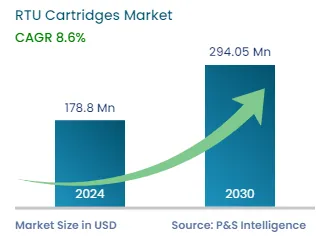

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 178.8 Million |

| 2030 Forecast | USD 294.05 Million |

| Growth Rate(CAGR) | 8.6% |

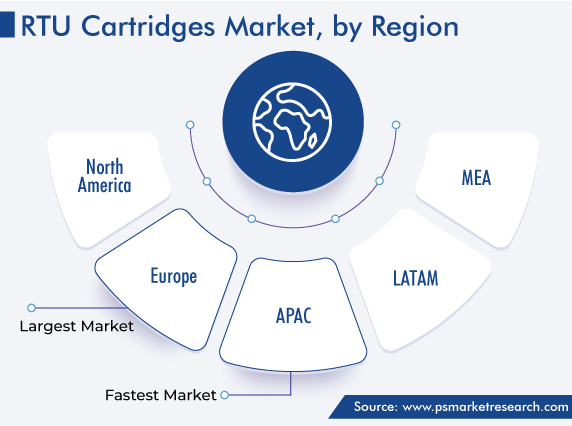

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12551

Get a Comprehensive Overview of the RTU Cartridges Market Report Prepared by P&S Intelligence, Segmented by Type (Nest and Tub, Tray), Method (Side-Up Inside, Down-Upside), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 178.8 Million |

| 2030 Forecast | USD 294.05 Million |

| Growth Rate(CAGR) | 8.6% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global RTU cartridges market was valued at USD 178.8 million in 2024, and the industry size will reach USD 294.05 million by 2030, advancing at a CAGR of 8.6% between 2024 and 2030. This is due to the high-quality operations with RTU cartridges and the increasing prevalence of diabetes.

With the growing trend of personalized medicine, the pharmaceutical industry faces the difficulty of effectively producing medications in smaller batch sizes with multiple batch changeovers. As a result, pharmaceutical firms are on the lookout for an RTU packaging solution that allows them to fill cartridges of different sizes and configurations on a single machine. It allows manufacturers to fill multiple forms of packaging without changing the equipment. RTU cartridges reduce costs, while improving quality, by preventing glass-to-glass contact during transport, storage, and filling and ensuring each cartridge remains free of contamination and scratches.

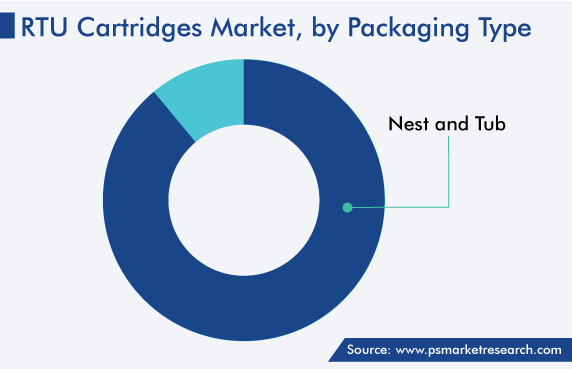

The nest and tube category held a larger revenue share, of 89.1%, in 2022. By using the same nest & tub format for multiple types of packaging, manufacturers can reduce the number of filling lines and equipment changes needed to produce various drugs, thus cutting the total cost of machinery and energy. Pursuing a single, standard method of filling for syringes, vials, and cartridges allows manufacturers to maximize the use of each filling line. Nests, which secure cartridges by the neck, can prevent them from touching one another, thus reducing the chances of scratches or defects.

The side-up inside category is expected to grow at a higher CAGR, of 9.1%, during 2021–2030. This can be because the side-up inside method has a wider application area, as it is used in the nest & tub packaging method widely.

Drug product manufacturers now want to streamline their operations and concentrate on their core competencies, such as drug production and processing, by using RTU cartridges, which remove several steps, such as cleaning, dehydrogenating, and sterilizing cartridges. These steps are not the key practices for pharmaceutical companies but also decrease the overall operational efficiency of the companies. Therefore, nowadays, these companies are preferring fill/finish technology/packaging that can guarantee sterility, without substantial expenditure.

Starting from research and development to the commercializing of products, the filling and manufacturing can be challenging. With RTU systems, pharmaceutical companies get higher fill-and-finish flexibility. The majority of the process problems are eliminated by using RTU systems because the packaging is pre-prepared and the only step left in the process is to fill and finish the package. Off-the-shelf packaging and closing solutions created according to drug component suppliers and fill/finish service providers’ requirements help them better serve their clients in a timely and regulatory-compliant manner.

Drive strategic growth with comprehensive market analysis

Geographically, Europe held the largest revenue share, of 55.3%, in 2022. This is attributed to the rising R&D activities and the growing geriatric population across the region. Other factors contributing to the growth of the market include the rising demand for accurate drug delivery, chemical durability of drugs, ease of use, and time-saving in the medication administration process. For instance, in 2021, about one-fifth of the European population was aged above 65 years.

Furthermore, in 2020, Europe contributed 23.9% of the global pharmaceutical sales revenue, and the rising pharma sales in the region make it evident that the demand for RTU cartridges will increase in the forecast period.

These containers are mainly used by diabetic patients, being fitted inside insulin pens, to self-administer insulin. Diabetes incidence is increasing in Europe every year due to unhealthy eating habits, physical inactivity, and an increase in obesity incidence. There are about 60 million people with diabetes in the region aged 25 years and over. This has significantly enhanced the demand for convenience during glycemic control. The rising number of cases of diabetes thus boosts the demand for insulin pens, which, in turn, fuels the growth in the European RTU cartridges market.

Moreover, the number of biosimilars approved in Europe is high than in other regions. Europe was the first region to implement a regulatory framework through the Committee for Medicinal Products for Human Use (CHMP), under the European Medicines Agency (EMA). This has created a boom in the regional biosimilars industry. As the primary route of administration of biologics is injectable, the demand for advanced drug delivery systems, such as RTU cartridges, is increasing.

Additionally, various conventional and biological drugs in the region are in the approval process, with many more in the pipelines of pharma firms. This has driven the number of clinical trials, which also propels the demand for RTU cartridges and other containers.

North America accounts for the second-largest revenue share in the market. This is ascribed to the rising demand for self-administration due to the development of various designs of RTU cartridges, the surging prevalence of chronic and lifestyle-associated diseases, and high healthcare expenditure in the region.

The increasing prevalence of chronic diseases in the region, such as cancer and heart disease, is among the strongest factors contributing to the growth of the market. In 2021, around 2.0 million new cancer cases were diagnosed. Moreover, the average cost of cancer care and drugs per person in the U.S. is around USD 42,000 yearly. This huge burden and the increasing number of affected individuals have created an urge among patients as well as the healthcare system to seek more-advanced drug delivery devices, such as RTU cartridges.

The geriatric population in the region is also growing at a significant rate and further adding to the burden of diseases. It is also expected to create a significant demand for drugs for age-related indications, which, in turn, would lead to an increased need for RTU cartridges.

Based on Type

Based on Method

Geographical Analysis

The RTU cartridges market size stood at USD 178.8 million in 2024.

During 2024–2030, the growth rate of the RTU cartridges market will be around 8.6%.

Nest and Tub is a larger packaging type in the RTU cartridges market.

The major drivers of the RTU cartridges market include the increasing prevalence of diabetes, high-quality operations with RTU cartridges, and the surging demand for personalized medicines.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages