Published: April 2023 | Report Code: 12610 | Available Format: PDF

- Home

- Power & Energy

- Pressure Vessel Market

Pressure Vessel Market Size and Share Analysis by Type (Boiler, Reactor, Separator), Material Type (Steel Alloys, Composites), Application (Storage vessels, Processing Vessels), Heat Source (Fired, Un-fired), End User (Power, Oil & Gas, Food & Beverages, Pharmaceuticals, Chemicals)- Global Industry Demand Forecast to 2030

- Published: April 2023

- Report Code: 12610

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

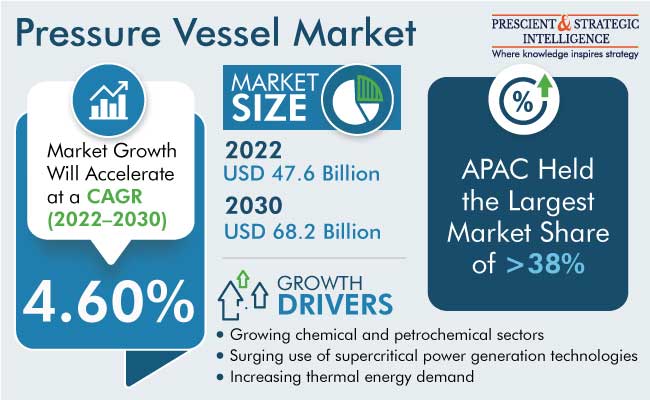

The global pressure vessel market was valued at USD 47.6 billion in 2022, and it is expected to reach USD 68.2 billion by 2030, advancing at a CAGR of 4.60% during 2022–2030. This is attributed to the rising global thermal energy demand, increasing chemical manufacturing, and surging demand for clean energy.

Moreover, pressure vessels are highly used in oil refineries, nuclear reactor vessels, mining operations, under-pressure hydraulic reservoirs, petrochemical plants, pneumatic reservoirs, submarine and spaceship habitats, road and rail vehicle air-brake reservoirs, and storage vessels for liquefied gases such as chlorine, ammonia, and propane.

In addition, the chemical industry is witnessing strong growth despite persistent supply chain restrictions as a result of inventory rebuilding, sustained demand across many end-use industries, and a continued competitive edge in natural-gas-based chemistries. Furthermore, heavy investment by companies in the industry, rebounding domestic oil and gas output, growing end-use markets, and the expansion in economies of trading partners are paving the way for increased chemical production, which, in turn, drive the demand for pressure vessels.

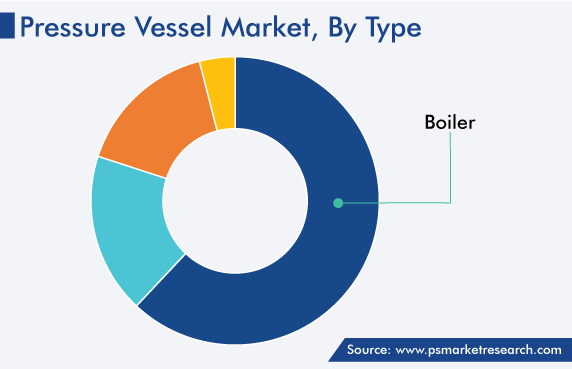

Boiler Is Majorly Used

The boiler category held the largest revenue share, of 62%, in 2022, owing to the initiation of various refinery projects and aging power infrastructure. By the end of 2023, when at least nine refinery projects are projected to begin construction in the Middle East and Asia, the world's refining capacity is expected to rise by around 3 million barrels per day (bpd).

Moreover, around 215 planned refinery projects around the world are now in the building phase and are projected to begin operations between 2022 and 2026. The other two important project stages are feasibility and approval, with 108 and 97 projects, respectively. By 2026, Asia will be one of the primary regions with the highest refinery projects.

Steel Alloy Is Getting Popular

Based on material type, the steel alloy category is expected to grow at the highest CAGR, of around 6%, during the forecast period. One of the most typical alloys found in steel is chromium. Chromium, a crucial component of stainless steel, has a stabilizing effect and leads to greater carbide production, making alloy steel tougher and stronger. Steel is also substantially more responsive to heat treatment and significantly more corrosion resistant, owing to the presence of chromium.

In alloy steels, molybdenum is frequently combined with chromium, to make them stronger, harder, and highly weldable, especially when heat treatment is used. To stop oxidation and the generation of gases in steel, silicon is practically included in steel grades. Additionally, silicon improves elasticity, hardness, and yield strength.

Alloy steels' yield strength is also increased by the addition of nitrogen, while stainless steels' austenitic stability is enhanced. Low-alloy steels frequently have phosphorus added to them to increase machinability, strength, and corrosion resistance. Phosphorus can, however, occasionally make steel more fragile. In addition, steel becomes more ductile, hard, and resistant to wear when manganese is added. It also delays the development of iron sulfides at high temperatures, enhancing the strength of the final alloy steel. Also, in alloy steels, manganese and sulfur are frequently mixed to reduce hot shortness.

Moreover, for specialist pressure vessel applications, nickel alloys, including Monel, Inconel, Incoloy, and Hastelloy, are frequently employed. Alloy steels can benefit from nickel alloys by having greater strength, impact resistance, toughness, and corrosion resistance.

Power End-Use Sector Held a Significant Revenue Share

The power category held a significant revenue share in 2022. The demand for pressure vessels in the power sector is mostly due to their ability to capture dangerous gases. Additionally, extra gas needs to be kept at metalworks and oil refineries. Reactor pressure vessels (RPVs) are unique pressure vessels used in the nuclear power sector. The most harmful pressure boundary in a nuclear power plant is the RPV, which is a pressure vessel that contains the nuclear reactor coolant, core shroud, and reactor core, and requires high dependability to survive high temperatures, high pressures, and neutron irradiation.

Moreover, it is also used in the food & beverages industry. The industry appears as a noteworthy application area since the pressure vessels are in direct contact with food. Making a pressure vessel is difficult, and when food contact is involved, the procedure is further complicated by the need for specific surface treatments like mechanical polishing and electropolishing. In order to mix, prepare, store, cook, and refrigerate food and beverages in the most hygienic way possible, pressure vessels are necessary for the food industry. The entire industry makes extensive use of process, storage, and mixing tanks for this purpose.

For instance, it is standard procedure to produce, store, and even pasteurize milk using dairy equipment. Pressure vessels’ versatility and adaptability are referred to as industrial diversification. This indicates that it is possible to store both food products, such as milk, coke, and chocolate, and chemicals and oils like chlorine, ammonia, and LPG in pressure tanks by employing the right materials during construction. They have also applications in other industries such as domestic hot water storage tanks and industrial compressed air receivers.

Suring Chemical Industry Drives the Market

Chemicals are necessary for food, clothes, healthcare, comfort, and convenience in everyday life. The chemicals industry is also an integral part of the global economic landscape. Chemicals are used in about 96% of all manufactured goods, and they cannot be replaced by other materials. More than 80% of chemicals are sold to other companies and through many transformations in different value chains before they are used by final consumers.

Chemicals are the underlying foundation on which economies are built because they are the input materials required for nearly every product. For example, India is one of the global manufacturing hubs for chemicals and petrochemicals. One of the global industries with the highest growth rate is the chemical industry in India, which is expected to reach a value of more than USD 300 billion by 2025. This industry is expected to contribute USD 300 billion to India's GDP by 2025. Also, the demand for chemicals is expected to expand by 9% per annum by 2025.

India is on the verge of becoming a major producer of chemicals and petrochemicals worldwide. The Aatmanirbhar Bharat Abhiyan and the Make in India are two of the Government of India's flagship initiatives that aim to boost this industry and foster an environment that will encourage additional investment. With the current low levels of consumption and a sizable prospective consumer base, the Indian chemical and petrochemical industry is projected to maintain its rapid development trajectory.

Moreover, in the U.S., the chemical sector is one of the largest manufacturing industries, which serves both global and domestic markets. Also, it is one of the top exporting sectors of U.S. manufacturing. For instance, the sector accounts for 15% of global chemical shipments, which makes the country one of the leaders in chemical production and exports.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

USD 47.6 Billion |

Revenue Forecast in 2030 |

USD 68.2 Billion |

Growth Rate |

4.60% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Material Type; By Application; By Heat Source; By End User; By Region |

Explore more about this report - Request free sample

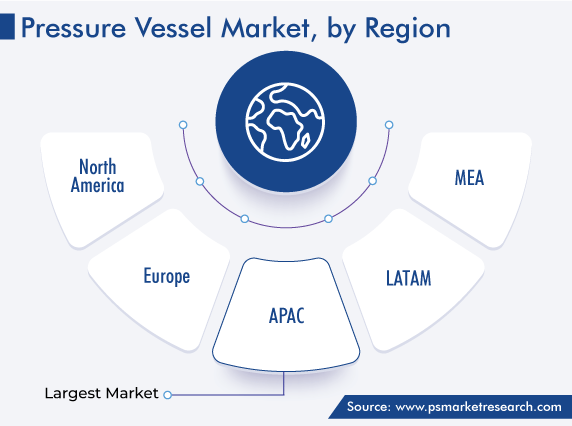

APAC Is the Market Leader

The APAC pressure vessel market held the largest revenue share, of 38%, in 2022, and it is expected to maintain the same trend in the coming years as well. This is ascribed to the growing chemical and power sectors in the region.

Since 2011, China has had the largest chemical industry in the world, and its growth continues to greatly outstrip that of other significant chemical-producing countries. Over the past two decades, China's expansion in the chemical industry has been marked by rapid investment, fierce competition, and fragmentation across a wide range of areas. The result is likely to further boost the demand for specialty chemicals as China's economic policy turns more toward consumption-driven development from investment-driven growth.

Moreover, in APAC, Japan holds the second-highest food consumption percentage of more than 20%, next to China with around 40%. Korea has around 5% while the rest of the countries in the region contribute around 30%. In Japan, people adopted Western habits for food choice and consumption. A majority of people have begun to consume more wheat, meat, milk, and other dairy products. As an increasing number of Japanese consumers allocate a higher budget percentage for food, many opportunities are getting open for international brands and investors to enter the country to introduce new food preferences for local consumption. This factor drives the demand for pressure vessels in Japan.

Moreover, the regional market is being driven by the increasing need for power. For instance, India's power demand growth rate is expected to roughly double over the next five years. According to the plan, India would increase its power generation capacity by 165.3 gigawatts (GW) over a five-year period ending in March 2027, with the majority of this capacity coming from renewable energy sources.

Top Pressure Vessel Manufacturers Are:

- Babcock & Wilcox Enterprises Inc.

- General Electric

- Larsen & Toubro Ltd.

- Mitsubishi Power Ltd.

- Hitachi Zosen Corporation

- IHI Corporation

- Bharat Heavy Electricals Limited

- Doosan Mecatec Co. Ltd.

- Dongfang Turbine Co. Ltd.

- Samuel Son & Co

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the pressure vessel industry from 2017 to 2030, based on all the relevant segments and geographies.

Based on Type

- Boiler

- Reactor

- Separator

Based on Material Type

- Steel Alloys

- Composites

Based on Application

- Storage vessels

- Processing Vessels

Based on Heat Source

- Fired

- Un-fired

Based on End User

- Power

- Oil & Gas

- Food & Beverages

- Pharmaceuticals

- Chemicals

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The pressure vessel market size stood at USD 47.6 billion in 2022.

During 2022–2030, the growth rate of the pressure vessel market will be around 4.60%.

Boiler is the largest type in the pressure vessel market.

The major drivers of the pressure vessel market include the increasing thermal energy demand, the rising need for clean energy, the growing chemical and petrochemical sectors, and the surging use of supercritical power generation technologies.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws