Saudi Arabia Water Pumps Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

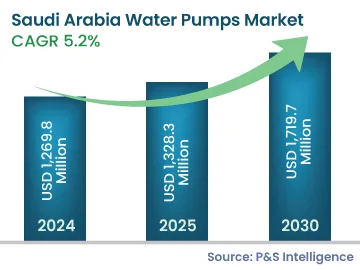

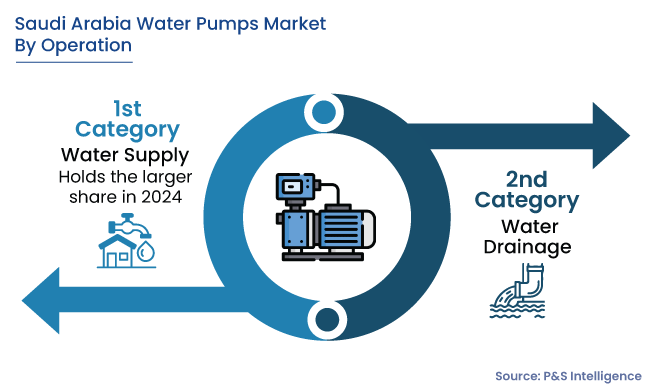

Get a Comprehensive Overview of the Saudi Arabian Water Pumps Market Report Prepared by P&S Intelligence, Segmented by Type (Positive Displacement, Dynamic), Power Range (0-1.5 hp, 1.6-2 hp, 2.1-4 hp, 4.1-6 hp), Operation (Water Supply, Water Drainage), Application (Agriculture, Mining, Construction, Manufacturing, Water Treatment, Oil and Gas, Residential), Province (Al-Riyadh, Makkah, Al-Madinah, Al-Qaseem, Eastern region, Aseer, Tabuk, Hayel, Northern Border, Jazan, Najran, Al-Baba, Al-Jouf), and Geographic Regions. This Report Provides Insights From 2019 to 2030