Market Statistics

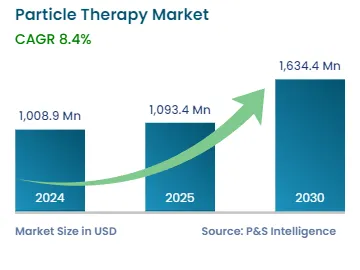

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,008.9 Million |

| 2025 Market Size | USD 1,093.4 Million |

| 2030 Forecast | USD 1,634.4 Million |

| Growth Rate(CAGR) | 8.4% |

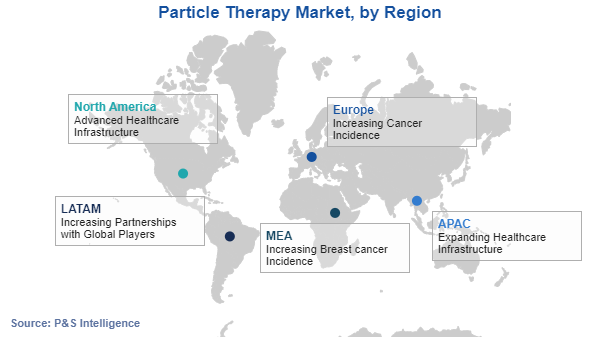

| Largest Region | Europe |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

| Largest End User Category | Hospitals |