Key Highlights

| Study Period | 2019 - 2032 |

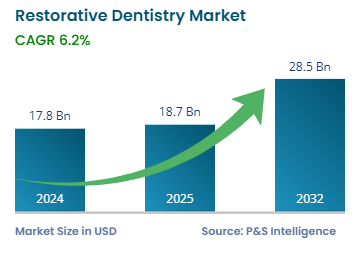

| Market Size in 2024 | USD 17.8 billion |

| Market Size in 2025 | USD 18.7 billion |

| Market Size by 2032 | USD 28.5 billion |

| Projected CAGR | 6.2% |

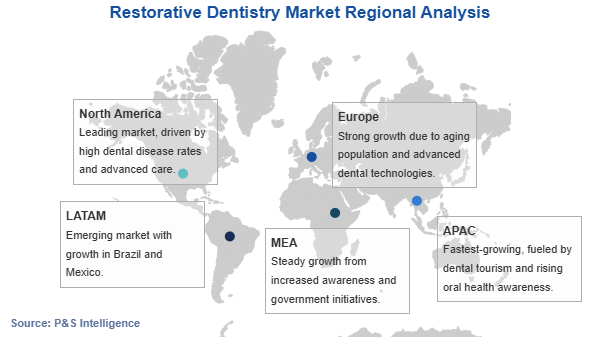

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

Report Code: 12517

This Report Provides In-Depth Analysis of the Restorative Dentistry Market Report Prepared by P&S Intelligence, Segmented by Product (Restorative Materials, Implants, Prostheses, Restorative Equipment), Application (Conservative & Endodontics, Implantology, Prosthodontics), End User (Hospitals & Clinics, Laboratories, Academic & Research Institutes), Type (Fillings, Crowns, Inlays & Onlays, Root Canals, Bridges, Dental Implants, Dentures), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 17.8 billion |

| Market Size in 2025 | USD 18.7 billion |

| Market Size by 2032 | USD 28.5 billion |

| Projected CAGR | 6.2% |

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The restorative dentistry market size stood at USD 17.8 billion in 2024, and it is expected to grow at a CAGR of 6.2% during 2025–2032, to reach 28.5 billion by 2032.

A steady expansion in the restorative dentistry market develops from dental disorder increases together with enhanced oral health knowledge and improved dental technology. The number of aged individuals in developed economies represents a major market driver since they face higher risks of tooth loss and need restorative treatments including implants and crowns and bridges. According to World Health Organisation, Oral diseases remain the most prevalent noncommunicable diseases which impact 3.5 billion people worldwide representing 45% of the total population throughout their entire lifetimes starting from early childhood into advanced age. Market growth strengthens because people increasingly seek cosmetic dental treatments which they attribute to their interest in looks and the impact from social media.

The restorative procedures underwent improvement through modern applications of CAD/CAM computer-aided design and manufacturing technology combined with 3D printing along with functional materials that are compatible with human tissue. The market demonstrates expansion because healthcare providers choose minimally invasive treatments that provide patients with minimally invasive procedures and shorter recovery times.

The improving economic conditions across emerging markets lead to greater access for populations to obtain restorative dental procedures therefore driving market expansion. The accessibility of restorative dental treatments increases through government sponsored healthcare programs together with insurance coverage in various nations. The market growth faces challenges due to both high treatment expenses and restricted insurance coverage policies.

Implants is the largest category, with a market share of 35% in 2024. The market for restorative dentistry primarily focuses on dental implants making up the biggest portion because these systems prove effective in replacing lost teeth. The market demands continue to increase due to the rising frequency of tooth loss alongside population aging trends and improved knowledge of extended dental solutions. Most dentists together with their patients select implants above traditional dentures or bridges because these prostheses offer long-lasting durability and great stability and mimic the natural dental structure.

The acceptance of dental implants has increased due to multiple technical developments that used titanium and zirconia biocompatible materials with guided implant placement approaches and customized implant production through 3D printing technology. The dental tourism industry contributes to market development through India alongside Mexico and Turkey who deliver top-quality implant treatments while maintaining affordable prices for international dental patients. Some areas enable the widespread adoption of dental implants through insurance coverage programs and implant procedure financing options.

The products analyzed in the report are:

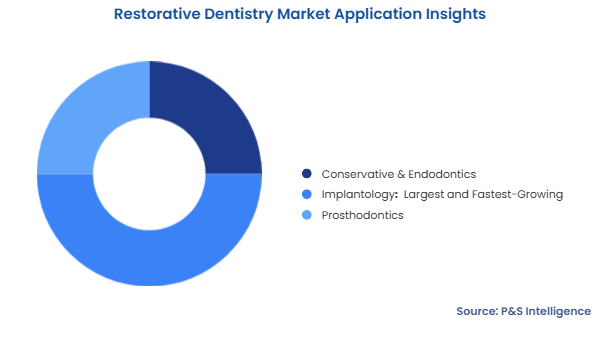

The implantology category is the largest category as it held the largest market share, of around 50%, in 2024, and it is also the fastest-growing as it is expected to grow at a CAGR of 8% during the forecast period, attributed to the increasing demand for dental implants in developed economies.

