Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 281.2 Billion |

| 2025 Market Size | USD 293.2 Billion |

| 2032 Forecast | USD 417.2 Billion |

| Growth Rate(CAGR) | 5.2% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 10020

This Report Provides In-Depth Analysis of the Savory Snacks Market Report Prepared by P&S Intelligence, Segmented by Product Type (Potato Chips, Extruded Snacks, Popcorn, Nuts & Seeds, Puffed Snacks, Tortillas), Distribution Channel (Supermarkets/hypermarkets, Convenience Stores, Specialty Stores, Online Stores), Flavor (Barbeque, Spicy, Salty, Plain/Unflavored), Category (Baked, Fried), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 281.2 Billion |

| 2025 Market Size | USD 293.2 Billion |

| 2032 Forecast | USD 417.2 Billion |

| Growth Rate(CAGR) | 5.2% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

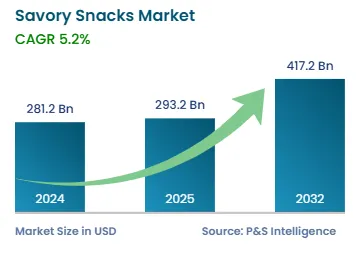

The global savory snacks market size in 2024 is USD 281.2 billion, and it is expected to advance at a CAGR of 5.2% during 2025–2032, to reach USD 417.2 billion by 2032. Considering the increasing consumer demand for healthy snacking, food manufacturers are offering more-nutritious and less-fatty savory munching alternatives. Consumers’ eating habits are being influenced by the rising urbanization rate and hectic lifestyles, with people increasingly substituting flexible, light, and convenient snacking options for main meals.

Because of the unexpected impact of the pandemic, the changing work cultures and lifestyles are encouraging the consumption of savory snack goods. Furthermore, the global market is characterized by a large number of organized and unorganized participants. A large portion of the savory snacks industry in most developing nations is unorganized, as local businesses have a diverse variety of region-specific products distinguished by the type of snack and, often, region-specific flavors. To attain maximum client penetration, key market participants have created a wide assortment of region-specific flavors for their savory eatables.

Producers of savory snacks are also investing in R&D to create products with a high nutritional value and health benefits. Because buyers are drawn to variety, key companies are spending increasingly on product innovation. The addition of proteins in such eatables has created a positive market outlook, as protein-rich eatables are nutritious and yummy. Furthermore, the wide availability of snacking options at various retail outlets is expected to drive business growth during the forecast period. When shoppers buy at retail stores, they are quite likely to spend on convenience food items too, which is the primary element fueling the industry's current rise.

Potato chips hold the largest share in the market, in terms of revenue, in 2024, as purchasers prefer these products because of their flavor, affordability, and accessibility. Among the most-widely consumed eatables for munching, potato chips combine well with fast food, including sandwiches and burgers.

As potato chips consumption has increased over time and the consumption patterns have changed dramatically, major market participants have been forced to develop new products from spuds. Additionally, the launch of fresh flavors and roasted potato chips with health advantages is set to boost category growth.

Nuts and seeds have the highest CAGR as they are promoted as excellent sources of protein, fiber, healthy fats, and vitamins. Roasted nuts and seeds are becoming popular among buyers because of their growing health concerns, emanating from their snacking habits. The recent advancements in a number of healthy snack niches have been driven by the consumer preference for eatables that provide health, convenience, and taste. Thus, producers provide a wide range of products, such as roasted almonds, cashews, chestnuts, pine nuts, and mixed nuts, to satisfy everyone's tastes and preferences.

We studied these product types:

Supermarkets & hypermarkets hold the largest revenue share, of 65%, in 2024. The availability of a wide range of items offered by numerous branded and private labels along with daily grocery items is expected to positively affect the sales via these channels. The large selection of savory goods allows customers to compare and shop with knowledge.

During the projection period, savory snack sales via the online distribution channel is expected to advance at the highest rate, of 5.5%. Numerous significant online merchants have benefited from the switch to digital commerce, especially during the pandemic. There has been a change in the way people buy food since the outbreak, with online shopping becoming increasingly popular with buyers.

The report offers analysis of the below-mentioned distribution channel:

The plain/unflavored category dominates the market, and it will continue doing so till 2032. This is attributed to the growing consumption of plain/unflavored snacks as an accompaniment to main dishes. For instance, tortilla chips are widely used to create flavorful and spicy nachos. From melted cheese and guacamole to roasted beef and salsa, the choice of added flavors is endless. Additionally, most people consume such snacks with alcohols, with the idea that the lack of flavor in the snacks will allow the taste of the actual alcoholic beverage to dominate.

Spicy is the fastest-growing category, with a CAGR of 6%. This is attributed to the changing food preference in developed countries, where people are increasingly inclining toward more-flavorful and spicy food. In this regard, the significant influence of Mexican and Italian cuisines on North American consumers is a main market driver. On the other hand, in the subcontinent, spice has been the defining feature of the cuisine. Therefore, snacks companies have launched a wide array of products customized to local tongues, including those with a lot of cumin, red chili, ginger, garlic, and coriander. Lays Magic Masala is one of the most-popular flavors of potato chips in India, where they are especially used as an accompaniment with alcoholic beverages. Other popular brands of spicy snacks in India are Cheetos, Kurkure, and Doritos. Moreover, with a growing Asian diaspora in Europe and North America, the consumption of spicy snacks is rising in these regions, which are traditionally accustomed to flavorful but almost non-spicy food.

The flavors analyzed in the report are mentioned below:

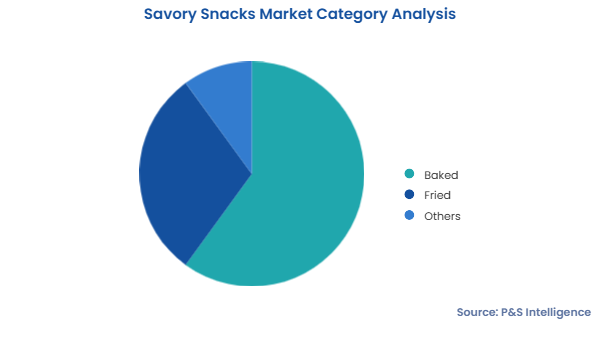

The baked bifurcation holds the largest share, of 60%, and it is also expected to witness the fastest growth over this decade and beyond. This is majorly because of the perceived benefits of baked goods over friend goods, due to the usage of a lot less oil and fats. Most popular brands of potato chips, such as Lays, Cheetos, and Doritos, are baked, and they have been a household name around the world for decades. Moreover, the launch of new kinds of snacks and flavors in the baked category benefits the growth and dominance of this category.

The report offers insights into these categories:

Drive strategic growth with comprehensive market analysis

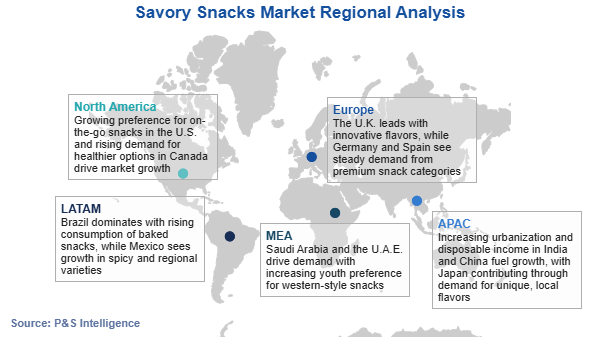

The APAC region dominates the market with 40% revenue, and it will also witness the highest CAGR, of 6.5%, as consumers here emphasize the mobility, convenience, and indulgence afforded by savory snacks. Additionally, snacking is an all-day trend, with consumers across ages eating them at least once daily. The most-common refreshment options for Asians are chips, which bring in the highest sales revenue for F&B firms. Inhabitants are becoming highly selective in making their grocery purchases, which is compelling companies to evaluate the taste profile of their products even more closely since their last observation. In particular, oven-roasted sweet potato chips, roasted almonds, and roasted coconut kale chips, are widening the flavor spectrum and driving the demand for savory snacks in the APAC market.

The localization of flavors is another factor that has enabled European and North American companies to gain a large consumer base in APAC. Wasabi, masala (spice), tangy, and ginger & garlic flavors are hugely popular in savory snacks among regional consumers.

Further, in the coming years, the regional market will expand due to the growing economies of countries such as China, India, and Japan. Further, due to the growing worries over childhood obesity, consumers in these nations have started living healthier lifestyles. As a result, the refreshment business now has greater and simpler access to high-quality raw materials, such as potatoes, wheat, and corn.

Savory snack demand is high in Europe as well, since the populace here consumes them on a variety of occasions. The market is pushed by the U.K and Spain, where customers prefer quick meals over full dinners. The region's industry's expansion is heavily influenced by buyers’ health consciousness, with a major surge in the number of health-conscious consumers noted during the last several years. The demand for food products that promote good health has increased as people pursue active and healthy lifestyles. As a result, in this region, nibbles serve as an equal and complementary addition to meals.

Moreover, the consumption of packaged goods has increased recently due to the expanding buyer preference for convenience foods in this urbanizing region. These titbits are becoming widely available, their sales have increased significantly in recent years, and they are satisfying consumers' preferences.

The savory snacks industry in the MEA region is expanding steadily as well on account of the population's shifting dietary tastes and changing lifestyles and rising disposable income. In the same way, the demand for these eatables in LATAM is driven by the rapid economic development, which has increased customers’ spending on indulgence and snacking options. LATAM’s customers are now choosing nutritious and organic snacking options due to the region's growing health consciousness and the rising incidence of lifestyle-related diseases.

Here is the geographical breakdown of the market:

The market for savory snacks will have a CAGR of 5.2% during 2025

The savory snacks industry witnesses the highest sale of potato chips.

The market for savory snacks is driven by the rapid urbanization, rising demand for healthy eating, and busy lifestyles.

The savory snacks industry is fragmented.

APAC is the largest and fastest-growing market for savory snacks.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages