Report Code: 12247 | Available Format: PDF | Pages: 91

Singapore Micromobility Market Research Report: By Type (E-Scooters, E-Bikes, E-Mopeds, E-Pods, Bikes, Scooters), Model (First- and Last-Mile, Multimodal), Sharing System (Docked, Dockless) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12247

- Available Format: PDF

- Pages: 91

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

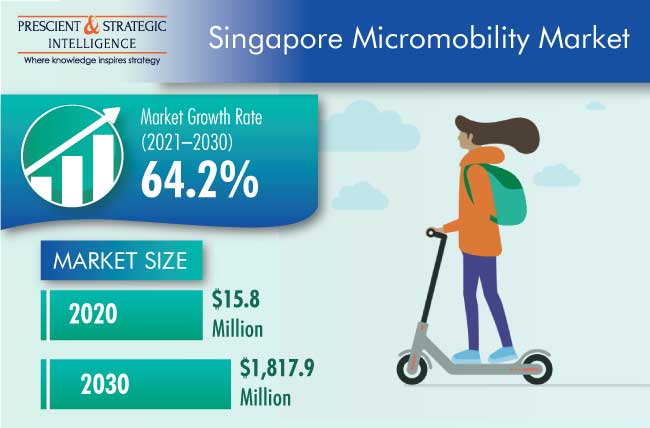

The Singapore micromobility market generated $15.8 million revenue in 2020, and it is expected to grow at a CAGR of 64.2% during the forecast period (2021–2030). The key factors responsible for the growth of the market include the compact country size, unfavorable vehicle ownership regulations, and need for an efficient transportation system for short distances.

The COVID-19 infection has spread to almost every country, and it has had a significant impact on the overall shared mobility and transportation industry. The use of shared vehicles, such as e-scooters, bicycles, and cars, facilitates physical distancing if compared with conventional mass transit modes, including metros and buses. Therefore, the COVID-19 situation has had a positive impact on the Singapore micromobility market. Amidst the reduced access to public transit, social distancing measures, and fear of infection, it started to be viewed as an alternative to conventional public transport and a potential solution to move around in the country.

Bikes Held Largest Share due to Low Cost of Rides

Bikes dominated the market during the historical period (2019-2020), on the basis of vehicle type. Bike sharing services are a low-cost and environment-friendly mobility option, which are also extremely beneficial in combating the problem of pollution. Singapore was the biggest bike sharing market in the Asia-Pacific (APAC) region after China in 2018 due to the presence of various companies, including SG Bike, Obike, Mobike, and Ofo.

Dockless Bifurcation To Grow Faster due to Its Cost-Effectiveness over Docked System

The dockless bifurcation is expected to witness the faster growth in the Singapore micromobility market during the forecast period, based on sharing system. This is attributed to the escalating popularity of dockless bike sharing systems among commuters, as well as service providers, as it is less expensive than a docked system.

Growing Investments is a Key Market Trend

There has been a swift increase in the number of micromobility startups due to the rising need for last-mile connectivity. Many prominent venture capitalists and automotive original equipment manufacturers (OEMs) have funded emerging companies in the micromobility market. This has helped increase the competition between the companies and resulted in the development of new products and services to meet the last-mile connectivity requirements of consumers. Some of the leading startups that have raised heavy funding are Beam Mobility Holdings Pte. Ltd. and Neuron Mobility Pte. Ltd., while some of the leading venture capitalists who have invested in Singapore-based micromobility startups are Sequoia Capital, AppWorks, and GSR Ventures.

Compact Country Size and Unfavorable Vehicle Ownership Regulations Key Drivers for Market

Singapore is a small country with only 728.6-square-km area; therefore, in order to reduce traffic congestion, the government uses a method of bidding through which individuals get a certificate of entitlement, which allows them to own a car for 10 years only. Furthermore, the cost of purchasing a personal vehicle in the country is high due to the need to import the vehicles and presence of the bidding process. As a result, a larger proportion of the population prefers to travel by public transport. Micromobility services provide an efficient transportation system that can be used for both first- and last-mile travel, as well as multimodal travel. This allows individuals to arrive at their destination on time, without shelling out much. All of these factors are major contributors to the Singapore micromobility market growth.

Need for Efficient Transportation System for Short Distances also Helping Market Advance

“First- and last-mile” is the distance that commuters have to cover between a transportation hub and their journey’s point of origin or destination. Public or shared transportation does not connect directly to a person's doorstep; the first- and last-mile distances have traditionally been covered by people driving their cars or walking to their destination, both of which require a significant amount of time and effort. As a result, a more-efficient last-mile connectivity system is required. Due to the low personal vehicle ownership rate, rising vehicle prices, and limited parking space in Singapore, the need for last-mile connectivity is becoming more pressing, and this presents numerous opportunities for micromobility service providers.

| Report Attribute | Details |

Historical Years |

2019-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$15.8 Million |

Market Size Forecast in 2030 |

$1,817.9 Million |

Forecast Period CAGR |

64.2% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Vehicle Type; By Model; By Sharing System |

Secondary Sources and References (Partial List) |

Alternative Fuels Data Center (AFDC), Electric Drive Transportation Association (EDTA), Electric Vehicle Association of Asia Pacific (EVAAP), International Energy Agency (IEA), International Kicksled and Scooter Association (IKSA), International Scooter Association (ISA), Land Transport Authority (LTA), Light Electric Vehicle Association (LEVA), Mobility as a Service Alliance (MaaS Alliance) |

Explore more about this report - Request free sample

Market Players Involved in Service Expansions to Gain Significant Position

The micromobility market of Singapore is consolidated in nature with the presence of several key players. Some of the major players in the industry are SG Bike Pte. Ltd., Moov, Grab Holdings Inc., OMNI TECH SOLUTIONS S.A., QIQ Global Pte. Ltd., and Beam Mobility Holdings Pte. Ltd.

In recent years, the market players have been involved in expansions in order to attain a significant position. For instance:

- In July 2019, Beam Mobility Holdings Pte. Ltd., an e-scooter sharing service company, announced that it has established its operations in Singapore, as well as Australia, South Korea, New Zealand, and Malaysia.

- In November 2018, Grab Holdings Inc. expanded its operations with the launch of an e-scooter sharing service at the National University of Singapore (NUS) Kent Ridge campus. During the three-month trial, e-scooters were deployed across eight parking stations on the campus, with each of these accommodating 10 e-scooters. All users were required to wear helmets, provided at each station, and undergo a 30-minute training course conducted by vendors.

Key Players in Singapore Micromobility Market Include:

-

SG Bike Pte. Ltd.

-

Moov Technology (S) Pte Ltd.

-

Grab Holdings Inc.

-

OMNI TECH SOLUTIONS S.A.

- Segway Inc.

-

Beam Mobility Holdings Pte. Ltd.

Market Size Breakdown by Segments

The Singapore micromobility market report offers comprehensive market segmentation analysis along with market estimation for the period 2019-2030.

Based on Type

- E-scooters

- E-bikes

- E-mopeds

- E-pods

- Bikes

- Scooters

Based on Model

- First- and Last-Mile

- Multimodal

Based on Sharing System

- Docked

- Dockless

The micromobility market in Singapore will witness a 64.2% CAGR during 2021–2030

The COVID-19 pandemic has affected the Singapore micromobility industry positively.

On the basis of vehicle type, bikes dominate the micromobility market in Singapore.

The national government’s stringent vehicle ownership laws are giving a boost to the Singapore micromobility industry.

The micromobility market in Singapore is fragmented due to the existence of a large number of service providers.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws