Polyurea Coatings Market Future Prospects

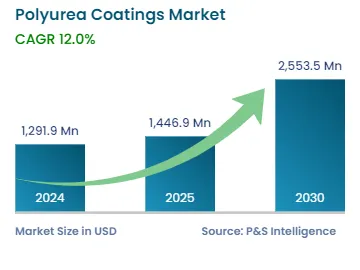

The global polyurea coatings market sales revenue crossed USD 1,291.9 million in 2024, and it is expected to advance at a CAGR of 12.0% during 2024–2030, reaching USD 2,553.5 million by 2030. Due to the rising environmental concerns and need for sustainable development, polyurea technology holds a major place in the coatings industry, garnering high investment in research and development.

The building and construction, automotive and transportation, and industrial sectors are among the key end users of these materials. Furthermore, the demand from the defense and marine industries for polyurea coatings has increased, as they protect military and marine equipment against chemical reactions and environmental damage.

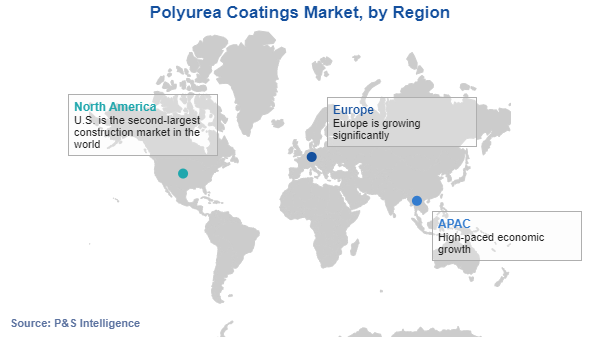

The U.S. and Europe have been at the forefront of the Industrial Revolutions over the last two-and-a-half centuries, but Asian countries have made a significant progress in the past few decades. A huge investment in infrastructure and a growing manufacturing base, because of the lower labor cost, are being seen in developing Asian countries, including China, South Korea, Singapore, Hong Kong, Taiwan, India, Indonesia, and Malaysia. Moreover, the demand for high-quality items is surging in the region as the middle-class population's disposable income rises, all of which is leading to a surge in the demand for polyurea coatings.

Polyurea coatings are utilized on the exteriors of automobiles, including trucks and two-wheelers. They are commonly seen on the chassis, transmissions, gearboxes, driveshafts, and engines, as they offer good resistance to the external physical and thermal pressure.

Further, polyurea coatings are becoming a popular choice among automakers. Germany, China, and Japan are the top three passenger automobile producers. As a result, polyurea coatings’ applications have developed greatly in these nations. Volkswagen, Audi, Mercedes, Opel, Porsche, and BMW are all part of Germany's highly competitive automobile sector. This industry generates around USD 468.5 billion, which accounts to approximately 20% of the total German industrial revenue.

Most truck manufacturers now use spray-on protective coatings that are not only attractive but also provide long-term protection. Polyurea coatings offer resistance to dynamic and static impact, corrosion, UV rays, and abrasion. These materials improve the appearance of substrates, while also keeping equipment safe for a long time with few resources. Polyurea coatings are commonly utilized as a primer alternative on vehicle chassis and as topcoats on vehicle bodywork. Hence, the increasing production of heavy-duty vehicles is predicted to significantly drive the market growth.