Report Code: 12842 | Available Format: PDF | Pages: 290

Provider Lifecycle Management Market Size and Share Report by Solution (Recruitment, Credentialing, Online Application, Contracting, Data Management, Finder Services), End User (Hospitals, Laboratories, Clinics, Ambulatory Surgery Centers) - Global Industry Growth Forecast to 2030

- Report Code: 12842

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Provider Lifecycle Management Market Size

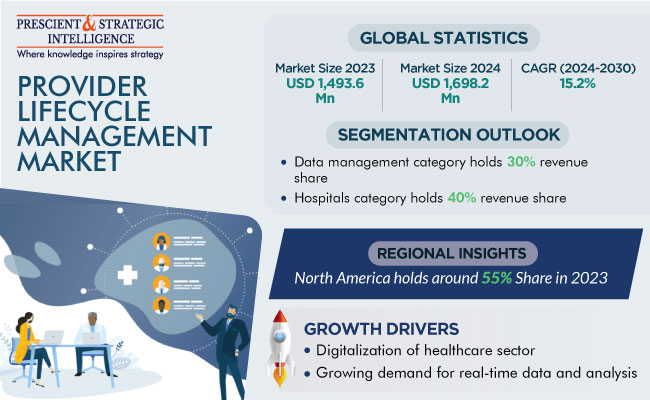

The global provider lifecycle management market is valued at an estimated USD 1,493.6 million in 2023, which is expected to reach USD 3,964.6 million by 2030, growing at a CAGR of 15.2% during 2024–2030.

The rising burden of chronic diseases and the increasing adoption of sedentary lifestyles, which is characterized by significant consumption of alcohol, tobacco, and high-calorie food and a lack of physical activity, are increasing the hospitalization rates. Therefore, the growing workload in the healthcare sector is increasing its adoption of provider lifecycle management solutions.

Additionally, a major factor contributing to the sector’s growth is the rising expenditure by governments on the healthcare industry to improve patient care quality. This is because in certain countries, such as India, Brazil, China, Mexico, and South Korea, the doctor-to-patient ratio is significantly low. In 2020, Brazil accounted for the lowest doctor-to-patient ratio, with merely 2.05 doctors per 1,000 people. In addition, these professionals are overburdened with tedious but necessary bureaucratic tasks, which, in turn, is increasing their inclination toward using these solutions.

Further, the growing pace of technological advancements, especially the employment of AI in the medical industry to decrease healthcare administrative burden, propels the market. Moreover, the advantages offered by these platforms, such as reduction in providers’ onboarding time, decrease in manual effort, and efficacious provider communication, have surged their usage.

Furthermore, in order to provide better patient care, medical organizations are increasingly focusing on different ways to enhance communication, streamline processes, and increase interoperability, all of which are enabled by provider lifecycle management solutions.

Digitalization of Healthcare Sector Is Driving the Sector

The adoption of digital technologies in the healthcare sector is significantly contributing to the industry’s expansion. The medical sector is quite extensive; therefore, its centralization has become essential in order to synchronize the workflow.

The use of digital technologies results in the optimization of resource usage, increases efficiency, reduces time consumption, and leads to fewer clinical errors, thereby resulting in both the patient and provider’s satisfaction. With all the data related to medical practice, such as on patient appointments, surgery and diagnostic test schedules, payments and insurance, as well as HR-related tasks, easily accessible on a laptop or smartphone, the healthcare community witnesses a significant reduction in the manual effort that goes into paperwork.

Growing Demand for Real-Time Data and Analysis Is Leading To Exponential Rise in Market Revenue

Healthcare institutions are turning their focus to platforms that can manage a substantial amount of data that constantly needs to be monitored, evaluated, and enhanced, thereby enhancing operations and the efficiency of the workflow. Access to real-time data has become crucial in healthcare centers in order to save time and expenses. For instance, Infosys’s Helix Credentialing module authenticates and simultaneously validates the provider information, by comparing it with external sources in real time. Moreover, it auto-checks and auto-corrects the provided data on a regular basis. Platforms such as this reduce the effort and time consumed in data management.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,493.6 Million |

Market Size in 2024 |

USD 1,698.2 Million |

Revenue Forecast in 2030 |

USD 3,964.6 Million |

Growth Rate |

15.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Solution, By End User, By Region |

Explore more about this report - Request free sample

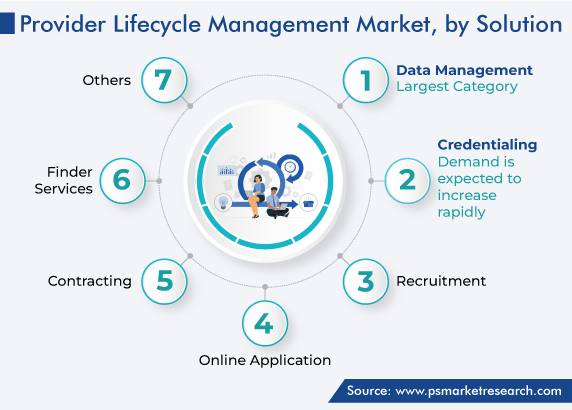

Data Management Is Highest Revenue Contributor

Data management dominates the solution type segment with a market share of 30% in 2023. The large share can be explained by the fact that hospitals possess an extensive amount of provider data, and its poor management can lead to errors. This, in turn, results in huge expenses and a waste of time and effort, which further leads to poor provider and member satisfaction.

The accuracy of provider data is crucial for operational efficiency and the achievement of consumer satisfaction. Moreover, the publishing of wrong or outdated provider details to health plan members results in the imposition of fines on healthcare payers. On top of this, if the incorrect data gets claimed by the member, leading to the nomination of an erroneous provider, the plan might get subjected to additional liability; this is in addition to the risk of unsatisfactory services. It has been estimated by a study that mistakes in providers’ information can result in USD 3 billion per annum in losses.

Furthermore, the rules introduced by the Centers for Medicare and Medicaid Services (CMS) make it necessary for payers to publish authentic, latest, correct, and complete healthcare provider (HCP) directories, consisting of their contact details, location, affiliation to an organization, specialty, and other aspects. Failure to adhere would result in the imposition of stiff fines.

Additionally, the advantages offered by these solutions, such as the efficient management of data and its ideal quality, substantial cost savings, and improvement in HCP directory authenticity, due to the reduction in data submission and usage time, lead to the overall contentment of HCPs and members.

The credentialing category accounts for a significant share as well, of more than 15%, in 2023. This is because conventional credentialing of medical practitioners is tiresome and difficult, requiring around 2 to 3 months. This is because the process involves background checks, application reviews, and the authentication and validation of licenses as well as certifications. All these tasks, if performed manually, can not only result in the consumption of significant time but also in additional expenses for the providers. This is because if credentialing team members identify that a particular detail has been missing or is erroneous, then they have to conduct a detailed review of the application. This results in the bearing of additional expense by providers and the extension of timelines.

Furthermore, any significant delay in this process leads to a delayed onboarding of credentialed physicians. All these factors are resulting in the adoption of provider lifecycle management platforms to not only hasten the process but also make it smooth and error-proof.

Additionally, there has been a significant rise in the awareness among patients regarding medical practitioner credentialing. Moreover, a large number of patients are refusing to consult physicians who are not part of their insurer’s network. This, in turn, is making it necessary for HCPs to get credentialed before beginning their practice. All these factors are collectively fueling the category’s growth.

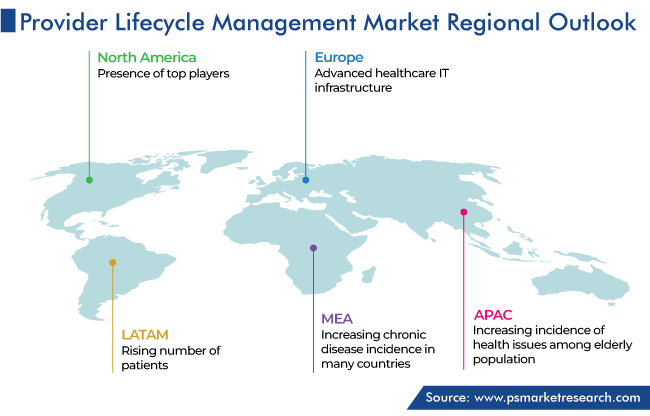

North America Is Highest Revenue Contributor

Our regional analysis says that North America leads the provider lifecycle management market with a share of around 55% in 2023. This is because of the presence of top players in the region, rising pace of technological advancements, and growing awareness among people to get quality care from verified doctors. Additionally, the presence of a robust healthcare sector, rising prevalence of diseases, resulting in a growing number of inpatient examinations, and increasing need to provide quality care contribute in the expansion of the regional business.

Furthermore, Canada contributes significant revenue to the regional market. This is attributed to the advanced healthcare infrastructure, significant government support for healthcare process digitization, and easy access to cutting-edge software technologies.

The European region is expected to hold a notable share as well, owing to the rising geriatric population, which requires efficient and instant medical care. Furthermore, the region’s sound economy results in the availability of quality medical services, which is another major contributor.

Top Provider Lifecycle Management Solution Developers Are:

- Infosys Limited

- Wipro Limited

- Virtusa Corporation

- Pegasystems Inc.

- Newgen Software Technologies Limited

- Unqork Inc.

- Simplify Healthcare Technology

- Virsys12 LLC

Report Breakdown

This fully customizable report gives a detailed analysis of the provider lifecycle management market from 2017 to 2030, based on all the relevant segments and geographies.

Solutions Analyzed

- Recruitment

- Credentialing

- Online Application

- Contracting

- Data Management

- Finder Services

End Users Covered

- Hospitals

- Laboratories

- Clinics

- Ambulatory Surgery Centers

Region/Countries Reviewed for this Report

- North America Provider Lifecycle Management Market

- By solution

- By end user

- By country – U.S. and Canada

- Europe Provider Lifecycle Management Market

- By solution

- By end user

- By country – Germany, U.K., France, Italy, Spain, and Rest of Europe

- Asia-Pacific (APAC) Provider Lifecycle Management Market

- By solution

- By end user

- By country – Japan, China, India, South Korea, Australia, and Rest of APAC

- Latin America (LATAM) Provider Lifecycle Management Market

- By solution

- By end user

- By country – Brazil, Mexico, and Rest of LATAM

- Middle East and Africa (MEA) Provider Lifecycle Management Market

- By solution

- By end user

- By country – Saudi Arabia, South Africa, U.A.E., and Rest of MEA

Projected Value by 2030 is USD 3,964.6 million

The estimated CAGR for the provider lifecycle management industry is 15.2%.

Some of the major factors driving the Provider lifecycle management market expansion include the rapid proliferation of chronic ailments, application of digital technologies in healthcare, optimization of resource usage, boosting efficiency and, consequently, diminished clinical errors that improve patient engagement and provider satisfaction.

In 2023, the data management category holds a leading market share of 30% in the provider lifecycle management industry.

The credentialing category is significant due to the tedious and costly conventional credentialing process, which has led to the adoption of medical provider lifecycle management platforms for rapid, error-free, and cost-saving credentialing.

In 2023, the North American region dominates the provider lifecycle management industry with a 55% share.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws