Report Code: 12914 | Available Format: PDF | Pages: 270

RF-Over-Fiber Market Size and Share Analysis by Component (Optical Cables, Optical Amplifiers, Optical Transceivers, Optical Switches, Antennae), Frequency Band (L (up to 2 GHz), S (2-4 GHz), C (4-8 GHz), X (8-12 GHz), Ku (12-18 GHz), Ka (26.5-40 GHz)), Deployment (Aerial, Underground, Underwater), Application (Communications, Broadcasting, Broadband, Radar, Navigation), Vertical (IT & Telecommunications, Government and Defense, Marine, Commercial Aviation) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12914

- Available Format: PDF

- Pages: 270

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

RF over Fiber Market Overview

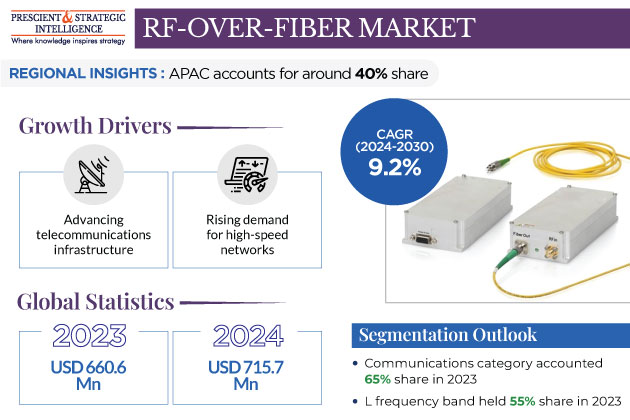

The rf over fiber market valued USD 660.6 million in 2023, which is expected to witness a CAGR of 9.2% during 2024–2030, reaching USD 1,215.2 million by 2030. This is ascribed to the rising demand for high-speed networks, advanced telecommunications infrastructure, and broadcasting & satellite communication and the increasing demand for these solutions from military & defense and industrial applications.

The market is also progressing due to the growing popularity of fiber-to-the-X (FTTX) architecture, where the RF-over-fiber technology is critical for delivering dependable and high performance for fiber-to-the-home (FTTH) and other installations. As a vital part of the current fiber-optic communication infrastructure, the adoption of RF-over-fiber would surge as the global demand for faster and more-robust internet access grows.

Demand for Higher-Bandwidth Communication Is Driving Market

- The increasing demand for higher-bandwidth communication is a significant driver in propelling the market.

- This technology plays a crucial role in meeting the need for low latency, reliable connectivity, and data transfer rates in the telecommunications, IT, and defense sectors.

- The increasing adoption of data-intensive applications, such as cloud computing, streaming services, video conferencing, and high-definition media, drives the demand for a higher bandwidth.

- Individuals and organizations need more-dependable and faster connections to use these data-hungry services.

For accommodating the processing and storage needs of users and organizations, the availability of cloud computing services and data centers is continually expanding. High-bandwidth connections are required for quick access to data stored in such facilities and cloud resources. The widespread deployment of 5G networks and the ongoing technological advancements in wireless technology also need a powerful infrastructure that is capable of handling significant high data speeds.

- COVID-19 has had a positive impact on the market as people’s priority has changed to remote work, which has further increased the need for high-speed data connections.

- A high bandwidth is not only needed by home users, but companies also need secure connections to facilitate remote operations.

- The proliferation of interconnected smart systems and the internet of things (IoT) further augments the demand for fast, safe connections for smooth information transmission.

- E-commerce websites and computerized exchanges are adding further fuel to the development of the market by propelling the need for protected and quick connections.

L Frequency Band Holds Largest Market Share

The L frequency band held a market share of 55% in 2023, and it is expected to be the largest category in the coming years as well. The demand for the L band is increasing due to the need for reliable and high-quality communication in different sectors, such as defense & aerospace and telecommunications. Further, the technological advancements across industries, especially those related to digitalization, propels the usage of the L Frequency band.

- The L-band RF over fiber technology has a broad area of application in terrestrial wireless communications, military satellites, and low-earth-orbit satellites, such as those for GSM mobile phones.

- The L band is widely used in satellite communication systems because it can penetrate atmospheric conditions and vegetation.

- It has an essential role in military and defense applications, such as electronic warfare, secure communication, and radar systems, because of its capability to provide reliable communication in different conditions.

Moreover, aviation & aerospace communication systems, such as weather radar systems; aircraft surveillance systems, including automatic dependent surveillance–broadcast (ADS-B); and navigation, rely on these frequencies. This band is also used in IoT devices and machine-to-machine (M2M) communication, specifically in situations where high data rates and long-distance communication are required. These frequencies are also utilized to provide coverage in distant places or fulfill specific communication needs by mobile satellite services (MSS).

| Report Attribute | Details |

Market Size in 2023 |

USD 660.6 Million |

Market Size in 2024 |

USD 715.7 Million |

Revenue Forecast in 2030 |

USD 1,215.2 Million |

Growth Rate |

9.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Component; By Frequency Band; By Application; By Vertical; By Deployment; By Region |

Explore more about this report - Request free sample

Communication Will Have Highest Market Share

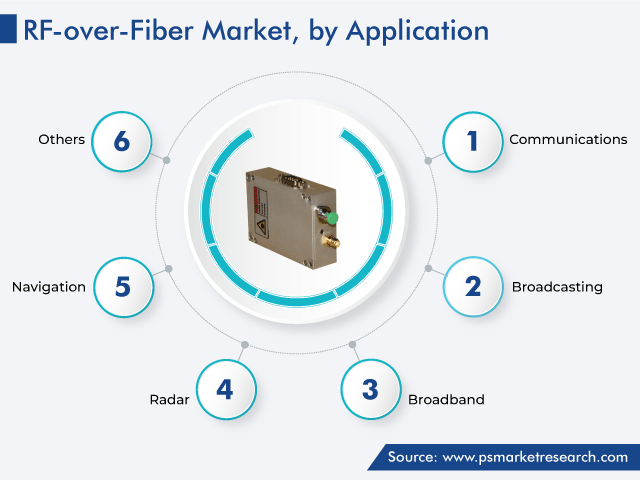

Based on application, the communication category held a market share of 65% in 2023, and it will have the largest market share in the near future too.

- This is ascribed to the strong need for secure data transfer and high speeds in many applications.

- As the telecommunication industry grows via the deployment of 5G networks, there is a rising need for transmitting signals between remote radio heads, base stations, and central units.

- This technology becomes the most important to enable high-speed data transfer, support 4G/5G networks, and increase their performance.

The RF-over-fiber technology has also an essential role in broadcasting, including radio, television, and satellite communications. To both satellite and terrestrial broadcasting systems, it offers trustworthy and high-quality transmission of signals over longer distances, without compromising quality. Therefore, it is essential for the deployment of small cell networks, distributed antenna systems (DAS), and wireless networks. These systems greatly depend on this technology for the efficient distribution of signals, specifically in places such as airports, institutional campuses, stadia, and urban areas with issues in wireless coverage.

- This technology is also important in defense and the military, where it enables the reliable and secure transmission of signals in harsh environments.

- Its applications include battlefield communication, radar systems, and surveillance.

- IoT and smart systems are increasing in usage, and they require reliable and high-bandwidth communication with each other for efficient data transfer.

- The RF-over-fiber technology is widely used in data centers for fast data transmission, high-speed interconnects, and decreased latency within servers and storage units.

- This helps in making cloud services accessible and large-scale data processing possible and efficient.

IT and Telecommunications Vertical To Generate Highest Revenue

Based on vertical, the IT and telecommunications category dominated the market, with a share of 75%, in 2023, and the same trend is predicted over this decade. This would be due to the increasing demand for high-performance and reliable communication infrastructure. IT and telecommunications companies extensively use RF-over-fiber to transmit high-frequency signals between central offices and base stations, increase transmission capabilities, and provide high bandwidths.

This infrastructure supports wireless and wired communication services for customers and businesses. The need for high-frequency, high-speed data transfer has increased due to the efficiency of RF over fiber technology.

- Due to the increasing demand for higher data speeds and lower latencies, telecommunication companies are making investments in 5G networks.

- Data centers are another important component of the IT infrastructure, and they depend on RF-over-fiber for the fast transmission of data between storage systems and servers.

- Cloud service providers use this technology to enable quick data transfers, which leads to faster access to cloud resources and services.

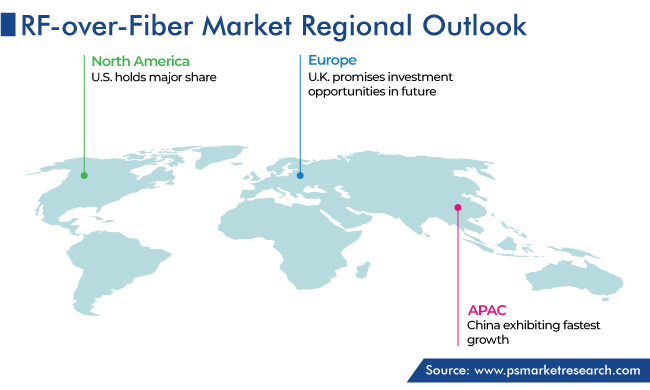

APAC Region Is Set To Have High CAGR

APAC will experience a CAGR of 10% during 2024–2030. This is attributed to the rapid developments in the media communications, broadcasting, and defense sectors, which are significant users of this technology. Besides, the APAC region is witnessing the swift deployment of 4G and 5G networks, in which this technology allows for data transmission over significant distances without signal degradation.

- The broadcasting industry in the APAC region has been expanding, with an increasing number of television and radio stations being set up.

- RF-over-fiber is used in broadcasting for its ability to transmit high-quality signals over long distances.

- As demand for high-bandwidth applications in data centers continues to grow in this region, the adoption of this technology will increase for transporting high-frequency signals over optical fibers with low signal loss and interference.

The growing pace of advancements, which have made this technology cost-effective, reliable, and efficient, also drives its adoption. The increasing adoption of IoT devices contributes to the rise in the demand for high-performance communications infrastructure, where RF-over-fiber is important. Further, the growing IT industry is adding fuel to the growth of the market.

North America Is Second-Largest Market

North America is the second-largest market, with a share of 30% in 2023. This is due to the expansive and technologically advanced telecommunications industry, particularly in the U.S. Other factors driving the market are the research and development initiatives related to this technology, investments to upgrade the existing communication infrastructure, and early adoption of 5G networks.

Competitive Analysis

Competition in the RF-over-fiber market is based on the range of market players catering to various industries and the increasing production of optical fiber cables. New product launches and other initiatives are other factors that contribute to the intensity of the competition among organizations.

Recent Developments

- In September 2023, Coherent Corporation introduced the pump laser module to fulfill the demand for EDFAs in optical networks. This pump provides additional power for amplifying numerous channels in next-generation transmission systems.

- In January 2023, HUBER+SUHNER’s launched MFBX Evo, which has a modular design that promotes resource efficiency.

- In October 2022, Phoenix Dynamics Ltd. was acquired by HUBER+SUHNER. The aim of this acquisition was to increase the sales of components for aerospace & defense and enhance its capabilities in providing connectivity solutions, including RF-over-fiber products.

- In March 2022, EMCORE Corporation introduced the MAKO-X C/X-band for military-grade applications in high-dynamic-range functions and electronic warfare systems.

- In February 2022, EMCORE Corporation acquired the L3Harris Space and Navigation business.

- In November 2021, HUBER+SUHNER launched the Rail Antenna to boost 4G and 5G connectivity.

Top Providers of RF-over-Fiber Solutions Are:

- HUBER +SUHNER

- EMCORE Corporation

- G & H Group

- SEIKOH GIKEN CO. LTD.

- Broadcom

- APIC Corporation

- Optical Zonu Corp.

- Dev systemtechnik

- Finisar

- ViaLite

- Glenair Ltd.

- Foxcom

- Octane Wireless

- Syntonics LLC

- ETL Systems Ltd.

Market Size Breakdown by Segment

This report offers deep insights into the RF-over-Fiber market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

- Optical Cables

- Optical Amplifiers

- Optical Transceivers

- Optical Switches

- Antennae

Based on Frequency Band

- L (up to 2 GHz)

- S (2–4 GHz)

- C (4–8 GHz)

- X (8–12 GHz)

- Ku (12–18 GHz)

- Ka (26.5–40 GHz)

Based on Deployment

- Aerial

- Underground

- Underwater

Based on Application

- Communications

- Broadcasting

- Broadband

- Radar

- Navigation

Based on Vertical

- IT & Telecommunications

- Government and Defense

- Marine

- Commercial Aviation

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws