Report Code: 12186 | Available Format: PDF | Pages: 222

RTF/RTU Vials Market Research Report: By Packaging Type (Nest and Tub, Tray), Color (Clear, Amber), Placing Method (Side-Up Inside, Down-Upside), Filling Product (Liquid, Lyophilized) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 12186

- Available Format: PDF

- Pages: 222

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

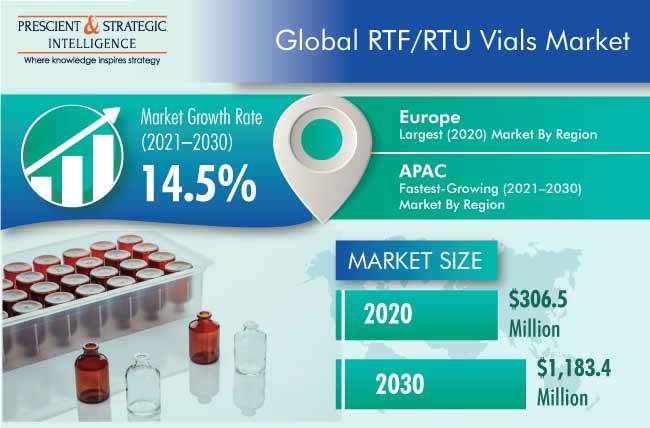

The global RTF/RTU vials market generated $306.5 million revenue in 2020, and it is expected to grow at a CAGR of 14.5% during the forecast period (2021–2030). Factors responsible for the growth of the market include need of pharmaceutical companies to increase their operational efficiency and growing usage of injectable drugs. Moreover, rising production capacity of vial manufacturers, surging healthcare expenditure, and growing pharmaceutical industry are also propelling the market growth.

The COVID-19 pandemic has given impetus to the pharmaceutical industry and the overall RTF/RTU vials market, worldwide. Several RTF/RTU vial companies are increasing their production capacity in order to meet the growing product demand from the pharmaceutical industry, research organizations, and biotech companies. An unprecedented push to manufacture billions of doses this year alone has led the market growth at an exceptional rate.

Clear vials to retain its market position during the forecast period

Based on color, the RTF/RTU vials market is categorized into clear and amber vials. The market for clear vials accounted for the larger revenue share in 2020, and it is expected to showcase a higher growth rate during the forecast period. This is due to the fact that amber vials are only used for those injectables that require protection from sunlight, and since there are fewer injectables that need such protection, clear vials are more commonly used.

Side-up inside placing method dominates the market

Based on placing method, the RTF/RTU vials market is bifurcated into side-up inside and down-upside. Of the two, the side-up inside placing method obtained the larger market share in 2020, and it is expected to showcase a higher growth rate during the forecast period. The side-up inside method is used in the nest-and-tub packaging method, and since the demand for this packaging method is higher than for the tray method, the side-up inside placing method finds a wider application.

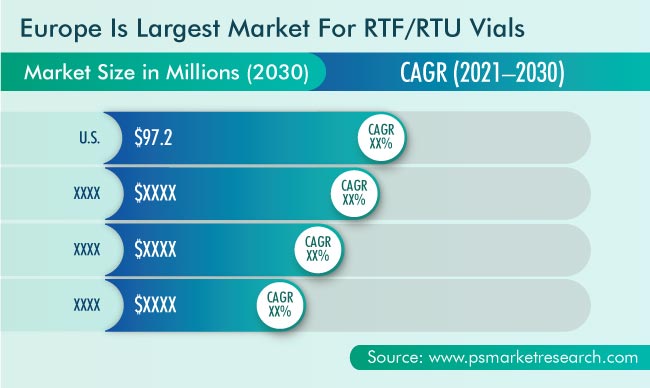

Europe to hold major market share in coming years

Globally, Europe held the largest share in the RTF/RTU vials market in 2020, and it is expected to lead the market during forecast period as well. This is attributed to the presence of a large number of RTF/RTU vial manufacturers in the region, such as Schott AG, Gerresheimer AG, Stevanato Group, and SGD S.A. Further, the increasing awareness on the newly developed drugs and high per capita income in the region, along with a large aging population, are driving the demand for RTF/RTU vials.

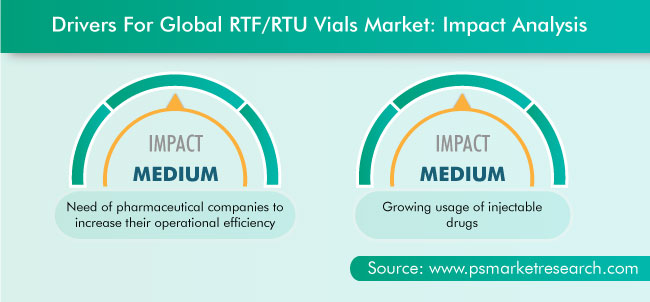

Need of pharmaceutical companies to increase their operational efficiency

Drug manufacturers are focusing on streamlining their operations and concentrating on their core competencies, such as production and processing. As a result, they are using RTF/RTU vials, which remove several steps, such as cleaning, dehydrogenating, and sterilizing the vials. These steps are not key practices for a pharmaceutical company, and they decrease their overall operational efficiency. Therefore, nowadays, pharmaceutical companies are preferring fill/finish technologies/packaging that can guarantee sterility without substantial expenditure. The majority of the processing problems are eliminated by RTF/RTU systems because packing is pre-prepared and the only step left in the process is filling and finishing the package. This factor drives the growth of the RTF/RTU vials industry.

Growing usage of injectable drugs

The injectable drug delivery industry is predicted to progress significantly in coming years, as a result of the rising diabetes and cancer incidence. Drugs are injected into the body for autoimmune diseases, oncological disorders, hormonal disorders, orphan diseases, and various other purposes. Injectables are beneficial for patients who are asleep or comatose, or unable to consume medicines orally, nasally, or via other means that require motor functions. Therefore, the rising demand for injectable drugs is propelling the requirement for vials, including RTF/RTU vials, as these variants are mainly use for injectable drugs. Hence, growing use of injectable drugs is boosting the demand for RTF/RTU vials, globally.

Market players involve in product launches and increasing their production to gain significant position

Some of the major players operating in the global RTF/RTU vials market include SCHOTT AG, Gerresheimer AG, SGD S.A., Stevanato Group, Nipro Corporation, China Lemon Trading Co. Ltd., Ningbo Zhengli Pharmaceutical Packaging Co. Ltd., and DWK Life Sciences GmbH. In recent years, the players in the industry have been involved in product launches to improve their position.

In October 2020, SGD S.A. launched EasyLyo vials of 20 ml and 25 ml capacity; new 50 ml flint vials; and 50 ml amber and 100 ml International Organization for Standardization (ISO) injectable vials, which are manufactured from Type I molded glass.

In March 2019, Gerresheimer AG introduced two new Type I vials, namely Gx Elite and Gx RTF, made of borosilicate glass. The vials are shatter-resistant, highly durable, and free of cosmetic defects.

| Report Attribute | Details |

Historical Years |

2014-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$306.5 million |

Market Size Forecast in 2030 |

$1,183.4 Million |

Forecast Period CAGR |

14.5% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regional and Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis; Company Profiling; List of Customers |

Market Size by Segments |

By Packaging Type, By Color, By Placing Method, By Filling Product, By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Netherlands, Japan, China, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, U.A.E. |

Secondary Sources and References (Partial List) |

Association for Accessible Medicines; China National Pharmaceutical Packaging Association; Consumer Healthcare Products Association; Drug Information Association; Drug, Chemical and Associated Technologies; Indian Pharmaceutical Association; Institute of Packaging Professionals; International Federation of Pharmaceutical Manufacturers & Associations; International Organization for Standardization |

Explore more about this report - Request free sample

Some of Key Players in RTF/RTU Vials Market Include:

-

SCHOTT A

-

Gerresheimer AG

-

SGD S.A.

-

Stevanato Group

-

Nipro Corporation

-

China Lemon Trading Co. Ltd.

-

Ningbo Zhengli Pharmaceutical Packaging Co. Ltd.

-

DWK Life Sciences GmbH

Market Size Breakdown by Segment

The global RTF/RTU vials market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Packaging Type

- Nest and Tub

- Tray

Based on Color

- Clear

- Amber

Based on Placing Method

- Side-Up Inside

- Down-Upside

Based on Filling Product

- Liquid

- Lyophilized

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Netherlands

- APAC

- China

- Japan

- India

- Australia

- LATAM

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- South Africa

- U.A.E.

In 2030, the value of the RTF/RTU vials market will be $1,183.4 million.

Nest & tub is the larger category under the packaging type segment of the RTF/RTU vials industry.

The major RTF/RTU vials market drivers are need of pharmaceutical companies to increase their operational efficiency and growing usage of injectable drugs.

Europe is the largest and APAC is the fastest-growing RTF/RTU vials market.

Most RTF/RTU vials market players are adopting facility expansions strategy to sustain their business growth.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws