Market Statistics

| Study Period | 2019 - 2032 |

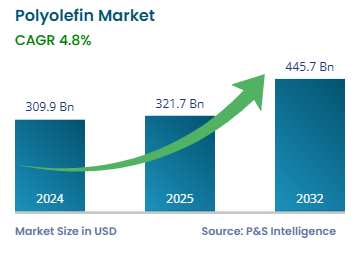

| 2024 Market Size | USD 309.9 billion |

| 2025 Market Size | USD 321.7 billion |

| 2032 Forecast | USD 445.7 billion |

| Growth Rate(CAGR) | 4.8% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Consolidated |

Report Code: 12491

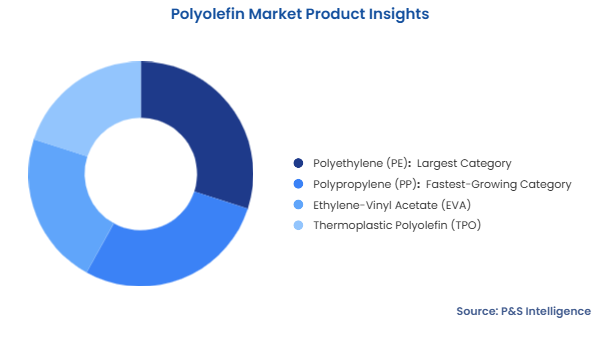

This Report Provides In-Depth Analysis of the Polyolefin Market Report Prepared by P&S Intelligence, Segmented by Product (Polyethylene (PE), Polypropylene (PP), Ethylene-Vinyl Acetate (EVA), Thermoplastic Polyolefin (TPO)), Application (Films & Sheets, Injection Molding, Blow Molding, Profile Extrusion), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 309.9 billion |

| 2025 Market Size | USD 321.7 billion |

| 2032 Forecast | USD 445.7 billion |

| Growth Rate(CAGR) | 4.8% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Consolidated |

|

Explore the market potential with our data-driven report

The global polyolefin market was valued at USD 309.9 billion in 2024 and growing with a CAGR of 4.8% during 2025–2032, it is predicted to reach USD 445.7 billion by 2032. This will be owing to the growing demand for this chemical from industries such as electrical & electronics, automotive, and packaging. These chemicals are also used for adhesion modiï¬cations in the textiles and nonwoven industry. In addition, the surging requirement for the commodity in renewal energy generation is propelling the domain advancement.

Polyolefins, which can be made into rigid and flexible plastics, are consumed in two-thirds of the total plastic production. The qualities of their derivatives include temperature resistance, chemical resistance, and high impact strength. Polyethylene and polypropylene belong to the family of thermoplastics. They are created by polymerizing ethylene and propylene, respectively, which are primarily sourced from fossil fuels, such as oil and natural gas, but may also be acquired from renewable resources. They serve many industries such as packaging, automotive, construction, and consumer manufacturing. Polyolefins serve as essential manufacturing materials because they present durability alongside flexible performance quality and affordable cost. The market continues to grow because emerging economies push up demand and plastic packaging becomes more widespread and manufacturers create superior polyolefin grades through continuous polymer research.

The polyethylene (PE) category dominates the market with 30% share, because it displays versatility and wide industry usage. Thermoplastic polyethylene in several density choices enables manufacturing of packaging films consumer items and pipes especially where its low-cost durability and handling benefits come together. The manufacturing of plastic packaging products consumes large amounts of PE which makes this product segment hold major market influence. The wide set of production options plus use cases makes PE stand as the top market leader among polyolefins.

The existing PE production systems and the market needs of packaging, construction, and consumer goods sectors make polyethylene the main product in this market. Polyethylene advances through better grades with enhanced features open up more opportunities to stay as the top-used polyolefin all over the world.

Polypropylene (PP) is the fastest-growing category within the polyolefin market because it possesses versatile characteristics along with expanding industrial applications across different sectors. Properties such as lightweight nature, high tensile strength as well as excellent chemical resistance have made PP a top choice material for automotive production of lightweight components which leads to better fuel efficiency and electric vehicle progress. The combination of cost-effectiveness and processability together make PP an excellent choice for packaging purposes which includes both rigid and flexible types of packaging formats. PP's growth accelerates because consumers demand more goods while preferring sustainable materials which are also sought after for recycling purposes. Moving forward continuous PP grade and processing technology developments including metallocene PP will boost both performance capabilities and application potential which strengthens PP as the fastest untamed polyolefin sector.

Products covered in the report:

The film and sheets application category held the largest market share, of 35%, in 2024. This is because of the polymer usage stays strong in packaging and protective operations. Polyolefins become widely used in food packaging as well as industrial films because of their good balance between strength and price. The number of items packaged in various industries plus rising preferences for light and adjustable packaging materials. The changing food preferences, such as for processed foods, are projected to boost the use of films and sheets. The multipurpose processing options of polyolefin films and sheets make them popular because they deliver performance that matches business packaging needs.

Ongoing improvements in film and sheet capabilities enable companies to use barrier films and layers to develop new products with better functionality. The market continues to value the polyolefin segment because companies focus on making more environmentally friendly packaging solutions out of recycled and plant-based materials.

The injection-molding category will grow at the higher CAGR, of 5%, during the forecast period, because it supports applications in automotive fields along with consumer goods and medical equipment and packaging products and its ability to generate innovative and efficient complex plastic parts. The automotive industry leads an increasing demand for lightweight components which drives the rapid expansion of the market through its need for fuel efficiency and electric vehicle development support.

The consumer goods and electronics fields now actively use injection-molded polyolefins for diverse products because they offer beneficial costs and flexible designs. The market expansion benefits from injection molding through its compound capabilities to create complex designs and its continual polyolefin grade advancements.

Here are the applications covered in the report:

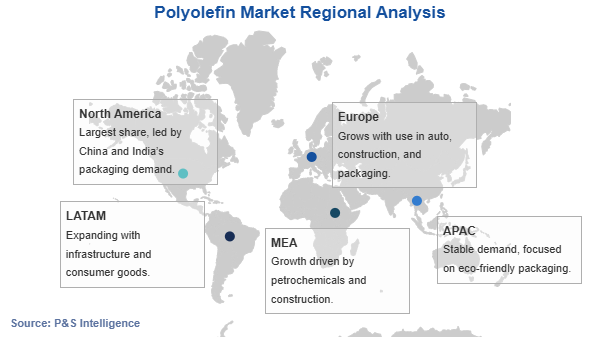

Drive strategic growth with comprehensive market analysis

The APAC region held the largest market share, of 45%, in 2024 and it will grow at the higher CAGR, of 6%, during the forecast period. With the booming population, industries, and packaging needs, sales of these materials are set to grow faster in APAC than in other regions. Essentially, the rising consumption of these polymers in developing countries, including India and China, itself due to the presence of numerous manufacturing centers, is responsible for this expansion.

The polyolefins industry in the Asia Pacific benefits from strong manufacturing performance and uses these materials in packaging parts for cars and homes. Infrastructure construction trends across the nation lead to rising product purchases like polyolefin pipes and construction components along with insulation materials to support urban development. The market grows because companies use more flexible packing methods and the online shopping industry expands.

China maintains its market leadership within APAC by holding more than 60 percent of polyolefin demand and will remain the top player in this region. The size of China's production facilities and trade role push polyolefin demand higher throughout numerous sectors across the country. Electric car sales and requirements for lighter vehicle parts allow the market to expand steadily. India's market growth speed comes from rising automotive and packaging industries alongside building expansion. The middle-class population growth and bigger purchases of packaged items drive market growth. In this area, many people and their rising incomes lead to regular upgrading of infrastructure which drives polyolefin product demand strongly. The polyolefin market will grow because Asia Pacific continues to develop its industries using modern production methods while serving its huge population.

The market develops from polymerization technology enhancements and strong environmental sustainability efforts. Companies produce more polyolefin products from plant materials and recycled sources to follow environmental rules and defend the planet. Additionally, the growing building and construction sector will aid the regional market advance. Owing to their durability and corrosion resistance, there is an increase in the use of these products in the building & construction sector. Moreover, the developing healthcare sector and lucrative investment opportunities will expand the consumption of this product in the region.

These regions are covered:

The polyolefin market is highly consolidated. There are few dominant firms in the market because they own big production capabilities plus vast distribution channels throughout their assets. Major global companies like LyondellBasell Industries, Saudi Basic Industries Corporation, and ExxonMobil Corporation control the marketplace by applying production scale advantages and polymer technology improvements. The top players in this sector invest in new product ideas while protecting the environment while developing their production locations to stay ahead of competitors. The market includes big global companies as well as small specialized manufacturers who operate both nationally and regionally. The increased needs from packaging production along with automotive assembly plants create construction buildings and healthcare facilities drive steady market growth. The growing use of renewable materials and recycled plastics makes business competition between companies more intense across the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages