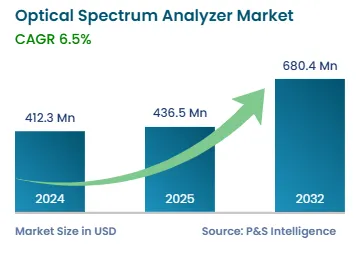

The optical spectrum analyzer market size stands at USD 412.3 million in 2024.

What will be the growth rate of the optical spectrum analyzer market during the forecast period?+

During 2025–2032, the growth rate of the optical spectrum analyzer market will be 6.5%.

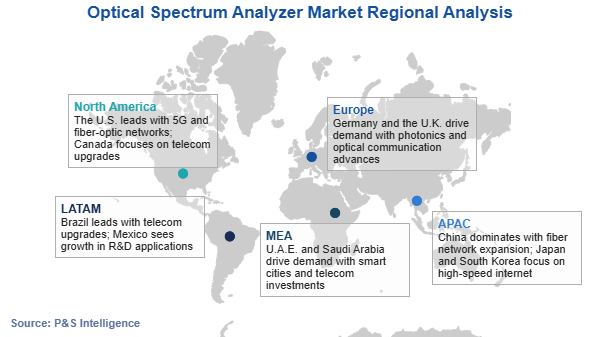

Telecommunication is the largest end user in the optical spectrum analyzer market.

The major drivers of the optical spectrum analyzer market include the advancement in 5G technology and developments in healthcare and telecom facilities.

Optical spectrum analyzer market is consolidated in nature.