Market Statistics

| Study Period | 2019 - 2032 |

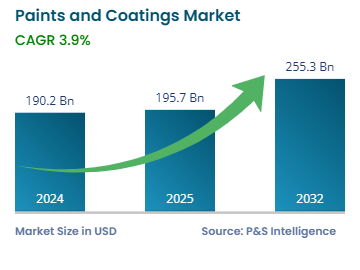

| 2024 Market Size | USD 190.2 billion |

| 2025 Market Size | USD 195.7 billion |

| 2032 Forecast | USD 255.3 billion |

| Growth Rate(CAGR) | 3.9% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 10371

This Report Provides In-Depth Analysis of the Paints and Coatings Market Report Prepared by P&S Intelligence, Segmented by Technology (Water Borne, Solvent Borne, High Solids, Powder Coatings, Ultraviolet (UV)), Formulation (Acrylic, Polyester, Polyurethane, Epoxy), Application (Architectural Coatings, Industrial Coatings, Special Coatings), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 190.2 billion |

| 2025 Market Size | USD 195.7 billion |

| 2032 Forecast | USD 255.3 billion |

| Growth Rate(CAGR) | 3.9% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The paints and coatings market was valued at USD 190.2 billion in 2024, and the industry size will reach USD 255.3 billion by 2032, advancing at a compound annual growth rate of 3.9% during 2025–2032.

The growth is credited to the rising product consumption in the automotive, general industrial, and construction sectors. In this regard, it is projected that the rapid urbanization and industrialization in emerging economies, such as India, China, and those in Southeast Asia, will drive product demand across a range of applications. Furthermore, the evolving consumer preferences together with technological advancements, are driving the development of eco-friendly, high-performance, and specialized coatings.

Moreover, the global demand has expanded moderately in recent years despite a number of uncertainties, including the slowdown of major economies, the negative effects of the low crude oil prices, the shutdown of the automotive and construction industries, and changes in global regulatory norms. Even though many of these factors are not in the control of formulators, manufacturers, distributors of raw materials and finished goods, and marketers, the sector has grown with these significant changes remarkably quickly. This has been made possible by the introduction of numerous cutting-edge manufacturing techniques that have enabled businesses to immediately mitigate a variety of potential negative effects and maximize their opportunities for driving the demand for products that are decorated and glazed.

The market is witnessing significant growth in demand for eco-friendly products such as waterborne, power, and bio-based coatings. Manufacturers develop sustainable alternatives due to increasing environmental regulations paired with escalating consciousness about volatile organic compound (VOC) emissions in the air. Advancement in nanotechnology and smart coatings enables market development through improved performance and functionality and aesthetic appeal due to modern technology integration.

The water-borne technology held the largest share, over 40%, in 2024, and it will grow at the highest CAGR, of 4.7%, during the forecast period.

Water-borne coatings have exceeded other options in the paints and coatings market because they pose a reduced impact on the environment lower VOC emissions and meet strict regulatory standards primarily in North American and European regions. These coatings serve multiple industries through exceptional adhesion and durability along with corrosion resistance making them safe for users and production staff in architectural and automotive as well as industrial applications.

With the implementation of the new formulation, technologies have improved their drying time, water resistance, and overall performance improvements that boosted their market acceptance. The global paints and coatings market will keep water-borne coatings as its largest segment because industries steer towards sustainable and eco-friendly options.

The technologies analyzed here are:

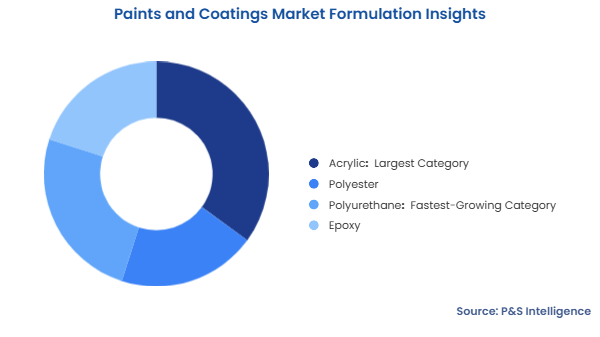

The acrylic formulation category held the largest share, over 35%, in 2024, acrylic leads in the paints and coatings market because it offers excellent cost-efficiency and adaptable properties. These coatings which use water or solvent as their base deliver superior weather resistance alongside long-lasting color protection with smooth application capabilities that suit an extensive section of usage needs. The durable satisfying finish qualities of acrylic coatings enable them to serve architectural needs for building surfaces inside and out. Their fast drying capabilities and low VOC content have become the main drivers of their market acceptance in environmentally sensitive markets. Acrylics dominate automotive refinishing sectors and industrial uses because they provide performance-specific solutions at affordable prices leading to their market dominance.

The polyurethane coatings category will grow at the highest CAGR, of 5.8%, during the forecast period, because they deliver outstanding durability together with superior performance characteristics. These coatings offer superior chemical resistance, abrasion resistance, and flexibility which helps them to be in demand. Automotive companies benefit from using polyurethane coatings to achieve strong long-lasting finishes which defend vehicles against environmental hazards. The industrial sector relies on polyurethane coatings to protect machinery and equipment from environmental damage brought by harsh chemicals alongside regular wear and tear. Polyurethane provides durable glossy finishes to wood coatings so that the sector benefits from this functionality.

The formulations analyzed here are:

The architectural coatings category held the largest share, over 47%, in 2024, because it addresses extensive paint requirements in residential together with non-residential construction. Interior and exterior paints together with primers and varnishes are essential components of this segment which serves both for building decoration and protection purposes. Global architectural coating consumption stays high due to unceasing trends in new construction together with renovation and ongoing maintenance of buildings. The architectural segment expands steadily mainly due to urbanization patterns and expanding populations and increasing household purchasing power.

The industrial coatings category will grow at the highest CAGR, of 4%, during the forecast period, because industrial machinery together with equipment and infrastructure depend on protective coatings to defend against these adverse elements of corrosion and abrasion and chemical exposure. Vehicle exteriors and interiors operated by automotive OEMs need high-performance coatings that drive the market expansion. Industrial coatings continue their growth because of increasing usage of powder coatings which provide both reliability and environmental sustainability benefits. High-quality industrial coatings lead the speediest market expansion within the paints and coatings industry.

Here are the applications covered in the report:

Drive strategic growth with comprehensive market analysis

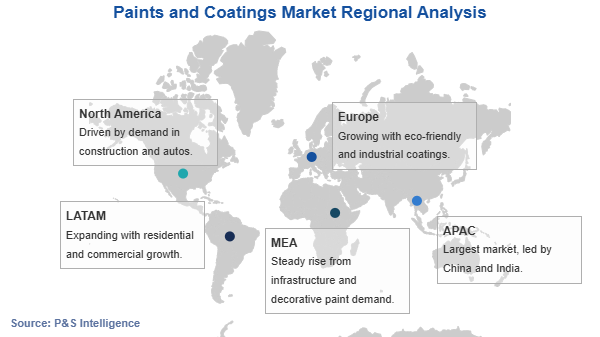

The APAC category will grow at the highest CAGR, of 5.9%, during the forecast period. This is mainly driven by the growing construction industry in China and India, which is driving the adoption of new coating resins and formulations. This is itself essentially credited to the increasing demand for paints and coatings for the renovation and repair of commercial and residential buildings. Additionally, the increase in government and overseas investments in the construction and automotive sectors is driving the market in the region.

Furthermore, the growing real estate activities, combined with the rapid urbanization, booming population, and increasing disposable income, propel the demand for paints and interiors in the region.

For instance, the Indian real estate sector has witnessed rapid growth in recent times, with a rise in the demand for office as well as residential spaces. A key reason for the growth of the sector is the shift in the work culture and the development of a taste for the high-end lifestyle. This, in turn, is leading to the development of designer commercial spaces and elegant homes, thus advancing the scope of painting materials, such as acrylic and polyester.

The regions analyzed here are:

The paints and coatings market are fragmented in nature because multiple organizations operating throughout different market portions including architectural along with industrial and specialty divisions. Large corporations like Sherwin-Williams, PPG Industries, AkzoNobel, Nippon Paint Holdings, and BASF SE dominates the market yet they encounter competition from area-specific and small-scale coating providers in specific applications. The market features multiple technological approaches water-borne and solvent-borne throughout various formula types acrylic and polyurethane which satisfies industrial and construction and automotive and marine market requirements.

Some distinct sectors within the market demonstrate rising signs of market consolidation. Major players in the architectural coating segment dominates through their research and development abilities along with global distribution capabilities since they invest heavily in environmentally friendly low-VOC water-based coating formulations. Major companies use mergers and acquisitions as common business strategies to both acquire more market share and attain advanced technological capabilities.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages