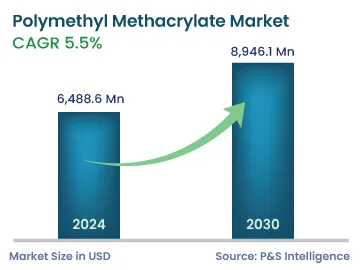

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 6,488.6 Million |

| 2030 Forecast | 8,946.1 Million |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12801

Get a Comprehensive Overview of the Polymethyl Methacrylate Market Report Prepared by P&S Intelligence, Segmented by Type (Extruded Sheets, Pellets, Beads), Grade (General-Purpose, Optical), Application (Signs & Displays, Construction, Automotive, Electronics, Marine, Healthcare, Agriculture, Consumer Goods), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 6,488.6 Million |

| 2030 Forecast | 8,946.1 Million |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global polymethyl methacrylate market size was USD 6,488.6 million in 2024, which is further expected to increase to USD 8,946.1 million by 2030, advancing at a CAGR of 5.5% during 2024–2030. This can be attributed to the rapid urbanization and industrialization, increasing standard of living associated with the rising per capita income, rampant infrastructure development, particularly in emerging economies, such as China, India, and South Korea; growing electronics and advertisement industries, and booming R&D expenditure to develop enhanced materials with better physical and chemical properties for different purposes.

The construction category accounted for the largest revenue share, of 31.4%, in 2023, and it is further expected to maintain its dominance during the forecast period. This is due to the rapidly rising population in urban areas, on account of the ongoing migration from rural areas; growing standard of living associated with rise in the per capita income, mounting trend of green building materials, which have the potential to reduce emissions; and increasing investment in the residential sector, supported by several government housing programs.

In regard to the construction sector, the material is widely used for the manufacturing of windows, canopies, doors, bathtubs, panels, sinks, and knobs, due to its weather and UV resistance and high durability.

Additionally, the electronics category will witness significant growth in the coming years. This can be ascribed to the high usage of LCD screens and monitors, mobile phone screens, and infrared transmitter and receiver windows in the booming electronics industry and the increasing advertising across industries via digital signage. The rise in the demand for electronic goods is especially rapid in developing nations, owing to the increase in the per capita income and improvements in the standard of living.

The automotive category will witness the fastest PMMA market growth during the prediction period. This can be attributed to the rising demand for new-generation vehicles, especially EVs; increasing need to manufacture lightweight and highly fuel-efficient automobiles, and surging investments by automotive giants in augmenting their production output. PMMA sheets are used in car windows, interior and exterior panels, spoilers, motorcycle windshields, fenders, instrument covers, and other ancillaries.

Research activities for polymers have shifted toward the development of eco-friendly polymers owing to the rising efforts to eliminate the negative impact of plastics on the ecosystem. Apart from the increasing environmental concerns, the sustainability regulations of governments are encouraging the development of biodegradable, renewable, and environmentally benign materials.

Moreover, the primary feedstock—MMA—as well as the secondary raw materials that are used in the manufacturing of PMMA are subject to the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation. It necessitates chemical importers as well as manufacturers to register all the substances they produce or place in the market in quantities over 1 tonne in a central database, which is managed by the European Chemicals Agency (ECHA). The REACH primarily ensures the protection of the environment as well as human health and also maintains the competitiveness and fragmentation in the European chemical industry. This regulation is applicable across the 27 states of the European Union.

The PMMA industry must comply with the national regulations pertaining to the health and environmental impact of PMMA products. For instance, several legislations regulate the manufacturing of acrylic cast sheets (ISO 7823-1), acrylic extruded sheets (ISO 7823-2), and acrylic continuous-cast sheets (ISO 7823-3).

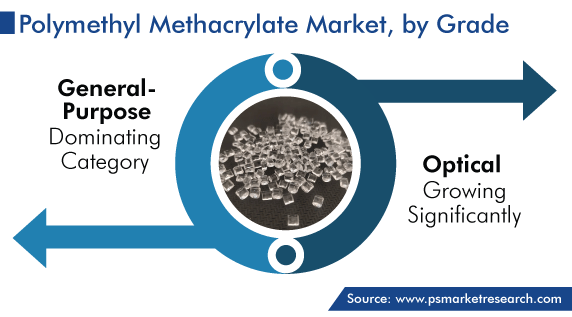

The general-purpose category accounted for the larger revenue share, of 62.4%, in 2023, and it is further expected to maintain its dominance in the coming years. This is due to the burgeoning usage of general-purpose PMMA in the construction, automotive, and other industries. This is because this variant is highly resistant to UV light and exhibits greater surface hardness compared to other thermoplastics.

The optical category will register significant growth during the prediction period. This is due to the several advantageous properties of optical-grade PMMA, including transparence, surface hardness, weather resistance, and scratch resistance.

PMMA is used as a raw material for the injection-molded plastics used to manufacture medical equipment, such as containers, catheters, syringes, and medical bags. Currently, the demand for highly durable yet lightweight medical products with easier sterilization procedures is rising, thus boosting the market growth. The rising incidence of diseases such as orthopedic disorders, dental caries, cardiovascular diseases and the burgeoning population create a high demand for injection-molded plastic equipment; hence, the demand for raw material for their production is growing.

Moreover, these types of plastics are used for production of blood sample analysis cuvettes, needle housings, pregnancy test device, and a variety of other inexpensive, lightweight, and easy-to-sterilize medical devices and components. Also, they can be precast to artificial heart valves, making blood bags, and disposable plastic syringes. They also have application in the manufacture of antibacterial contact interfaces, which kills numerous kinds of pathogens, therefore, infection spread risks are decreased.

Also, they are easy to be customized into specific application. As they acclimatize to extremely delicate and small molds, their application is growing in the manufacture of surgical equipment, as well as in implantable products, such as stents, pacemakers, and joint replacement systems, along with catheters.

Extruded sheets held the largest revenue share, of 43.8%, in 2023, and they are further expected to maintain their dominance during the prediction period. This is due to the mounting usage of such sheets in construction activities, EVs, and healthcare equipment due to their weather resistance, optical clarity, and glossy surface.

Drive strategic growth with comprehensive market analysis

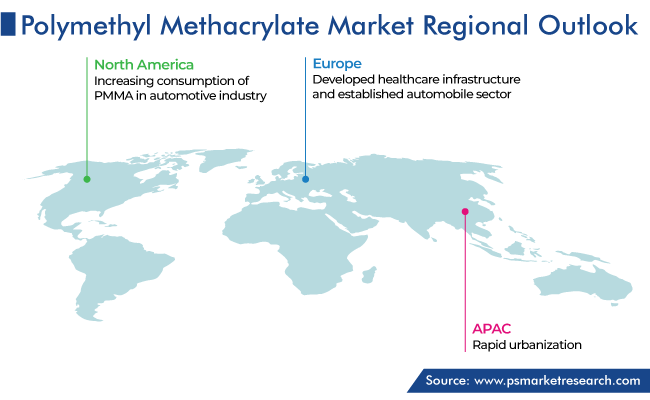

Asia-Pacific accounted for the largest revenue share, of 38.0%, in 2023, and it is further expected to dominate the market during the forecast period. This can be ascribed to the burgeoning healthcare, electronics, and agriculture industries, rising R&D and manufacturing investment by industry giants, and the shift of international players’ manufacturing facilities to the region. Additionally, the increasing population and rising per capita income are driving the demand for this material, especially in the building & construction and automotive industries.

Moreover,

North America held a significant revenue share in 2023 in the polymethyl methacrylate market as well. This can be attributed to the developed healthcare infrastructure, increasing usage of signs and displays, and mounting construction rate in the continent.

Moreover, Europe will witness substantial polymethyl methacrylate industry growth during the forecast period. This can be attributed to the rising need to reduce the weight of cars, for improved performance, high rate of adoption of advanced technologies and products, and increasing demand for lightweight medical equipment. In addition, Germany contributes the majority of the revenue to the region owing to its huge automobile industry.

This fully customizable report gives a detailed analysis of the polymethyl methacrylate market, based on all the relevant segments and geographies.

Based on Type

Based on Grade

Based on Application

Geographical Analysis

In 2024, the market for polymethyl methacrylate generated USD 6,488.6 million.

The polymethyl methacrylate industry 2024-2030 CAGR will be 5.5%.

The market for polymethyl methacrylate is propelled by the growing construction, automotive, medical devices, and electronics industries.

Eco-friendly PMMA is trending in the polymethyl methacrylate industry.

Asia-Pacific generates the highest revenue in the market for polymethyl methacrylate.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages