Patient Engagement Solutions Market Future Outlook

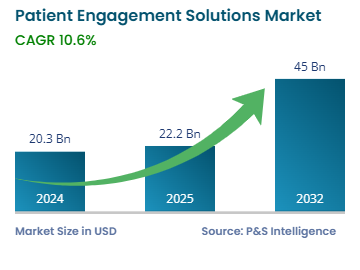

The global patient engagement solutions market size stood at USD 20.3 billion in 2024, and it is expected to grow at a CAGR of 10.6% during 2025–2032, to reach USD 45.0 billion by 2032.

The growth can be primarily ascribed to the increasing prevalence of chronic diseases and growing requirement for advanced drugs. Moreover, the improving healthcare infrastructure, spurring demand for wearable health technology, snowballing geriatric population, and surging usage of mobile health solutions are driving the market growth.

Patient engagement involves activate patients, meaning they engage in positive behavior, such as managing their own wellbeing and care. This helps improve fitness outcomes and achieve lower care expenses.

Moreover, the high capital requirement to implement conventional ways of enhancing wellbeing often restricts their adoption. To overcome this barrier, market players are introducing automated solutions that consist of interactive voice response systems, which automate phone calls to reach individuals and activate notifications to physicians and personnel providing treatment. A large number of hospitals and fitness clubs have adopted automated solutions to reduce call volumes at call centers, provide better online ratings for physicians, and lower the rate of hospital readmissions. Thus, these advantages are encouraging market players to develop advanced methods, to increase their market share and customer reach.