Saudi Arabia Heavy Machinery Rental Market Analysis

Explore In-Depth Saudi Arabia Heavy Machinery Rental Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 13202

Explore In-Depth Saudi Arabia Heavy Machinery Rental Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

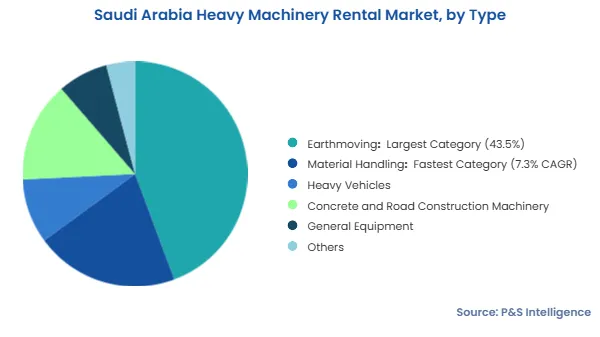

With a 43.5% share, the earthmoving category dominates the market in 2024. Excavators, bulldozers, loaders, and motor graders are widely used in construction, and they are often the first requirement. They are pressed in excavating the worksite and then levelling it before the actual construction can begin. Apart from their essential role in preparing the land, they are also used to transport earth to and from the project site. Depending on the area on which a project is being executed, hundreds of earthmoving machines can be required. Additionally, the sandy landscape of the kingdom necessitates extensive site preparation for construction to begin, thus driving the usage of these machines.

Material handling is the fastest-growing category in the market, also on account of the increasing construction activity across industries. The megaprojects of the kingdom require millions of tons of material to be moved in and out every month, which makes material handling machinery vital to drive productivity and efficiency. Additionally, the growth of the logistics & warehousing sector in the kingdom in parallel with the manufacturing sector propels the demand for cranes, automated guided vehicles, forklifts, and other kinds of machines. In this regard, the growth of the e-commerce sector is also significant, as it drives warehousing and logistical activities.

We have studied the following types:

The ICE category is the larger as conventional machines are cheaper and more widely available than their electric counterparts. Essentially, engines offer the reliability and power needed for large-scale construction projects. Moreover, most projects are being undertaken in remote and undeveloped areas, which lack EV charging infrastructure. Hence, the long range of ICE vehicles allow them to be used for construction projects in such areas. Moreover, the easy availability of fuel at low rates makes ICE machinery more preferable over electric models.

The hybrid/electric category will witness the higher CAGR, of 10.5%, during the forecast period. This is attributed to the government efforts to promote sustainable practices, which include offering purchase cost rebates and incentives in electric models and implementing stringent fleet emission norms. Moreover, access to electricity continues to increase in the kingdom, which encourages the installation of slow and fast EV charging stations. Furthers, users and players are becoming aware of the advantages of EVs, including long-term operational cost savings, scope for the integration of advanced technologies, and low noise.

The below-mentioned propulsions have been studied:

The Saudi Arabia heavy machinery rental market is dominated by the northern and central regions, with a 40.0% share. The central region is the location of Riyadh, the kingdom’s capital and one of the most-rapidly developing urban agglomerations currently. Main and Rig Road Axes, King Abdulaziz Project for Riyadh Public Transport, Sports Boulevard, Riyadh Art, King Salman Park, Riyadh Metro, Historic Addir’iyah, Diplomatic Quarter, and several other construction projects are underway in Riyadh. Moreover, the mineral-rich northern region of Saudi Arabia is a hotbed for mining activities, and this industry is a key user of heavy machinery, such as dump trucks, loaders, and drilling equipment.

The eastern region will have the highest CAGR, of 7.2%, over this decade. This region is home to Dammam Port, one of the largest international trading hubs of the kingdom, as well as the coastal cities of Dhahran and Al-Khobar, which are witnessing large-scale infrastructure development. Additionally, the presence of the Ras Tanura, Abqaiq, Shaybah, and many other oilfields and refineries drives E&P activities. Further, the expansion of the Jubail Industrial City drives the market in the eastern region of Saudi Arabia.

These regions are part of the scope:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages