Payment Processing Solutions Market Future Prospects

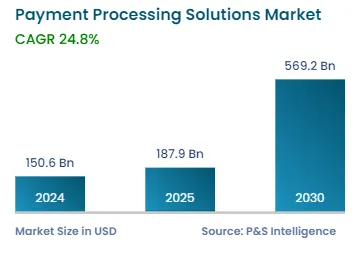

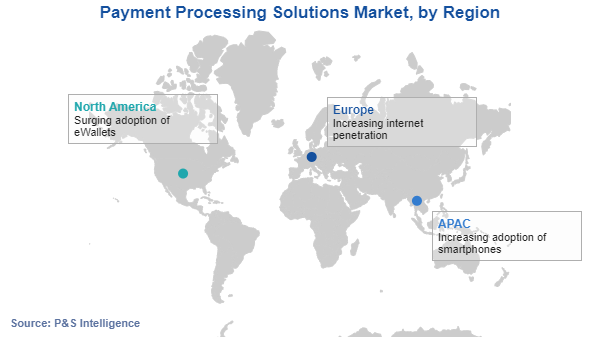

The global payment processing solutions market will generate an estimated revenue of USD 150.6 billion in 2024, and it is projected to grow at a CAGR of 24.8% from 2024 to 2030, reaching USD 569.2 billion by 2030. This is ascribed to the rising e-commerce sales coupled with the surging internet penetration and the increasing smartphone utilization.

Businesses are compelled to implement advanced payment processing systems as more consumers embrace digital transactions and online shopping in order to enable safe and easy transactions. Key sectors driving the market growth are the growth of the retail, healthcare, hospitality, and financial services.

Moreover, the rising adoption of alternative payment solutions, such as cards, e-wallets, and mobile applications, by various small, medium, and large-scale enterprises is leading to surging growth in the market.

Furthermore, continuous developments in payment technologies, such as blockchain, and artificial intelligence, are a further aspect of the competitive landscape that improves the effectiveness and security of payment processing systems.

Additionally, the expansion of the market is being driven by regulatory frameworks that support digital payments. Globally, financial institutions and governments are implementing laws and programs to promote cashless transactions, which increases the need for dependable and effective payment processing services. For instance, the Revised Payment Services Directive (PSD2) of the European Union aims to improve customer security and encourage innovation and competition in the payments sector.