Polyurea Coatings Market Analysis

Explore In-Depth Polyurea Coatings Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 12347

Explore In-Depth Polyurea Coatings Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

In 2024, the building and construction category has the largest market share, of around 50%, and it will also witness the highest CAGR, of 12.5%, over the forecast period. This is attributed to the critical role of these coatings to protect concrete and metallic structures from moisture and abrasions, while reducing VOC emissions. The robust growth in construction activities worldwide on account of the rising population, economic growth, and surging demand for a better urban life, propels the market in this category.

We have analyzed the following applications in the report:

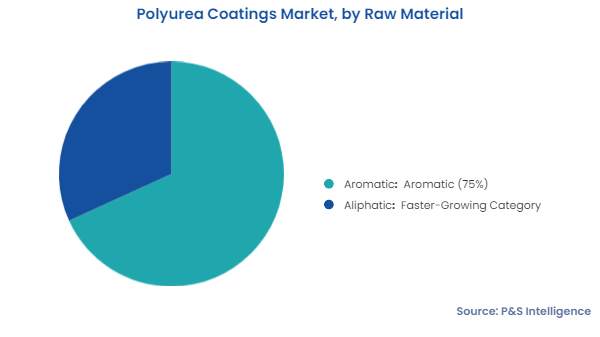

Aromatic isocyanates hold the larger share in 2024, of 75%. They contain chemicals that react with amine hydroxyl groups to generate polyurea coatings. Aromatic isocyanates are made using benzene and toluene as raw ingredients. Toulenedisocyanate and methylenediphenyl disocyanate are the two most-common aromatic isocyanates utilized in the building and construction industry.

The weather in North America and Europe favors the use of aromatic polyurea coatings, which are often less expensive than aliphatic alternatives. Aromatic isocyanates are employed as a basecoat, which means they are the first layer applied to any surface. As a result, they are widely utilized in automobiles, which is why the aromatic polyurea coatings market size is predicted to grow rapidly.

The aliphatic bifurcation will witness the faster growth, with a CAGR of 12.6%, over the forecast period. This is attributed to the UV resistance and color stability of aliphatic polyurea. Moreover, these variants have wide-ranging applications, including building exteriors, automobiles, and marine structures.

The below-mentioned raw materials are covered:

Hybrid is the larger and faster-growing bifurcation in the market, with a 2024 share of 60% and 2024–2030 CAGR of 12.4%, respectively. This is attributed the growing demand for hybrid-polyurea coatings in the construction industry, which continues to boom globally, especially in developing countries. This is itself because these coatings are cheap, durable, and long-lasting, which are the key requirements of construction companies these days. Additionally, the technical advancements in them have made them more desirable over pure-urea variants.

The segment is bifurcated as follows:

The spraying category dominates the market with 55% share in 2024. The introduction of advanced pumps and spray guns have made this method popular among end users. Additionally, this technique is preferred in a range of industries, including automotive and construction. This technique also reduces the requirement for labor in mixing and pouring the coating by hand and enables high-quality and consistent finishes.

The technologies studied in the report include:

The following regions and countries have been analyzed in the report:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages