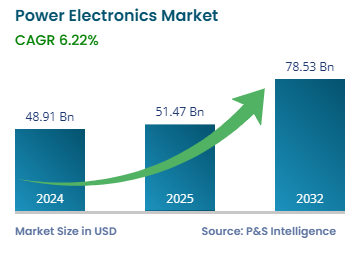

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 48.91 Billion |

| 2025 Market Size | USD 51.47 Billion |

| 2032 Forecast | USD 78.53 Billion |

| Growth Rate(CAGR) | 6.22% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 10384

This Report Provides In-Depth Analysis of the Power Electronics Market Report Prepared by P&S Intelligence, Segmented by Offering (Power Discretes, Power Modules, Power ICs), Material (Silicon, Silicon Carbide, Gallium Nitride), Voltage (Low, Medium, High), Vertical (Consumer Electronics, Industrial, Automotive & Transportation, Power & Energy, Aerospace & Defense), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 48.91 Billion |

| 2025 Market Size | USD 51.47 Billion |

| 2032 Forecast | USD 78.53 Billion |

| Growth Rate(CAGR) | 6.22% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

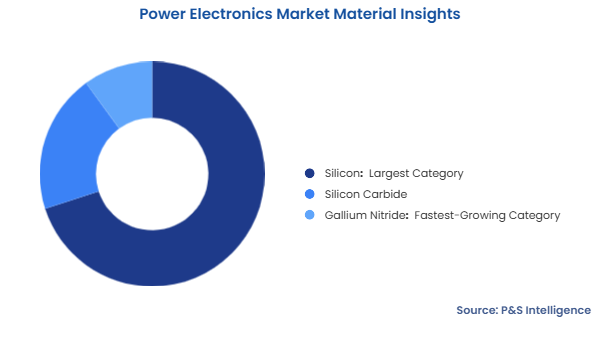

The silicon category accounted for the largest revenue share in 2024, of 70%. This can be ascribed to the high usage of these variants in multiple verticals, such as consumer electronics and ICT, which are themselves advancing; the surging demand for them from emerging economies, including China and India, and their high cost-effectiveness. Furthermore, the product demand is driven by their growing use as a substrate in the majority of the semiconductor wafers, as well as in low-power applications.

Additionally, the gallium nitride (GaN) category will witness the highest growth rate over this decade. This will be due to the several advantages of GaN-based semiconductor devices, such as higher energy efficiency, faster device speed, and cost-efficiency, which make them ideal for computers, smartphones, TVs, and cameras. Moreover, the increasing demand for energy-efficient GaN components and power semiconductors in wired communications will drive the market advance. As per studies, the GaN semiconductor device market value is set to cross USD 72.8 billion by 2030.

These materials are covered:

The power discretes category accounted for the largest revenue share in 2024, and it is further expected to maintain its dominance during the forecast period. This is because industrial appliances’ electricity consumption and noise can be reduced with power discrete devices, including IGBTs, BJTs, and MOSFETs. Thus, the need for these products will increase as they are increasingly being used in electrical power grids, industrial motor drives, inverters, and DC–DC converters.

The modules category will witness the fastest growth during this decade, with a CAGR of 7.32%. This can be ascribed to the widespread usage of these components in wind turbine inverters, micro-inverters, and photovoltaic inverters, where these modules are critical components of the power architecture. In this regard, the market growth is influenced by the increasing need for renewable resources, which require converters to change DC to AC and vice versa.

These offerings are covered:

The low-voltage category dominates the market with 65% share, and it will witness the highest growth rate during the projection period. This is due to such products’ extensive deployment in consumer electronics and the advancement in energy harvesting techniques. Moreover, the high usage of power electronics in automobiles to provide standardized output, thermal control, and control interfaces, with the help of converters, is the prime factor contributing to the industry advance.

The segment has the following categories:

Vertical Insights

Consumer electronics accounted for the largest revenue share in 2024, and they are further expected to dominate the vertical segment during this decade. This can be ascribed to the increasing number of consumer electronics manufacturers, expansive consumer base for these gadgets due to the rising income and improving standards of living, and the high rate of adoption of advanced-technology-based products.

The integrated power electronics technology is central to the functioning of consumer products, such as televisions, laptops, smartphones, computers, LCDs, and DVD players. The swift adoption of advanced technologies, at the same time maintaining a supply of electricity in these devices, drives the incorporation of power electronics.

The automotive & transportation category has the highest CAGR, of 7.82%. This is attributed to the increasing demand for hybrid, battery, and fuel cell electric vehicles on account of the rising emissions concerns. Vehicle electrification requires efficient energy storage and conversion, which leads to significant use of power discrete devices for this purpose. In addition, power electronics play a valuable role in minimizing power loss and boosting performance. Thus, the increase in demand for EVs and HEVs is expected to fuel the need for power electronics semiconductors during the forecast period. Moreover, the adoption of mass transit electric buses and the use of railway traction systems in developed regions are expected to trigger market growth. Moreover, efficient power conversion is vital for high-power electric and diesel–electric locomotives to offer optimum speed, haulage capacity, and energy efficiency. Almost all the electric locomotives and the manufactured by Indian Railways since the 2000s have either thyristors or IGBTs, while the latest diesel–electric locomotive also have IGBTs.

These verticals are covered:

Drive strategic growth with comprehensive market analysis

APAC accounted for the largest revenue share in 2024, of 35%, and it is further expected to showcase the highest CAGR, of 8.45%. This is due to the increasing population, rapid industrialization, surging demand for renewable energy, improving consumer spending, growing trend of EVs and HEVs, availability of skilled and cheap labor, large consumer base for end products, rising adoption rate of advanced technologies, and favorable government initiatives supporting the renewable energy industry. Moreover, the growing trend of European and American companies shifting their production operations to developing countries, such as China and India, will further augment the market growth.

China generates remarkable revenue owing to its huge manufacturing base, growing semiconductor industry, and strong consumer pool. The country has the largest fleet of electric vehicles, numbering over 22 million. Moreover, as per the International Renewable Energy Agency (IRENA), the People’s Republic is also the largest renewable energy generator in the world, producing 2,673,556 Gigawatt-hours (GWh) in 2022. Further, India ranked fifth with a production of 343,138.7 GWh and Japan seventh, producing 227,629 GWh. These three are also among the largest markets in the world for consumer electronics, industrial equipment, telecommunication systems, and medical devices, which propels the sale of power electronics.

Further, India has electrified over 90% of its mainline broad gauge railway network and is on track to achieving 100% electrification soon. This will drive the demand for power electronics for locomotives and traction substations. As per the latest estimates, Indian Railway operates 249 WAP-5s, 1,866 WAP-7s, 5,909 WAG-9s, 490 WAG-12s, 521 WDG-4Gs, and 162 WDG-6Gs, all of which consist of IGBT-based power electronics. In total, 800 WAG-12s, 700 WDG-4Gs, and 300 WDG-6Gs are to be manufactured for the national transporter. Further, Siemens AG has been contracted to manufacture 1,200 freight locomotives of 9000 hp to Indian Railways, further hinting at a massive demand for power electronics.

These regions and countries are covered:

The market for power electronics valued USD 48.91 Billion in 2024.

The power electronics industry is fragmented.

Technological advancements and energy efficiency are the major trends in the market for power electronics.

Consumer electronics dominates the vertical segment of the power electronics industry.

APAC will be the most lucrative in the market for power electronics.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages