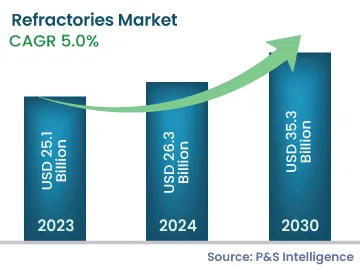

The refractories market will reach USD 35.3 billion by 2030.

The industry will experience a CAGR of 5.0% during the projection period.

The key drivers include growing demand from numerous sectors, technical improvements, and energy efficacy concerns.

There is a growing trend of using refractories in industries operating at extreme temperatures, such as cement, non-ferrous metal, glass, and steel & iron.

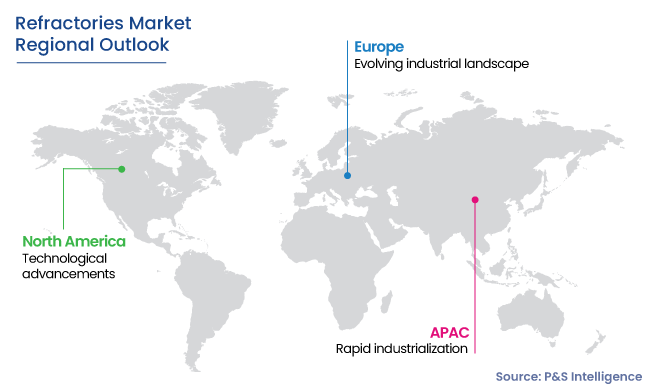

APAC, with the highest market share at the beginning 70% in 2023 and is considered to grow at the highest CAGR of 5.2% during the forecast period by major industries such as glass, cement, power generation, and iron & steel in countries like India and China.