Qatar Facility Management Market Future Prospects

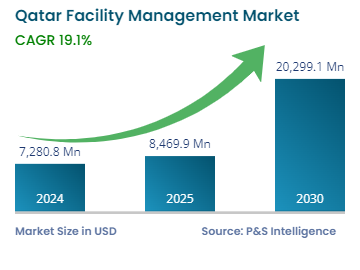

The Qatar facility management market is estimated to have generated revenue of USD 7,280.8 million in 2024, and it is expected to grow at a CAGR of 19.1% during 2024–2030, to reach USD 20,299.1 million by 2030.

The key factors driving the growth of the industry include the increasing infrastructure development, the growing tourism industry, the introduction of freehold properties in the country, Qatar National Vision 2030, and the surging private sector.

Moreover, Qatar has made outstanding developments in the green building sector, with the development of many world-class sustainable structures. Green buildings require facility managers to manage the air quality, energy usage, water consumption, and waste disposal efficiently. Each of these parameters is measured and monitored to achieve an efficiency level that benefits occupants and owners in the long run.

Some examples of green practices are energy-efficient HVAC systems, water-saving plumbing fixtures, solar and wind power, high-efficiency lighting systems, the latest energy management controls, and waste recycling. Low operating and maintenance development costs, enhanced durability, and a healthier indoor environment are the features of a green building. Therefore, the above-mentioned factors boost the demand for FM services in green buildings.