Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 470.9 Million |

| 2025 Market Size | USD 542.5 Million |

| 2032 Forecast | USD 1549 Million |

| Growth Rate(CAGR) | 16.2% |

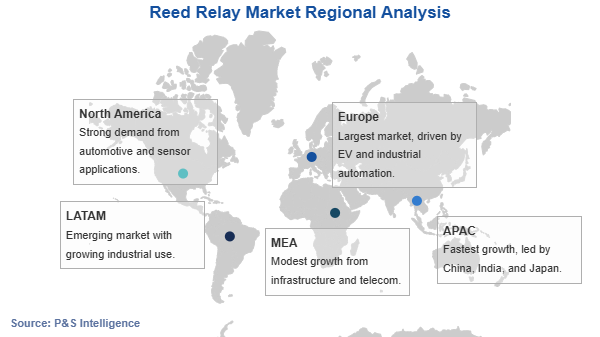

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 12532

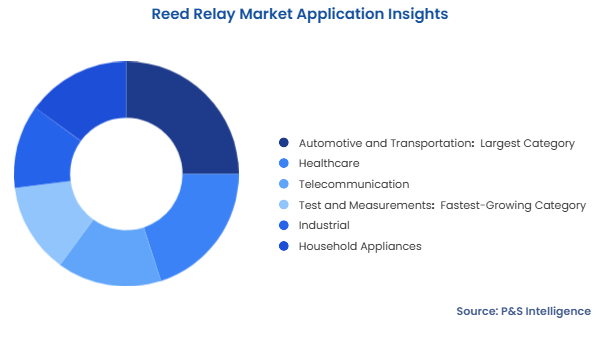

This Report Provides In-Depth Analysis of the Reed Relay Market Report Prepared by P&S Intelligence, Segmented by Voltage (200V, 200-500V, 500V-1KV, 1KV-7.5KV, 7.5KV-10KV, 10KV and Above), Switching Action (Normally Open or Make Action contact, Normally Closed or Break Action contact, Changeover or Break Before Make action contacts, Bi-Stable contacts), Application (Automotive and Transportation, Healthcare, Telecommunication, Test and Measurements, Industrial, Household Appliances), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 470.9 Million |

| 2025 Market Size | USD 542.5 Million |

| 2032 Forecast | USD 1549 Million |

| Growth Rate(CAGR) | 16.2% |

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The reed relay market size stood at USD 470.9 Million in 2024, and it is expected to grow at a compound annual growth rate of 16.2% during 2025–2032, to reach USD 1549 million by 2032.

The market witnesses substantial growth as automation demand increases alongside control system requirements in numerous industries. Reliable and efficient switching devices like reed relays maintain critical importance for industries that advance in manufacturing robotics and industrial automation fields. Inside automation procedures these relays play an essential role for precisely controlling systems that conduct numerous switching operations. Humongous operational cost savings together with productivity enhancement through automation demands more reed relays across these industrial applications.

Modern industry called Industry 4.0 brings significant changes to manufacturing. Major businesses everywhere are installing smart sensors and robots in their production sites. The new technology systems automatically run production lines better and faster while decreasing human employment needs. Manufacturers worldwide require dependable parts that match automated system requirements, especially reed relays because of their fast-growing business needs.

When manufacturing systems evolve their output products naturally become more intricate. More and more devices today decrease in size like smartphones and wearables plus medical instruments. Manufacturers need smaller high-quality sensors and switches to operate properly within the confined product areas they need to build. Reed relays serve these applications perfectly because they offer reliable results as compact units.

Tests and semiconductor testing as well as measurement systems need Reed relays for exact and dependable results in their applications. The accuracy and durability demand of these applications make them unsuitable for any performance issues. Reed relays operate reliably in large numbers up to 5 billion cycles because of their trusted suitability for essential applications. These relays stand strong and switch quickly which makes them ideal tools for tech businesses reaching their limits.

Major players like Pickering Electronics, Standex International Corporation, and Littlefuse are offering high-voltage reed relays, which are apt for ultraminiature products. For example, series 131 by Pickering with a minimum of 1.5 kV stand-off is the world’s smallest footprint reed relay. In addition, series 120 devices are rated for 1 A, 20 W switching having a footprint of just 4 mm x 4 mm.

The 200V category held the larger market share, of 25%, in 2024, because this voltage range suits diverse everyday applications. The telecommunications industry and test, measurement equipment sector, and consumer electronics field widely adopt these low-voltage relays. These areas need devices that work within this voltage range causing a stable demand for this equipment throughout the market. These relays provide a perfect solution for engineers because their small size comes at an affordable price point, and they use minimal energy.

The 200V–500V category will grow at the highest CAGR, of 16.4%, during the forecast period. The need for components that can operate at higher voltages when space is limited is accelerating because industries require them for electric vehicles, industrial automation, and power electronics systems. This voltage range defines the optimal power capacity which also supports compact design specifications because Reed relays provide optimal performance for present-day high-efficiency applications. Rising demands for high-voltage power systems within spatially limited applications create a strong market expansion in this segment.

Here are the categories of this segment:

​The normally open or make action contact category held the larger market share, of 55%, in 2024. The market dominance of normally open contact relays stems from their basic design with cost-effective features that enable them to be used across many application fields containing telecommunications and consumer electronics together with industrial automation applications. NO contacts establish broad market adoption because of their basic design and reliable operation. ​

The changeover or break before make action contacts category will grow at the highest CAGR, of 16.5%, during the forecast period. Modern electronic systems demand flexible switching abilities which drive the increase in this market since circuits need to interoperate between conditions without creating accidental circuits. The advanced electronics sector alongside industrial automation depends on this feature because precise control and reliability remain essential in their operations.

Here are the switching actions studied in the report:

​The automotive and transportation category held the larger market share, of 25%, in 2024. Reed relays maintain their dominant market position because they are indispensable for several vehicle operations including signal switching, overheat protection, and climate control systems. Miniature reed relays deliver efficient high-load switching abilities which make them highly beneficial for automotive applications that enhance vehicle reliability and safety.

The test and measurements category will grow at the highest CAGR, of 16.8%, during the forecast period. The testing equipment sector rapidly expands because different industries such as electronics and telecommunications as well as healthcare require precise instruments. Reed relays serve well in measurement instruments because they show low contact resistance together with high insulation resistance and reliable switching operations.

The following applications are analyzed in the report:

Drive strategic growth with comprehensive market analysis

The ​Europe held the larger market share, of 30%, in 2024. The region maintains its significant position because its well-developed automotive and electronics sectors and telecommunications networks utilize reed relays broadly throughout their operations. The demand for these components has grown stronger because Europe follows strict environmental regulations and is making a transition toward renewable energy.

The Asia-Pacific (APAC) will grow at the highest CAGR, of 16.5%, during the forecast period. Countries across Asia-Pacific demonstrate rapid expansion of their reed relay market because they experience rising industrialization and technological advancements and expanding automotive, telecommunications, and consumer electronics industries. The population expansion and rising income levels within the region drive demand for electronic devices and automotive technologies because these factors simultaneously strengthen the need for reed relays.

The geographical breakdown of the market is as follows:

The reed relay market is considered fragmented in nature because multitudes of both worldwide and regional corporations participate in this business domain. The market lacks a leader since no organization holds commanding market control thus creating active competition between companies. Manufacturers throughout European states alongside North America and Asian markets produce specialized versions of their relays for automotive sectors together with telecom and industrial automation applications. The diverse product ranges along with variable pricing structure and multiple geographical locations enable several companies to exercise market power rather than allowing its concentration into a few businesses.

The extensive variety of reed relay applications along with their different voltage needs produces market segments due to specialized manufacturing approaches. The market features different companies that specialize in making aerospace or test equipment ruggedized high-voltage relays alongside producers who create compact affordable relays for consumer electronics. Multiple players gain entry to specific market segments thanks to the need to satisfy distinct industry requirements and technical specifications. The combination of market competitiveness encourages companies to sustain their presence by developing innovative solutions and customized products.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages