Market Statistics

| Study Period | 2019 - 2030 |

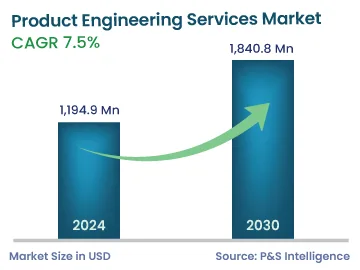

| 2024 Market Size | 1,194.9 Million |

| 2030 Forecast | 1,840.8 Million |

| Growth Rate(CAGR) | 7.5% |

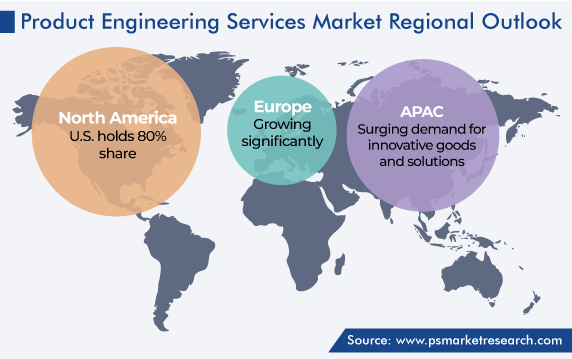

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12772

Get a Comprehensive Overview of the Product Engineering Services Market Report Prepared by P&S Intelligence, Segmented by Service (Product Design & Development, Process Engineering, Implementation & Integration, Support & Maintenance), Organization Size (Small & Medium-Sized Enterprises, Large Enterprises), Application (Customer Enterprise Products, Customer Mobile Products), Vertical (Automotive, Industrial Manufacturing, Healthcare, IT & Telecom, Aerospace & Defense, BFSI, Energy & Utilities), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 1,194.9 Million |

| 2030 Forecast | 1,840.8 Million |

| Growth Rate(CAGR) | 7.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The product engineering services market was valued at USD 1,194.9 million in 2024, which is expected to reach USD 1,840.8 million by 2030, growing at a CAGR of 7.5% during 2024–2030. This is due to the increasing demand for smart homes, lower manufacturing expenses, and continuous innovation and iteration.

The process of designing, creating, and testing software, devices, systems, or assemblies is known as product engineering. Development of new products, product design, prototype testing, and maintenance services are some of the key areas of focus. Modern product engineering services are more important than ever because of the increased desire for improving consumer experiences.

For businesses intending to quickly introduce new products and achieve a competitive advantage, less time to get to market is an essential factor. Product engineering services aid in accelerating the product development process, allowing for faster time-to-market (TTM) and guaranteeing that companies can promptly satisfy customer requests. These are also used by companies to minimize costs, reduce resource usage, and deliver products on time. In addition, they use techniques like Six Sigma and project risk management to enhance product management, marketing, engineering, support, and sales necessary to assure an agile environment through the entire product development life cycle. Thus, these factors drive the market growth.

Moreover, innovations in technology like IoT, AI, and cloud computing are increasing the demand for specialized product engineering services. These services are in higher demand because of these technologies' need for knowledge in integrating complex systems, creating scalable architectures, and guaranteeing continuous communication. In addition, without compromising quality, businesses work to reduce the expenses of product creation. By optimizing procedures, utilizing effective technology, and lowering development costs, providers of these services help organizations realize cost savings.

Furthermore, the COVID-19 pandemic has given several opportunities to market players. The industry has expanded as a result of the increased demand for prompt product deliveries and creative solutions. The pandemic brought attention to the value of flexibility and quick product development, as product engineering services make solutions easily available and help firms adjust to the shifting market needs and consumer demands. This involved creating new products, improving current ones, and applying technical improvements to satisfy the changing needs of the pandemic-affected businesses.

Overall, the COVID-19 pandemic has given the product engineering services sector the chance to contribute to the quick creation of emergency treatments. The sector's capacity to make timely product deliveries, create technology-driven solutions for fraud detection, adapt machine learning models, and maintain steady growth has aided in its relevance in the pandemic.

The customer enterprise product category dominates the market. This is because a thorough examination of the customer's requirements forms the basis of product engineering services. When analyzing customer enterprise items, it is important to recognize the issues, workflows, and business procedures of a company. Product engineers work directly with enterprise stakeholders to establish the product's scope and collect requirements.

Following the conceptual design stage, product engineers construct the physical design of the client enterprise product. This includes specifying the architecture, attributes, capabilities, and user interface of the product. Prototyping is frequently used to check the design and get input from business stakeholders.

Software technologies like CRM systems, ERP systems, or analytics platforms appear in many customer enterprise solutions. These software applications are developed using product engineering services, which also cover coding, testing, integration, and deployment. To ensure high quality and dependability, the software development process adheres to best practices, standards, and techniques. Moreover, continuous upgrades are necessary for companies to stay up with changing business requirements and technological developments. Product engineering services help the product's post-production maintenance, improvement, and support. Enterprise users' suggestions are gathered and included in further updates and releases.

On the other hand, the customer mobile product category is expected to witness significant growth in the coming years. This can be because this product or app is designed exclusively for mobile devices like smartphones and tablets. In order to design, develop, and optimize these mobile devices to satisfy client demands and expectations, product engineering services are essential. These services include coding, programming, and software development in the process of actually creating the mobile product.

Moreover, product engineering services carry out extensive testing and quality assurance procedures to make sure the mobile device complies with industry requirements. These also include functional testing, compatibility testing, performance testing, security testing, implementing features, functionality, and integrating with pertinent technologies.

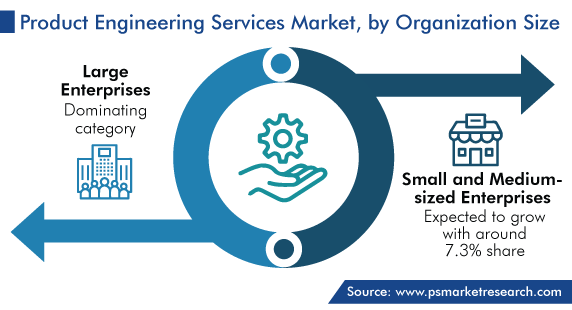

The large enterprises category was valued at USD 0.7 billion in 2023, growing at a CAGR of 7.5% during 2024–2030. This is because most big companies aim to innovate more quickly and operate at lower costs. Also, large enterprises often have more capital, technological infrastructure, and skilled labor available to them. They have the resources to pay for product engineering services in order to build or improve their mobile products.

Product engineering services give these businesses the ability to run more quickly and agilely, which improves customer engagement. Prototypes can be made by an organization using efficient digital product development services to support business expansion. Moreover, smart organizations understand that they must fully utilize their strengths in order to realize their technology plan. They need to develop platform knowledge in the newest software, tools, and technologies, as well as introduce new accelerators and frameworks, in order to apply the best products within the organizations.

In addition, large enterprises typically have a broader consumer and a greater range of goods. To create and sustain their mobile products at scale, they need product engineering services. This entails planning, creating, and testing numerous mobile software or application solutions. They may also require customization, system integration, or advanced functionalities. Additionally, these services help them provide the specialized knowledge and technical capabilities necessary to meet these complicated objectives.

The SMEs category is projected to witness significant growth in the coming years. This can be because SMEs often specialize in specific domains or niche markets, allowing them to use unique product engineering services tailored to their needs. This helps them attract clients looking for highly focused and customized solutions.

SMEs are recognized for their adaptability and quickness in responding to shifting market demands. In the quick-paced world of product engineering, their smaller size facilitates quicker decision-making and more efficient processes, which might be beneficial. SMEs are able to quickly modify their offerings to meet changing client needs and technology developments. Also, they use cost-effective product engineering services, to minimize their spending.

Moreover, SMEs frequently work as suppliers or partners with larger enterprises. They might help by offering specialized resources and experience to cooperative product development initiatives. These partnerships may be advantageous for both parties, giving SMEs access to bigger markets and more visibility while promoting the expansion of the market for product engineering services as a whole.

Drive strategic growth with comprehensive market analysis

The APAC product engineering services market is expected to grow at a CAGR of 7.9% during 2024–2030. This can be due to the increasing investments in technology infrastructure and the surging demand for innovative goods and solutions, in the region.

Many countries in the region have established themselves as global manufacturing powerhouses. These nations are recognized for their skills in electronics, automotive, telecommunications, and other industries, and they place a significant emphasis on research and development (R&D). To support the creation and enhancement of new goods, this manufacturing strength generates a high demand for product engineering services.

To remain competitive in the market, several companies in the Asia-Pacific area are implementing digital transformation efforts. The adoption of modern technologies, software, and digital platforms is part of this shift. By creating software applications, improving user experiences, and integrating new technologies into existing systems, product engineering services are essential in assisting these digital transformation initiatives.

This report offers deep insights into the product engineering services industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Service

Based on Organization Size

Based on Application

Based on Vertical

Geographical Analysis

The product engineering services market size stood at USD 1,194.9 million in 2024.

During 2024–2030, the growth rate of the product engineering services market will be around 7.5%.

Customer enterprise product is the largest application area in the product engineering services market.

The major drivers of the product engineering services market include the rising focus on time-to-market (TTM) products, the increasing requirement for ongoing innovation and iteration, the surging adoption of digital transformation technology, and the growing desire for smart homes, smart electronics, and in-vehicle networking systems.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages