Razor Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Razor Market Report Prepared by P&S Intelligence, Segmented by Type (Cartridge Razors, Disposable Razors, Electric Razors, Straight Razors, Safety Razors), Segment (Mass, Standard, Premium), Distribution Channel (Supermarkets/Hypermarkets, Department Stores, Convenience Stores, Online), Blade Type (Stainless Steel, Carbon Steel), Consumer (Men, Women), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

Razor Market Data

Market Statistics

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 18.5 Billion |

| 2024 Market Size | USD 18.8 Billion |

| 2030 Forecast | USD 21.9 Billion |

| Growth Rate (CAGR) | 2.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

| Largest Razor Type | Cartridge |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

Razor Market Analysis

The global razor market generated revenue of USD 18.5 billion in 2023, and it is expected to grow with a CAGR of 2.6% during the forecast period, reaching USD 21.9 billion by 2030. This is primarily due to the rising focus on personal grooming and the surging disposable income of people.

Physical appearance has been a captivating factor for human beings, which relates to self-esteem and self-confidence. The growing consciousness about physical hygiene among women as well as men and the increasing need for on-the-go grooming solutions are further driving the demand for razors. Promotions through celebrity endorsements and technological developments also have a key role here.

The emerging demand for razors from female consumers would offer lucrative growth opportunities for the market players in the coming years. In the recent past, a large part of the women population, especially in APAC, LATAM, and Africa, considered shaving as optional. However, with the rising adoption of the Western culture, coupled with the significant influence of the beauty industry, nowadays, removing hair is an inherent part of personal grooming among women. Now, women are on board with keeping their underarms and legs smooth.

In addition, the rapid urbanization and significant increase in the number of working women are further fueling the demand for hair removal products. As of 2022, 40% of the total global labor force is female. Companies such as The Proctor & Gamble Company increasingly focusing on this segment in order to capture the razor market for females.

Razor Market Trends & Drivers

Continuous Technological Advancements in Razors

- With urbanization, the appearance of razors has also become significant, primarily amidst the consequently increasing demand for beauty and grooming products. This includes electric and non-electric razors, which are the most inherent grooming products in day-to-day life.

- Hybrid razors, which is a combination of razor and trimmer, serve both these purposes, which is making them increasingly popular. The increasing flexibility of foil shavers is grabbing the attention of customers, who want a close shave with high flexibility in the process.

- For instance, Koninklijke Philips N.V. has launched Philips Shaver Series 7000, the world’s first personalized and AI-powered shaving solution for sensitive skin. It provides a personal shave plan based on each man’s individual shaving technique.

- Additionally, lithium-ion-battery-based shavers offer additional advantages to customers and are, hence, trending in the razor market.

- Further, the Skarp laser razor is a recent advancement in shaving technology that uses a compact laser to burn hair, rather than cutting it. This razor is used to reduce both irritation and waste that is produced by disposable razor blades.

Increasing Focus on Personal Grooming

- The increasing focus on personal grooming is a key factor driving the razor market across the globe. Nowadays, with the rise in the adoption of the Western culture, men are becoming more aware of grooming and paying more attention to their looks, with more focus on haircare and shaving. With the surging focus of men on personal grooming, more of them are preferring male-focused salons or spas to get better advice from professionals for their shave and haircut.

- Additionally, according to research by The Procter & Gamble Company, shaving accounts for the largest category of the men’s grooming segment, with around 43% of men aged 18–24 years and 39% of men aged 25–34 years old preferring clean shaving. The interest in shaving and male grooming would continue to rise in the coming years, predominantly driven by the younger populace.

- The rising interest of males in improving their physical allure is driving the demand for personal grooming products. Hence, with increasing focus on personal grooming products, the market for razors is exhibiting growth across the globe.

Trend of Growing Beards

- Beards have become one of the most-popular trends among men with their ability to completely change the look and aesthetic. In a study, researchers found that a beard is more common in cities with larger populations and among men in their early 30s.

- The renewed fashion of growing beards is changing the shaving frequency among men. Earlier, men used to shave on a regular basis, but now the shaving frequency has reduced, and instead of shaving daily, they grow beards for a week or more than that.

- For instance, in 2019, Procter & Gamble wrote down its men’s grooming brand by USD 8 billion Gillette as millennial men are not shaving as much as previous generations.

- Additionally, manually shaving with razor blades demands patience, time, and care. It requires the use of pre-shave lotion, foam, and shaving cream. In developed countries, electric shavers have rapidly become popular as they offer simplicity and safety while shaving, and they also fit well amidst the trend of growing beards.

In-Depth Segmentation Analysis

Razor Type Overview

- The cartridge category, based on type, dominated the razor market, with a revenue share of around 30%, in 2023. This is because cartridges blades are relatively easy to replace. Personal care companies are also heavily marketing this product, which contributes to its widespread use.

- Moreover, the demand for these products is significantly high in APAC and Europe, with China, India, and Germany accounting for the majority of sales. In the global environment, Gillette cartridge razors are highly popular.

- The electric category is expected to register the highest CAGR, of 2.9%, during the forecast period. This can be attributed to the high demand for electric razors in APAC due to their easy and convenient usage. Moreover, the increasing trend of growing beards and stubble as a fashion, primarily among youngsters, is projected to propel the growth of the electric razor market during the forecast period.

Razor Types covered in the report include:

- Cartridge (Largest Growing Category)

- Disposable

- Electric (Fastest-Growing Category)

- Straight

- Safety

Segment Insights

- On the basis of segment, the market is categorized into mass, premium, and standard, wherein the mass category generated the highest revenue, holding a share of around 50% in 2023. As APAC is the largest market for razors and the per capita income of APAC countries is low, the populace of these countries primarily prefers mass products, which are cheap. For instance, in 2022, the GDP per capita of India and China were USD 2,388 and USD 12,720, respectively, which were significantly less than in developed countries, such as the U.S. and Germany.

- The premium category is expected to witness the fastest growth, advancing at a CAGR of around 3.0%, during the forecast period. As the mass market is maturing, companies are increasingly targeting the premium customer segment in order to generate more revenue. Thus, companies are launching several premium razors with advanced features to target the premium consumer segment.

During the study, we have analyzed two segments in the report:

- Mass (Largest Category)

- Standard

- Premium (Fastest Category)

Blade Type Insights

- On the basis of blade type, the stainless-steel category accounted for the larger market share, of around 75% in 2023. This is primarily because stainless steel blades have a higher build quality, and they do not rust easily. Due to these reasons, both manufacturers and consumers are switching to stainless-steel blades.

- Furthermore, these blades stay sharp for a longer period; hence, consumers are more likely to choose them. The blade also warms up quickly, so that consumers do not feel the cold steel in their face.

The following blade types are included in the report:

- Stainless Steel (Larger Category)

- Carbon Steel

Distribution Channel Analysis

- Among distribution channels, the hypermarkets/supermarkets category accounted for the largest revenue share, of around 35%, in 2023. This is primarily due to the availability of a wide range of razor products, which help customers physically compare and examine before purchase.

- The online distribution channel category is expected to witness the highest CAGR, of 3.4%, during 2024–2030 in the market. A greater variety, better sales offer, 24*7 hassle-free shopping, easy price comparison, and home delivery are some factors that will propel the growth of the online channel during the forecast period.

Below are the major distribution channels covered in the report:

- Supermarkets/Hypermarkets (Largest Category)

- Department Stores

- Convenience Stores

- Online (Fastest Category)

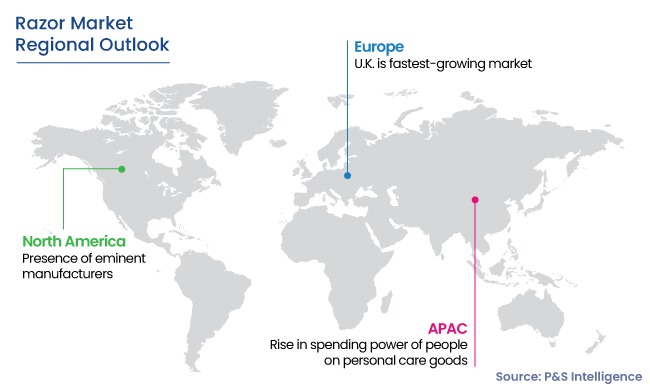

APAC is the Fastest Growing Region

- Geographically, APAC is the fastest-growing market, advancing at a CAGR of 3.2% during 2024–2030, as well as holding the largest market share. This can be ascribed to the enormous demand for this product in emerging economies of the region is likely to push the market forward.

- China, India, and Indonesia are the most-populous countries in APAC, and because of its fast-growing population, high rate of urbanization, and rise in spending power of people on personal care goods, the regional market is expected to witness the highest growth rate during the forecast period.

- Furthermore, market players in the region are focused on the value-for-money consumer base, cutting product prices, and offering new yet affordable razors to target them. For example, The Proctor & Gamble Company has introduced Gillette Guard, a low-cost razor that enables shaving at an affordable price, in order to attract Indian mass customers.

- Further, North America held a significant market share, in 2023. This is due to the presence of eminent manufacturers in the region. Gillette, owned by The Procter & Gamble Company, is the leading brand that has dominated the razor industry in the region.

- Moreover, the interest in shaving and male grooming to improve physical allure is expected to rise in the coming years, predominantly driven by the younger population, which, in turn, will drive the regional market growth.

The regions and countries analyzed for this report include:

- North America

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Europe

- Germany (Largest Country Market)

- U.K. (Fastest-Growing Country Market)

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Largest and Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Competitive Analysis

The market has a high degree of fragmentation, owing to many domestic and international players. The continual appearance of new entrants is impacting the established and new key players. Major companies in the global razor industry have been involved in product launches, partnerships, and acquisitions to widen their customer presence and increase their products’ sales.

Top Razor Manufacturing Companies:

- The Procter & Gamble Company

- Koninklijke Philips N.V.

- Edgewell Personal Care Company

- Societe BIC S.A.

- Dorco Co. Ltd.

- OSCAR RAZOR

- Feather Safety Razor Co. Ltd.

- Harry’s Inc.

- Wahl Clipper Corporation

- Dollar Shave Club Inc.

- MERKUR Stahlwaren GmbH & Co. KG

- Vikings Blade

- Hans-Jürgen Müller GmbH & Co. KG

- BIC

- The Razor Company

Razor Industry News

- Edgewell Personal Care Company has acquired a U.S.-based consumer brand company Billie Inc. to offer a broad portfolio of personal care products for women.

- Philips Norelco has steamed with Movember to invest up to USD 550,000 in the form of more than 850 Philips Norelco shavers and funds to help Movember perform men's health research.

- Gillette has launched Planet Kind, which is a new shaving and skincare brand that uses 85% recycled paper, 85% recycled plastic, or recyclable aluminum in its packaging. A razor handle composed of 60% recyclable plastic is also part of the assortment.

- Philips has introduced the BT1000 range of beard trimmers with skin-friendly blades, to meet the grooming needs of Gen Z males.

Request the Free Sample Pages