A number of companies are significantly focusing on launching innovative dental implants. For instance, in January 2021, Dentalpoint AG, a Swiss company offering ceramic dental implants, was acquired by the CeramTec Group. The objective of CeramTec behind this acquisition was to be able to tap the swiftly growing demand for metal-free dental prostheses and widen its medical technology portfolio. CeramTec Group now offers high-quality, biocompatible ceramic components for dental and joint implants.

The growing geriatric population worldwide, together with the high prevalence of dental disorders, is likely to drive the usage of dental implants over the forecast period.

The applications analyzed in the report are:

The dental hospitals and clinics is the largest category as it held the largest share of 65% in 2024. This is due to the rising number of hospitals and dental clinics globally, growing adoption of advanced technologies by such small and large care facilities, growing dental tourism sector in emerging markets, and booming number of group dental practices in developed countries.

Moreover, the category is projected to be the fastest-growing, with a CAGR of 7%, in the forecast period. This is due to the upgradation of the healthcare infrastructure by governments and private players. Moreover, unhealthy lifestyle habits, such as smoking and drinking, are accelerating the market growth. According to the Centers for Disease Control and Prevention, around 47.2% of the adults aged 30 years and above in the U.S. have some form of periodontal disease.

The end users analyzed in the report are:

Fillings is the largest category, with a revenue share of 30% in 2024. Tooth decay stands as a frequent oral condition which affects millions of individuals in annual cycles. The need for fillings exists because patients require replacements as well as routine maintenance services. Filings represent one of the most budget-friendly dental restorative treatments thus they serve the broad patient population across various income brackets. The market leading position of dental fillings exists because they remain affordable for routine preventive and corrective dental procedures.

The types analyzed in the report are:

Drive strategic growth with comprehensive market analysis

The Europe accounted for the largest revenue share, around 45%, in the restorative dentistry market. This is attributed to the rising incidence of dental diseases, the growing geriatric population, the presence of leading players, and the surging government expenditure on dental care in this region. Metallic and ceramic dental implants are the top two revenue contributors to the European restorative dental implants market. Zirconia-based ceramic implants are widely preferred by patients with tooth sensitivity issues.

Additionally, the U.K. restorative dentistry sector is growing on account of the early adoption of dental implant procedures, increasing healthcare expenditure, and growing awareness on dental hygiene. The increasing geriatric population is also driving the growth of the market in the country. Furthermore, the favorable reimbursement policies of private insurance companies for dental procedures and the rising importance of aesthetics are expected to propel the industry growth in the region. The insurance generally includes routine procedures, such as simple fillings, bridges, prostheses, crowns, and others related to oral hygiene. Besides this, the market is driven by the rising disposable income, which, in turn, is creating a high demand for cosmetic dentistry in the developing countries in Eastern and Central Europe.

The Asia-Pacific region will grow at the higher CAGR, of 8.5%, during the forecast period, due to the huge patient base in countries such as China and India. Moreover, government initiatives as well as the expansion of the medical industry are projected to lead to the progress of the market in the coming years. Various companies are manufacturing advanced equipment for dental restoration procedures using computer-aided design (CAD) and computer-aided manufacturing (CAM) technologies, which is fostering the growth of the market. The growing usage of CAD and CAM has lowered the demand to wear temporary bridges and crowns, thus reducing the need for doctor revisits and the consumption of time during the treatment.

The regions analyzed in the report are:

The Restorative Dentistry Market is highly fragmented because numerous international and regional businesses contest different market sections. The restorative dentistry market consists of dominant major corporations which include Institute Straumann AG, 3M Company, Zimmer Biomet Holdings Inc., and DENTSPLY SIRONA Inc. yet numerous mid-sized and specialized companies strategically participate within the market. Companies specialize in restorative solutions that include fillings as well as crowns and bridges and dental implants and biomaterials leading to numerous competitive entities. The market shows further fragmentation because stakeholders can choose from diverse restorative product options which extend from conventional to digital dentistry solutions.

The market experiences fragmentation because technology advances and regional market conditions and product distinctiveness strategies influence it. The dental industry receives continuous innovation from companies that use biocompatible materials and CAD/CAM technology along with 3D printing systems which attracts new participants to join the sector. Affordable restorative solutions in emerging economies create business opportunities for start-up manufacturers to enter the market. Market consolidation through mergers and acquisitions indicates restricted market concentration but overall fragmentation remains because of the wide variety of restorative procedures combined with multiple competitors.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages