages: 230

Solar Photovoltaic Glass Market Size and Share Analysis by Application (Crystalline Silicon Photovoltaic Module, Perovskite Module, Thin-Film Photovoltaic Module), Type (AR-Coated Solar Photovoltaic Glass, Tempered Solar Photovoltaic Glass, TCO-Coated Solar Photovoltaic Glass), End User (Residential, Commercial, Utility), Installation (Float Glass Technology, Patterned Glass Technology) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 11070

- Available Format: PDF

- Pages: 230

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Solar Photovoltaic Glass Market Outlook

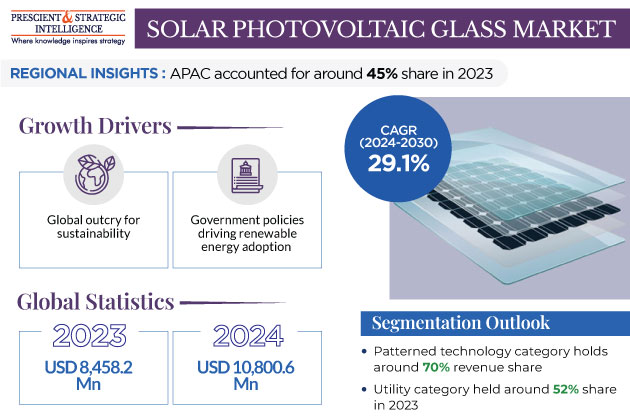

The solar photovoltaic glass market size stood at an estimated USD 8,458.2 million in 2023, and it is expected to witness a compound annual growth rate of 29.1% during 2024–2030, to reach USD 51,223.5 million by 2030.

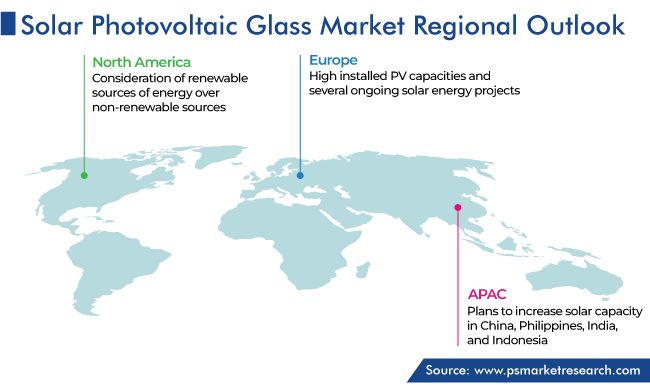

The growing recognition of clean sources of electricity and government initiatives to promote the use of sustainable energy sources are some of the major forces propelling the market expansion.

- Solar PV glass is incorporated with a transparent semiconductor, known as the photovoltaic cell.

- The cells are fitted between two sheets of glass and are connected to each other.

- It also provides sound and thermal insulation, filtering up to 99% of the harmful UV radiation and absorbing up to 95% of IR radiation.

The construction of new green buildings is increasing across the world, which is a key market trend. Various organizations are opting for green buildings as well as related products and systems. To keep pace with sustainability and achieve net-zero emission objectives, biodegradable, recycled/recyclable, and renewable materials are being used together for the construction of such buildings. The facades, curtain walls, and windows of the building can be utilized to produce solar energy. Green buildings are gaining popularity and photovoltaics enable them to generate electricity from a renewable source of energy, i.e., solar.

Global Outcry for Sustainability Is Major Market Driver

The world is focusing on shifting from carbon-emitting fuels to cleaner sources of energy, to reduce carbon footprint and achieve net-zero emission objectives. Renewable sources tend to cause less damage to the environment and are abundant in nature.

- According to data from the U.S. Energy Information Administration (EIA), solar power installations for residential use increased by approximately 34% from 2020 to 2021.

- In the EU as well, solar photovoltaic installed generation capacity reached 136 GW at the end of 2020, and in 2019, 19.7% of the electricity consumed in the EU was from renewable sources.

The material is being used in buildings for roofs, windows, and facades, as a part of building-integrated photovoltaics, to generate energy. Additionally, solar control glass is being used in various residential and commercial buildings to limit heat transmission, thereby reducing the usage of air conditioners and increasing the savings on power bills.

Furthermore, according to Duncan Nsevett, the number of photovoltaic patent filings has been significantly increasing across the world. Thus, the surging recognition of clean and renewable sources is expected to propel the market growth.

Government Policies Driving Renewable Energy Adoption

Governments across the world are taking several initiatives to promote the use of renewable sources of electricity. For instance, in India’s Union Budget 2022–2023, about USD 2.57 billion has been allocated for the Production Linked Incentive (PLI) scheme to promote the manufacturing of PV modules. Similarly, in the U.S., the Bureau of Land Management approved the Arica and Victory Pass solar projects in California, which will provide up to 465 MW of electricity with up to 400 MW of battery storage. In the same way, in July 2021, an online platform that enables jurisdictions to rapidly approve residential solar installation permits—the Solar Automated Permit Processing (SolarAPP+) tool—was launched by the U.S. DoE.

- According to an article published in 2022, China’s PV glass capacity reached 64,000 metric tons (MT) per day across 348 production lines from 38 companies.

- The State Grid Corporation of China (SGCC) has planned to allocate USD 4.3 billion (CNY 26.07 billion) for new incentives, and the Ministry of Finance is currently reviewing the proposed budget.

- At the end of 2020, the EU reached 136 GW of photovoltaic installed generation capacity, adding more than 18 GW that year.

- The EU aims to bring online over 320 GW of capacity by 2025 and almost 600 GW by 2030.

Hence, the gradual inclination of governments toward safeguarding the environment would propel the market growth in the coming years.

Crystalline Silicon Photovoltaic Module Category Is Likely To Dominate Market

The crystalline silicon photovoltaic module category, under the application segment, is likely to dominate the market and grow at a CAGR of 29.1% during the projection period.

These modules are made up of crystalline silicon solar cells, which are made of highly pure silicon wafers. These modules can be used in the residential, commercial, and utility sectors, which is why it is the most-extensively used PV technology.

Additionally, the perovskite module is likely to hold a significant market share in the coming years. They are thin-film devices wherein layers of materials are either coated or printed from liquid inks or vacuum-deposited. Their growing popularity is owed to their high UV spectrum absorption efficiency and cost-effectiveness.

| Report Attribute | Details |

Market Size in 2023 |

USD 8,458.2 Million |

Market Size in 2024 |

USD 10,800.6 Million |

Revenue Forecast in 2030 |

USD 51,223.5 Million |

Growth Rate |

29.1% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Application; By Type; By End User; By Installation; By Region |

Explore more about this report - Request free sample

TCO-Coated Category To Exhibit Substantial Growth

The transparent conductive oxide (TCO)-coated category, under segmentation by type, held a significant share during the historical period (2017–2023), and it is likely to advance at a CAGR of 29.8% during the projection period.

- The growth can be attributed to the efficiency of these variants in offering a high rate of transmission and a high haze value.

- Furthermore, the ability of it to be transparent yet conduct electricity makes it optimal to be used in the solar photovoltaic glass industry.

Anti-reflective (AR) coated variants are also prominently used, and this category is expected to hold 50% share by 2030.

- In it, the AR coating is added by plating one layer of an AR film before the glass is tempered.

- The coating ensures improved performance of the module, an increment of light transmission, and a decrement in reflection.

Moreover, another significant category is tempered glass, which is also referred to as safety or toughened glass; it is manufactured by thermal or chemical means. It is used in PV panels as it is stronger than other types of glass, i.e., it does not break easily, and even if it does, it shatters into several small pieces, thus preventing harm to people.

Patterned Technology Likely To Hold Major Share

The patterned technology, under segmentation by installation, is expected to hold the major share of the solar photovoltaic glass market during the projection period.

- It is likely to grow at a CAGR of 30% owing to factors such as the efficiency of patterned variants to allow the focus of light on the PV cells in a controlled manner and high transmission as well as low reflection for improved efficiency of the modules.

- Additionally, patterns enable easier lamination, a non-blinding effect, and better aesthetics for PV modules.

The other category, which is float technology, involves a process wherein molten glass is poured over molten tin and then cooled. It has a smooth finish and is free of distortion, hence making it optimal for use in solar photovoltaic modules.

APAC Region Held Major Share of Solar PV Glass Market

The APAC region held the largest share in 2023, and it is expected to grow at a CAGR of 33% during the projection period. Various countries in the region, such as China, the Philippines, India, and Indonesia, have plans to increase their solar capacities by 2030. China, which has a large number of PV material manufacturers, alone would account for approximately 60% of the globally installed PV capacity of 1,500 GW by 2030.

- The demand for clean and sustainable sources in the region has been on a constant rise, and the sun is one such source.

- The APAC region has access to abundant UV radiation, and to meet the power supply needs of highly populous countries in the region, such as China and India, renewable sources of energy are being explored and utilized.

- Over the past few years, countries such as China, India, South Korea, and Vietnam have significantly increased their solar capacities, wherein China installed 53 GW in 2021.

In addition, the transition to cleaner sources of energy for meeting the energy demands in the region and supportive initiatives by governments are expected to propel the demand for renewable energy components such as photovoltaic glass.

Top Solar Photovoltaic Glass Companies:

- Nippon Sheet Glass Co Ltd.

- AGC Inc.

- KANEKA CORPORATION

- Sisecam

- Xinyi Solar Holdings Limited

- Taiwan Glass Ind. Corp.

- Flat Glass Group CO. LTD.

- Borosil Renewables Ltd.

- IRICO Group New Energy Co Ltd.

- Onyx Solar Group LLC

- Targray Technology International Inc.

- Qingdao Jinxin Glass Co. Ltd.

Market Size Breakdown by Segment

This report offers deep insights into the solar photovoltaic glass market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Application

- Crystalline Silicon Photovoltaic Module

- Perovskite Module

- Thin-Film Photovoltaic Module

Based on Type

- AR-Coated Solar Photovoltaic Glass

- Tempered Solar Photovoltaic Glass

- TCO-Coated Solar Photovoltaic Glass

Based on End User

- Residential

- Commercial

- Utility

Based on Installation

- Float Glass Technology

- Patterned Glass Technology

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws