Market Statistics

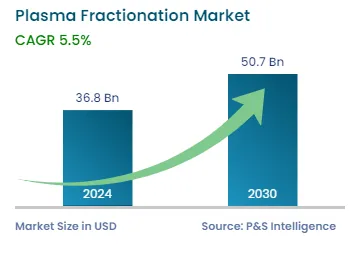

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 36.8 Billion |

| 2030 Forecast | USD 50.7 Billion |

| Growth Rate(CAGR) | 5.5% |

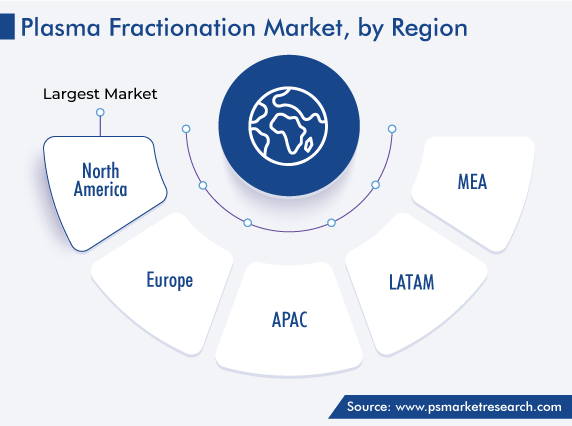

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 11610

Get a Comprehensive Overview of the Plasma Fractionation Market Report Prepared by P&S Intelligence, Segmented by Product Type (Immunoglobulins, Coagulation Factors, Albumins, Protease Inhibitors), End User (Laboratories, Hospitals & Clinics, Academic Institutes), Application (Neurology, Immunology, Hematology, Pulmonology, Rheumatology), Processing Technology (Ion-exchange Chromatography, Affinity Chromatography, Cryopreservation, Ultrafiltration, Microfiltration), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 36.8 Billion |

| 2030 Forecast | USD 50.7 Billion |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global plasma fractionation market generated revenue of USD 36.8 billion in 2024, which is expected to observe a CAGR of 5.5% during 2024–2030, to reach USD 50.7 billion.

The growth of this market is primarily driven by the rapid surge in the geriatric population, which is susceptible to a number of unusual disorders that create the need for plasma derivatives for treatment. In addition, the market is expanding as a result of the burgeoning usage of immunoglobulins in various therapeutic areas, rising incidence of respiratory problems, and growing network of plasma collection facilities.

Moreover, the growing R&D efforts, blood donation awareness, and investments by large players are expected to open up lucrative business prospects in the global market. Additionally, the encouraging government activities to raise awareness of the use of plasma-derived products are propelling the industry forward. For instance, several plasma-derived medicinal products (PDMPs) were included in the WHO Model List of Essential Medicines in March 2021. This list identifies PDMPs as effective and safe for addressing the fundamental needs in a health system and offers recommendations on how to increase their supply in low- and middle-income countries.

During the COVID-19 pandemic, the need for the treatment of patients increased the demand for Convalescent plasma, which benefitted this business. Convalescent plasma, or blood with antibodies, has long been used to treat infectious diseases, such as Ebola and influenza. Thus, a team of researchers started collecting blood from COVID-19 survivors who have antibodies in their blood, isolating the plasma from it, and then transfusing it to those suffering from the infection at that time. As a result, the industry has benefited from the rising need for plasma fractions to treat COVID-19 patients.

The increase in the global geriatric population is also a major factor responsible for the increasing incidence of many uncommon conditions/disorders that necessitate the use of blood derivatives. With the number of people aged 65 and above set to cross 1.5 billion by 2050, the usage of the plasma fractionation method to derive Ig and other therapeutic agents from the blood will rise.

Based on product type, the immunoglobulins category is predicted to witness a significant growth rate, of 7.9%, during the forecast period. This is owing to the wider commercial availability of plasma-derived immunoglobulins compared to other products and their increasing usage, especially for treating patients with chronic inflammatory demyelinating polyneuropathy or intrinsic immune deficits. Moreover, the rising prevalence of neurological and immunological diseases and increasing off-label indications for IVIg, because it provides relief to patients with systemic lupus erythematosus and improves the cardiac outcomes in infants borne by women with antiphospholipid syndrome during pregnancy, are driving product sales.

Additionally, the usage of SCIg is growing due to its ease and reduced time of administration. Immunoglobulins are also used to fight the effect of immune dysfunctions that occur with age-related changes. Thus, with the growing prevalence of infectious diseases, the use of immunoglobulins is expected to increase in the future.

In various immunological, hematologic, and neurological disorders, immunoglobulins are the first line of treatment. In the last 10 years, the prevalence of numerous immunological illnesses has increased. Moreover, due to a growth in the number of individuals with immunodeficiencies, genetic research to characterize and diagnose these conditions has grown, thus raising the clinical demand for immunoglobulins and other plasma-derived therapies.

For instance, the number of people worldwide who had the human immunodeficiency virus in 2021 was 38.4 million. To lower the risk of bacterial infections in these patients, the use of IVIg in children with HIV has been authorized by the U.S. Food and Drug Administration (FDA).

Moreover, a group of 300 disorders known as primary immunodeficiency are characterized by recurring chronic infections, autoimmune diseases, allergies, or inflammation. These illnesses are a result of genetic mutations affecting the immune system, and they can be treated with specialized immunoglobulin therapies, or immunoglobulin substitution. As a result, the market is driven by the rising demand for these therapies and the consequent growth in immunoglobulin synthesis by the plasma fractionation technique.

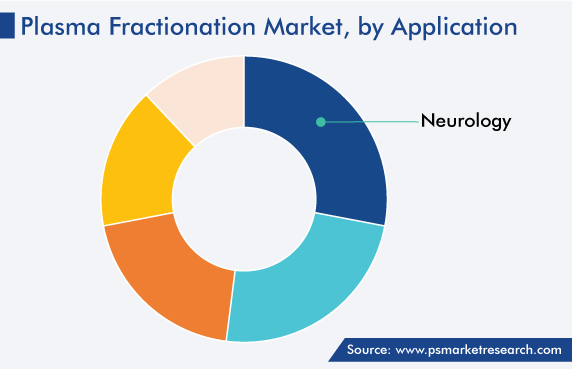

Based on application, the neurology category held the largest revenue share, of around 28%, in 2022, because of the widespread use of plasma-derived products for the treatment of neurological illnesses, which are rising in prevalence. For instance, roughly 795,000 Americans experience strokes each year. This and many other neurovascular conditions are growing in incidence due to a rise in the elderly population. The chances of having a stroke double beyond the age of 55, which encourages the use of plasma-based products for therapy.

The oncology category will display the fastest growth during the forecast time frame, because the adoption of cancer plasma therapies is quickly growing to address difficult targets that were previously intractable, such as those with the potential for metastasis and drug resistance. Additionally, a thorough examination of the complex effects of cold atmospheric plasma in cancer treatment is necessary to move toward its widespread clinical adoption, which supports the category’s expansion.

On the basis of process technology, the ion-exchange chromatography category held the largest revenue share in 2022. The usage of this technology for plasma fractionation has resulted in the creation of a new generation of therapeutic plasma derivatives, particularly coagulation factors, protease inhibitors, and anticoagulants. The implementation of chromatography techniques has also allowed for the development of new products with improved purity and safety for treating congenital or acquired plasma protein deficiencies. Recently, the advantage of chromatographic plasma protein purification in the elimination of plasma-borne viruses was demonstrated.

Moreover, the advancement of packing materials, in terms of their properties, for industrial applications, such as increased rigidity and capacity, should further encourage the use of chromatography as a crucial tool for plasma fractionation and increasingly restrict the usage of the conventional ethanol precipitation method till the final stages of albumin recovery.

Drive strategic growth with comprehensive market analysis

North America captured the largest revenue share of the market, of around 55%, in 2022. This is attributed to the ongoing development in the pharmaceutical R&D sector, growing population of hemophilic patients, rising number of plasma collection centers, booming paid plasma donation activities, and expanding product portfolios and geographical presence of the top market players in North America. Moreover, the increased awareness of the advantages of plasma and a rise in the cases of respiratory disorders make region profitable for plasma fractionation market players.

Moreover, companies in the region are focusing on the development of new drugs. For instance, Permira released a novel immunodeficiency disorder medicine in June 2022 that uses plasma-based products for more-effective and quicker outcomes.

Additionally, Canada is increasingly contributing to the regional plasma fractionation market owing to the presence of numerous established players in the country, increase in the number of plasma collection facilities, and rise in the consumption of immunoglobulins.

Additionally, companies are showing interest in mergers and demergers as a means to grow their business. For instance, in June 2021, LFB plasma declared intentions to acquire ImmunoTek Bio Center, a plasma collection center, to ensure a steady supply of plasma in the U.S.

Furthermore, Europe is holding the second-largest share for this market. This is because immunodeficiency and bleeding disorders are becoming more common in the region, leading to an increase in the investments in these systems. For instance, in 2021, Northern Europe had a high prevalence of common variable immunodeficiency (CVID), which affects 1 in 25,000 individuals.

Germany holds a sizable share in the regional market owing to its robust healthcare infrastructure, wide availability of diagnostic labs, growing consumption of immunoglobulins, and burgeoning investment by the key players.

This fully customizable report gives a detailed analysis of the plasma fractionation industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Product Type

Based on End User

Based on Application

Based on Processing Technology

Geographical Analysis

The market for plasma fractionation accounted for USD 36.8 billion revenue in 2024.

Immunoglobulins dominated the plasma fractionation industry.

The market for plasma fractionation will grow by 5.5% till 2030.

The plasma fractionation industry is driven by the rising burden of immunological, hematologic, infectious, and neurological diseases.

APAC is the most-lucrative market for plasma fractionation.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages