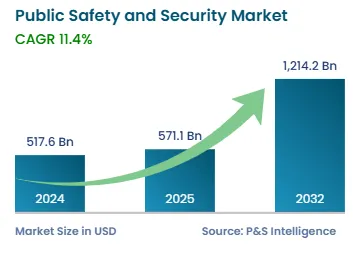

The market of public safety and security size stands at USD 517.6 billion in 2024.

What will be the growth rate of the public safety and security market during the forecast period?+

During 2025–2032, the growth rate of the public safety and security market will be 11.4%.

Homeland security is the largest application area in the public safety and security market.

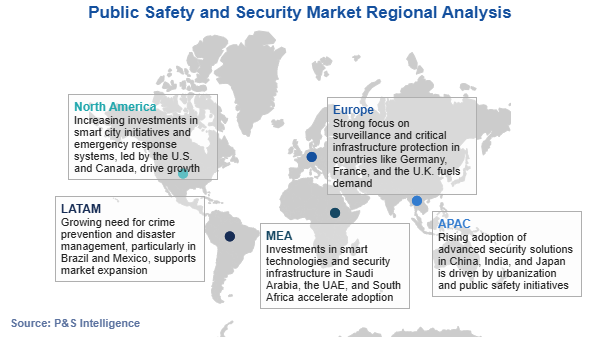

The major drivers of the public safety and security industry include the increasing cases of catastrophic accidents, the growing crime rates, the surging implementation of advanced technologies in smart cities, and the rising number of terrorist events across the globe.

Public safety and security market is fragmented in nature.