SOC as a Service Market Analysis

Explore In-Depth SOC as a Service Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 12378

Explore In-Depth SOC as a Service Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

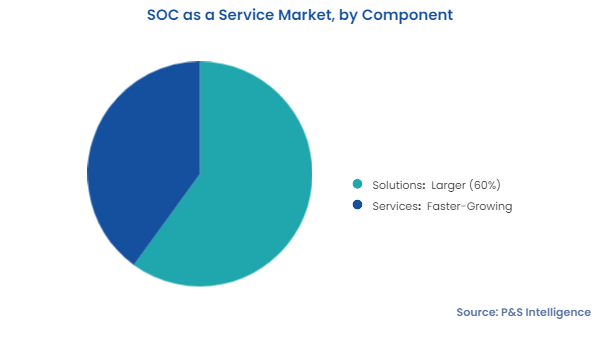

The solutions category dominates the market with a share of around 60%, whereas the service category is expected to witness higher growth rate of, of 14.1%, during the forecast period.

This is attributed to the rising need for monitoring, detection, prevention, and response services against cyberthreats. Outsourcing these services allows companies to limit their IT spending on computing and human resources, thus making operations more cost-effective. Further, with cyberattacks becoming increasingly complex, the demand for real-time threat monitoring and detection services continues to rise. All this can be linked to the increasing adoption of remote working models and cloud solutions around the world.

The following components have been analyzed:

The co-managed category holds the larger share, of around 80%, in 2024. This is because these solutions can be customized by organizations as per their workflows and specific use cases. Additionally, this model allows companies to leverage external advice to bolster their in-house IT security capabilities. Via this approach, enterprises generally utilize their internal IT resources for daily operations and decision making and offload the more-complex aspects of their IT security, such system upgrades and data backup, to third-party vendors.

The fully managed bifurcation is the faster-growing category in the coming years. This model allows companies to have their third-party vendors modify their IT security solutions as the nature of cybercrimes or their workload changes, without investing in an in-house IT security team. The reduction of the IT security workload on the in-house staff allows it to focus on the core operations of their company and be more involved more in the decision-making process.

The segment is bifurcated as below:

The detection service category accounts for the largest market share, of around 40%, in 2024 owing to the increasing adoption of digital technologies. Additionally, targeted attacks are becoming more common as people rely more on digital information and share massive amounts of data, around the world. To minimize this, the demand for detection services across organizations is rising.

The prevention category will have the highest CAGR in the forecast period. This is attributed to the need for compliance with global data privacy laws, such as GDPR, ISO 27001, and HIPAA. Moreover, since the mere detection of the attack might not be enough to stop it, ultimately costing companies loads of money, enterprises are taking proactive steps to prevent such attacks from happening in the first place.

The following services are covered:

Large enterprises lead the market in 2024. These companies have several operations; thus, they are always implementing new and developed technologies to detect, prevent, and respond to any kind of cyberattack. Furthermore, multinational organizations have extensive corporate networks and multiple revenue streams, therefore they implement SOCaaS solutions in large numbers, resulting in secure access to financial resources.

SMEs are expected to witness the higher CAGR, of 15%, during the forecast period. This growth can be attributable to the increasing cyberattacks on SMEs. Around 43% of cyberattacks are pointed at SMEs, but just 14% of the SMEs are equipped to defend themselves. With the advent of cloud computing, several out-of-reach software solutions have become accessible to SMEs.

The following are the categories of this segment:

Endpoint security dominates the market. This is attributed to the constant increase in the number of devices, including smartphones, tablets, laptops, and personal digital assistants, connecting to enterprise networks. They can be both the source or the target of cyberattacks on a company, which makes their monitoring, the detection of malicious activity, and responding to them vital.

Cloud security is the fastest-growing category during the forecast period. With the advent of high-bandwidth internet connections, enterprises and individuals are increasingly storing their data on cloud platforms to save on IT expenses. The preference for cloud computing is primarily driven by the growing trend of remote workforces, which raises the demand for enterprise asset mobility. Since clouds are majorly shared resources, they are highly vulnerable to all kinds of cyberattacks.

We have studied the below-mentioned applications:

The BFSI sector is the largest end user in the market, accounting for around 45% revenue share in 2024, as it is one of the most attractive industries for cybercriminals because of its nature of business. Typically, an employee of a financial service organization gets access to roughly 11 million files on the first day of work. This count rises to 20 million files for employees working in large enterprises.

Also, more than 70% of cyberattacks are targeted at the financial sector. For example, more than 30 billion accounts are expected to be breached by 2030. The organizations operating in the sector are largely prone to phishing attacks, which incur the cost of around USD 6 million per data breach.

The healthcare sector is expected to witness the highest CAGR during the forecast period, rising substantially. Since healthcare organizations maintain a huge amount of Personally Identifiable Information Payment Card Industry (PII PCI) data for each patient for billing purposes, cybercriminals are attracted to these organizations, resulting in the need to implement the security operation center as a service.

Moreover, most of the PII PCI data is sent between hospitals, clinics, and laboratories unencrypted. Because of the widespread use of digital medical equipment, network administration has become critical to protect devices from malicious cyberattacks. In fact, in the last three years, more than 90% of healthcare organizations have experienced a cyberattack. SOCaaS solutions assist enterprises in this sector in securing the data of their customers and patients.

The report contains analysis on the following end users:

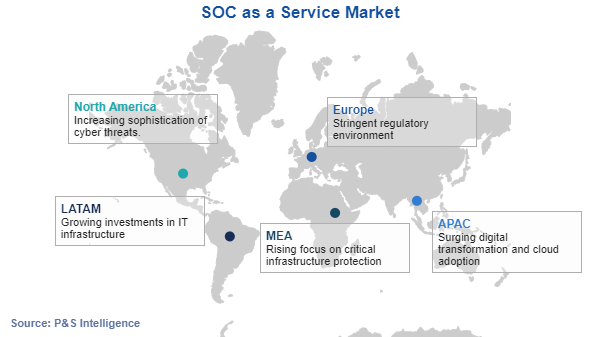

The geographical breakdown of the market is as follows:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages