Report Code: 11702 | Available Format: PDF | Pages: 163

Small Joint Reconstructive Implants Market Research Report: By Type (Hand and Wrist, Foot and Ankle, Staple Fixation), Material (Metal, Polymer), End-User (Hospitals, Ambulatory Surgical Centers) - Regional Insight (U.S., Canada, Germany, France, U.K., China, Japan, Brazil, Mexico, Saudi Arabia, South Africa) - Global Industry Analysis and Demand Forecast to 2024

- Report Code: 11702

- Available Format: PDF

- Pages: 163

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Small Joint Reconstructive Implants Market Overview

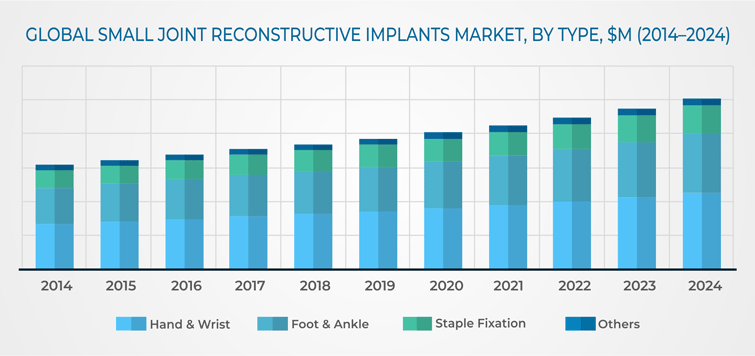

The global small joint reconstructive implants market generated $7.4 billion revenue in 2018, and is expected to grow with a CAGR of 5.5% during the forecast period, mainly on account of rising incidences of arthritis, surging geriatric population, and increasing prevalence of osteoporosis, across the globe.

On the basis of type, the small joint reconstructive implants market is classified into hand and wrist, foot and ankle, staple fixation, and others. Among these, the hand and wrist category held the largest share, of 44.2%, in 2018. This can be ascribed to the increasing number of sport injuries and growing geriatric population across the globe.

Based on material, the small joint reconstructive implants market is categorized into metal and polymer. Reconstructive implants are usually made up of metals, as polymers have tendency to degrade, if not constructed properly. Therefore, the polymer-based implants category is expected to hold smaller market share, of 45.8%, by 2024 in the market.

On the basis of end user, the small joint reconstructive implants market is bifurcated into hospitals and ambulatory surgical centers (ASCs). The ASCs are now being preferred more than hospitals for better outpatient care and low-cost services. Therefore, this end-user category is expected to witness faster growth, advancing at a CAGR of 5.6%, during the forecast period.

Geographically, North America is expected to be the largest revenue generating region in the small joint reconstructive implants market, with an expected contribution of 36.4% by 2024. However, APAC is expected to be the fastest growing market for these products, globally, garnering a CAGR of 6.1% during the forecast period. This is primarily due to the increasing healthcare expenditure and access to better healthcare facilities in the APAC countries.

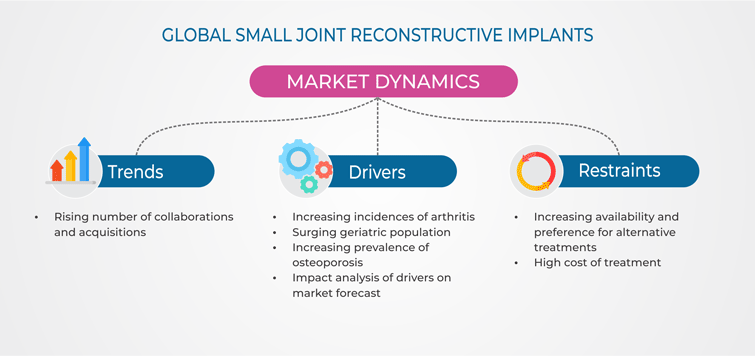

Small Joint Reconstructive Implants Market Dynamics

Globally, the prevalence of arthritis is on a rise. With the increasing incidences of arthritis, the growth of the small joint reconstructive implants market may be affected positively. According to the Arthritis Foundation, it is a leading cause of disability among adults in the U.S. Moreover, approximately, 300,000 babies and children have arthritis or a rheumatic condition in the country. It is also expected that more than 74 million Americans would be suffering from arthritis by 2040.

A similar scenario is likely to be seen in Europe. According to a study conducted by the National Rheumatoid Arthritis Society of Europe in 2017, the annual incidence of rheumatoid arthritis estimated approximately between 20 and 50 cases per 100,000 population in the European countries. All these factors lead to strong positive impact on the growth of the small joint reconstructive implants market.

In addition, the elderly population is more susceptible to bone associated disabilities, due to which the demand for medical devices, which aid in the diagnosis and management of diseases, is high in this demographic category. Thus, with the increasing geriatric population, the demand for small joint reconstructive implants is expected to rise in various regions across the globe, to facilitate proper diagnosis and treatment. Therefore, surge in geriatric population is propelling the growth of small joint reconstructive implants market.

Small Joint Reconstructive Implants Market Competitive Landscape

In recent years, major players in the small joint reconstructive implants market have taken several strategic measures, such as product launches, acquisitions, and product approvals, to sustain and improve their position in the industry. For instance, in June 2019, Smith & Nephew plc announced acquisition of Brainlab’s orthopedic joint reconstruction business. This acquisition supports Smith & Nephew plc’s strategy to invest in advanced technologies, which include multi-asset digital surgery and robotic ecosystem. Brainlab, headquartered in Munich, Germany, is engaged in the development and manufacturing of software-driven medical technology products.

In February 2019, Colfax Corporation completed its earlier announced acquisition of DJO Global Inc., one of the leading manufacturers of small joint implants. The acquisition benefitted Colfax Corporation in diversifying its portfolio related to small joint reconstructive implants and increasing its revenue; while, DJO Global Inc. got the advantage of increase in consumer base.

Furthermore, in June 2018, Johnson & Johnson Medical Devices Companies, through its subsidiary, DePuy Synthes, announced the launch of DYNACORD Suture to repair soft tissue injury (rotator cuff in shoulders) in the U.S. The product is available as a part of the DePuy Synthes Mitek Sports Medicine portfolio adding to DePuy Synthes’ innovative solutions designed to help address unmet patient needs in soft tissue repair.

Smith & Nephew plc, Integra LifeSciences Holdings Corporation, DePuy Synthes Companies, Zimmer Biomet Holdings Inc., Stryker Corporation, Orthofix Medical Inc., Wright Medical Group N.V., Arthrex Inc., Acumed LLC, Exactech Inc., and DJO Global Inc. are some eminent players in the global small joint reconstructive implants market.

The small joint reconstructive implants market growth will be driven by the increasing incidence of arthritis and osteoporosis and soaring geriatric population.

The small joint reconstructive implants industry generated revenue of $7.4 billion in 2018.

Under the type segment, the categories of the small joint reconstructive implants market are foot and ankle, hand and wrist, and staple fixation.

Ambulatory surgical centers (ASCs) and hospitals are the biggest end users in the small joint reconstructive implants market.

Hospitals will record the higher revenue in the small joint reconstructive implants industry in the coming years.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws