Market Statistics

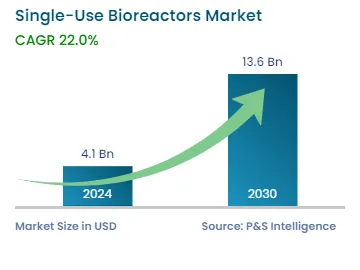

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4.1 Billion |

| 2030 Forecast | USD 13.6 Billion |

| Growth Rate(CAGR) | 22% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12634

Get a Comprehensive Overview of the Single-Use Bioreactors Market Report Prepared by P&S Intelligence, Segmented by Product Type (Systems, Media Bags, Assemblies), Type (Wave-Induced, Stirred-Tank), Cell Type (Mammalian Cells, Yeast Cells, Bacterial Cells), Molecule Type (Monoclonal Antibodies, Gene-Modified Cells, Vaccines, Stem Cells), Application (Research & Development, Process Development, Bioproduction), Usage Type (Lab-Scale Production, Pilot-Scale Production, Large-Scale Production), End User (CROs & CMOs, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4.1 Billion |

| 2030 Forecast | USD 13.6 Billion |

| Growth Rate(CAGR) | 22% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global single-use bioreactors market was valued at USD 4.1 billion in 2024, which is expected to reach USD 13.6 billion by 2030, growing at a CAGR of 22% between 2024 and 2030. This is ascribed to the rising demand for biologic and biosimilar drugs due to the increasing prevalence of infectious and chronic diseases, and the availability of cutting-edge single-use bioreactors.

These bioreactors offer many advantages over traditional ones, such as reduced turnaround time and downtime, easy installation, no risk of cross-contamination, and reduced operating costs and capital investments. Moreover, due to their reusability, they eliminate the need for cleaning and the bags used in them are able to adjust to different volumes.

In the last few years, the world has seen a tremendous upsurge in infectious diseases. For instance, the COVID-19 outbreak has led to the increased adoption of cutting-edge and flexible technologies by life sciences and biopharmaceutical firms, due to the requirement for fast and mass production of vaccines against the virus. These have resulted in an upsurge in the demand for single-use systems. Additionally, the modular nature of such systems and the flexibility offered by the same have resulted in local manufacturing in emerging nations that are unable to bear investments, which, in turn, support the market. Also, these systems are widely used for the production of viral vaccines, especially during the COVID-19 outbreak.

Certain manufacturers are utilizing bioreactors to culture apt host cells for the COVID-19 virus in order to study the pathogenesis of the virus in human beings. Furthermore, a number of companies collaborated with each other to improve their market position. For instance, in September 2020, a U.S.-based company, ABEC announced that it would provide 6 four-thousand-liter CSR bioreactors to Indian-based firm Serum Institute of India Pvt. Ltd. for the production of Novavax’ COVID-19 vaccine candidate, NVX‑CoV2373.

Furthermore, many biopharmaceutical, biotechnological, and pharmaceutical firms are dealing with an immense amount of pressure both cost and time-wise for the production of therapeutics. Presently, in order to produce new medicine as fast as possible, the focus is aimed on time to market and flexible production approach for biopharmaceutical therapeutics. Therefore, many such life sciences firms are moving toward a hybrid approach, which involves the development of certain components of the procedure utilizing single-use technologies. Moreover, the benefits of using such facilities involve reduced expenditure and less support infrastructure. Further, due to the flexibility offered by such systems, they are increasingly used by contract development and manufacturing organizations (CDMOs)

A significant rise in the adoption of such bioreactors by startups and small & medium-sized enterprises has been observed. This is because the establishment of a biomanufacturing facility requires substantial capital investments. Moreover, small-scale biotechnological, pharmaceutical, and biopharmaceutical firms produce fewer batches annually. Also, for such small-scale players, establishing stainless steel facility can be costly. Thus, emerging companies are adopting single-use systems in their manufacturing units, as they require less capital investments, as validation, sterilization, cleaning, and changeover are not needed in such facilities.

On the basis of product type, the system category leads the market, accounting for a revenue share of 55% in 2022. This is attributable to the extensive utilization of such systems in biopharmaceutical manufacturing facilities requiring a high yield of products. Additionally, such systems are economical, versatile, and possess large-scale production capabilities. Moreover, there is a surging need for rapid development of biotherapeutics, such as antibodies, hormones, vaccines, and enzymes, in large quantities, which can be produced in such bioreactors. Therefore, all these factors are propelling the growth of the market in this category.

On the basis of the type segment, stirred-tank bioreactors accounted for the largest revenue share, of 45%, in 2022. This is attributable to numerous advantages offered by them such as low operating costs, good fluid mixing ability and oxygen transfer, and easy scale-up.

Whereas, the wave-induced category is projected to witness significant growth during the forecast period. This can be attributed to the manufacturing developments in this type of system. Furthermore, advantages like flexible configuration of accessories, convenient handling, low costs, and long-life cycle are posing a positive impact on the market in this category.

On the basis of the cell type segment, the mammalian cells category dominated the market in 2022. This is because these cells are widely used for the development of recombinant proteins and biopharmaceutical therapies. According to a study, it has been observed that a large amount of biopharmaceutical candidates is developed using the mammalian cell culture.

Whereas, the yeast cells category is projected to display significant growth during the forecast period. This can be because these cells offer advantages in the production of therapeutic recombinants and aid in serving as heterologous and homologous hosts for biopharmaceutical synthesis. Furthermore, advantages offered by them such as easy gene manipulation, significant growth on affordable media, and ease of addition of post-translational alterations of eukaryotes have gained the attention of several research organizations and researchers to utilize such cells in clinical settings.

On the basis of molecule type, the vaccines category accounted for the largest revenue share in 2022. This is accredited to the upsurge in infectious diseases over the last few years. The rise in contagious ailments has led to a surge in the mass production of vaccines for prophylaxis and therapeutic purposes. Additionally, the outbreak of the COVID-19 pandemic led many biopharmaceutical firms to manufacture vaccines rapidly and in large amounts. This led them to adopt single-use bioreactors, as they provide simple installation, require less capital investments, and eliminate validation issues and others. All these benefits offered by the system pose a positive impact on the single-use bioreactors market.

Furthermore, the monoclonal antibodies category holds a substantial share as well in the industry. This is accredited to the growing prevalence of severe chronic ailments and the rising use of mAbs for the treatment of the same. mAbs are obtained from biological sources and are used to produce antibodies for the treatment of diseases like blood cancer and autoimmune ailments. Thus, due to several benefits, the requirement for monoclonal antibodies is also on the rise. Moreover, according to a study, it was observed that the production, efficiency, and performance of monoclonal antibodies can be accelerated with the use of single-use bioreactors.

Additionally, the surging number of collaborations among top players, the rising research and development initiatives, the increasing demand for therapeutics, and the growing cases of ailments are contributing to the market growth in this category. For instance, in January 2022, an Australian firm HaemaLogiX collaborated with a Swiss pharmaceutical manufacturing company Lonza. As per the agreement, Lonza would manufacture a drug substance of HeamLogiX lead drug molecule for multiple myeloma.

In addition, the gene-modified cells category is expected to display a high growth rate during the forecast period. This can be attributed to the advancements in the field of genetics and genomics, and the surging adoption of cell and gene therapies for the treatment of several serious genetic disorders like sickle cell anemia, hemophilia, cystic fibrosis, and muscular dystrophy.

On the basis of the usage type segment, the lab-scale production category leads the single-use bioreactors market. This is because the biopharmaceutical industry requires the frequent utilization of bioreactors for various clinical and preclinical research purposes. Additionally, the growing acceptance and advancements in single-use technologies will further boost the industry expansion in this category.

Whereas, the large-scale production category is expected to witness a high growth rate in the coming years. This can be due to the rising demand for biopharmaceutical commodities for commercial purposes and the increasing production capacities to meet these demands.

Drive strategic growth with comprehensive market analysis

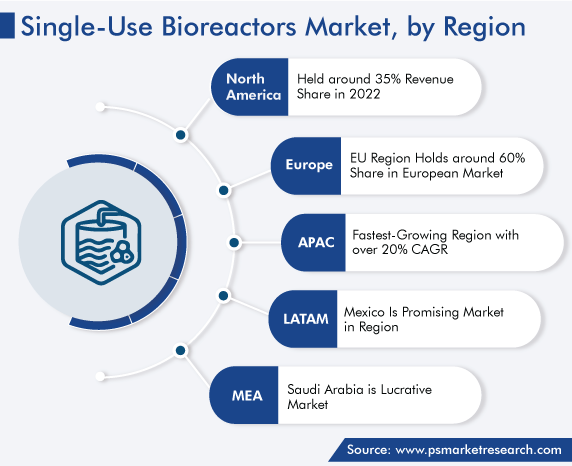

Globally, North America holds the largest market share. This is accredited to the growing prevalence of chronic ailments like diabetes, the presence of top players and robust healthcare facilities, technological advancements in this field, and robust research and development initiatives such as availability and accessibility to research funding, in the region.

In North America, the U.S. is significantly contributing to the market expansion. This is credited to the growing adoption of cutting-edge technologies, the rising public awareness for disease prevention, strong government support, and advanced healthcare facilities in the country.

Furthermore, the European market is projected to display significant growth during the forecast period. This can be accredited to the presence of key industry players and major research institutions operating in the region. Additionally, the growing expenditure on healthcare systems and the establishment of universal healthcare systems in several nations have significantly boosted the demand for single-use systems in the region.

Germany is majorly contributing to the regional market. This is because of the surging awareness among people to get early or preventive treatment for a disease, the growing older population base, the rising adoption of technology-based solutions, and the increasing medical budget in the country. Whereas, the French market is expected to display substantial growth in the upcoming years. This can be accredited to the surging prevalence of ailments, the improving medical facilities, and the growing biotechnology and pharmaceutical sectors in the nation.

Based on Product Type

Based on Type

Based on Cell Type

Based on Molecule Type

Based on Application

Based on Usage Type

Based on End User

Geographical Analysis

The single-use bioreactors market size stood at USD 4.1 billion in 2024.

During 2024–2030, the growth rate of the single-use bioreactors market will be 22%.

Research & development is the largest application area in the single-use bioreactors market.

The major drivers of the single-use bioreactors market include the rising prevalence of infectious and non-infectious diseases, technological advancements in this field, surging research and development activities, and the increasing number of collaborations among companies.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages