Report Code: 10266 | Available Format: PDF

Probiotics Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10266

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

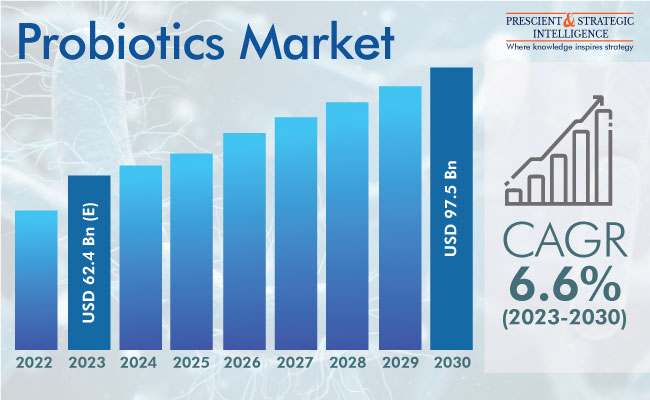

The probiotics market size was estimated at USD 62.4 billion in 2023, and it will power at a rate of 6.6% during 2023–2030, to reach USD 97.5 billion by 2030.

The industry growth is due to the increasing inclination of consumers toward preventive healthcare and the recent development of many effective probiotic strains. Such products, when consumed adequately, improve the health of the gut and decrease intestinal inflammation. They also strengthen the overall immune system, thereby strengthening the body’s natural defenses against infectious diseases.

Preventive healthcare comprises a healthy dietary and lifestyle choices to help prevent a range of ailments. Efforts in this direction are rising encouraged by the increasing income, improvement in the standards of living, and ballooning elderly population. The easy obtainability of information regarding preventive healthcare online also has a positive impact on the market. Moreover, the pandemic drove the requirement for food products that boost immunity.

Functional Food & Beverages Lead Industry

The functional food & beverages category has the largest revenue share in 2023, based on product, as probiotics are widely used for increasing the nutritional value and flavor of baked goods. Moreover, the increasing preference of consumers for buying snacks that have digestive health benefits and the rapid strengthening of food & beverage products with probiotic ingredients will power the market in this category over this decade.

In recent years, many muffins and healthy bars with good bacteria have been launched around the world because of the rising focus on preventive healthcare. For instance, So Perf, a food and drink startup that manufactures pre- and probiotic bars, was established in 2021. The bars are said to fulfill 50% of the dietary requirements of children and adults.

The dietary supplements category also contributes significant revenue to the market. These products have gained popularity amongst consumers who are on the lookout for organic solutions to prevent health issues. Dietary supplements are a natural and less-risky way of boosting gastrointestinal health and the overall immunity than conventional pharmaceuticals. The development of new products, for example, fizzy powders, gummies, and chewables, further boosts the growth of the industry.

Bacteria Had Larger Revenue Share

Under the source segment, bacteria led the industry in 2023. Most of the probiotics are sourced from bacteria, mainly Lactobacillus and, further, used in fermented foods, for example, sauerkraut, yogurt, kefir, and kimchi.

An array of bacteria genera, such as Bifidobacterium, Lactobacilli, and Streptococcus, are used as raw materials to create probiotic food & beverages. The role of these organisms, which are naturally present in the body, in maintaining gut health has been researched for ages. For instance, Lactobacilli acidophilus, which inhabits the vagina, mouth, and stomach, helps in food breakdown, nutrient absorption, and immune response initiation.

Similarly, Streptococcus salivarius is known to inhibit the activity and growth of another species in its own genus, Streptococcus pyogenes, the main cause of strep throat. Moreover, Bifidobacterium can be employed as a natural treatment for ulcerative colitis, as well to regulate intestinal microbial hemostasis, inhibit harmful pathogens that live in the gut mucosa, modulate systemic and local immune activity, and produce vitamins.

Further, the yeast category is divided into Saccharomyces boulardii and others. Apart from their usage in fermented foods for improving the flavor, ingredients with yeast enhance lactating animals' output and health. Saccharomyces boulardii is commonly used as it helps people and animals bear harsh pancreatic juices, biliary enzymes, and stomach acids.

Hypermarkets/Supermarkets Are Preferred Distribution Channel

Hypermarkets/supermarkets leads the industry in 2023, on the basis of distribution channel. People prefer to buy everyday food items and supplements from these places because of the obtainability of multiple brands under one roof. Moreover, the expansion of supermarket chains in developing countries will propel the market in this category.

During 2023–2030, the online category will be the fastest growing, propelled by the limited time people have in their busy lives to shop at brick-and-mortar stores. Additionally, e-commerce websites allow comparison on products of multiple brands, as well as offering customers the convenience of electronic payments, discounts, and home deliveries. Additionally, the increasing penetration of smartphones will power the growth of this category, especially in emerging economies.

Growing Usage of Probiotic Ingredients in Animal Feed

One of the biggest trends in the industry is the usage of Streptococcus strains in improving animal feeds, as this bacterium genus reduces the risk of pox and TB in animals. Additionally, probiotics are increasingly being used in supplements for treating numerous inflammatory skin ailments, such as atopic dermatitis and eczema. This trend is itself driven by the growing adoption of companion and production animals and the increasing concerns for their health among owners.

Human-Targeted Products Are Leading End Use

The human category holds the larger share in the end use segment in 2023. The advancements in nutraceutical research have expanded the portfolio of bacterium- and yeast-enriched food & beverage products and dietary supplements fit for consumption by humans. This is reflected in the recent launches of numerous beverages and other non-milk probiotic products. For example, Ganeden Inc. offers bacterium-enriched juices for children, elderly people, and athletes.

Over the forecast period, the animal category is expected to witness significant increase in revenue. This is because such products are receiving substantial attention with regard to animal nutrition. The ban on the usage of antibiotics on animals in numerous nations has had a positive impact on this category, as probiotics are being used to replace antibiotics in achieving the same goals.

| Report Attribute | Details |

Market Size in 2023 |

USD 62.4 Billion (E) |

Revenue Forecast in 2030 |

USD 97.5 Billion |

Growth Rate |

6.6% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Market To Grow Significantly

APAC is the largest market in 2023, driven by a considerable increase in the awareness of consumers of such products, because of the effective marketing strategies implemented by the major players. The robust demand from India, Australia, and China is playing a major part in the growth of the industry. The increasing populace, along with the rising income and bettering living standards, will also help in this regard.

North America will also grow significantly till the end of this decade due to the constant funding from the pharmaceutical and food & beverage industries in such products. The major players in the region are investing in research and development to introduce new products, for meeting the demands of different genders and age groups for a healthier lifestyle.

Key Players in Probiotics Market Are:

- BioGaia AB

- Chr. Hansen Holding A/S

- Danone S.A.

- Arla Foods Inc.

- Danisco A/S

- General Mills Inc.

- i-Health Inc.

- Lallemand Inc.

- Lifeway Foods Inc.

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Kerry Group plc

- Nestle S.A.

- Probi AB

- Koninklijke DSM N.V.

- Yakult Honsha Co. Ltd.

- Archer–Daniels–Midland Company

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws