Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 175.3 Billion |

| 2030 Forecast | USD 255.9 Billion |

| Growth Rate(CAGR) | 6.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12583

Get a Comprehensive Overview of the Operational Technology Market Report Prepared by P&S Intelligence, Segmented by Component (Field Instruments, Control Systems, Services), Connectivity (Wired, Wireless), Industry (Process Industry, Discrete Industry), Technology (SCADA, DCS, PCD, PLC, SIS, BAS), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 175.3 Billion |

| 2030 Forecast | USD 255.9 Billion |

| Growth Rate(CAGR) | 6.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global operational technology market was valued at USD 175.3 billion in 2024, and the market size is predicted to reach USD 255.9 billion by 2030, advancing at a CAGR of 6.5% during 2024–2030. The market is driven by the increasing emphasis on real-time data analysis and predictive maintenance, strategic initiatives by governments to promote the adoption of operational technologies (OTs), and emergence of connected enterprises.

Operational technology is used to regulate physical systems, such as in manufacturing. It encompasses industrial control systems (ICS) and the ICS management framework, as well as supervisory control and data acquisition (SCADA) systems.

In this new era of technology, manufacturing and other associated industries are driven by Industry 4.0. The requirements of the new manufacturing paradigm are profoundly dependent on data. To operate, robotics and other automation technologies rely on data gathering and its advanced analytics. The smart machines that drive the Industry 4.0 revolution are connected to each other and the internet. This connection allows data to be apprehended, shared, analyzed, and used to optimize industrial systems, with the help of OT.

Connected enterprises are also emerging, and they utilize smart processes, which employ data analytics, facilitating a secure and unified connection among individuals, procedures, and equipment. A well-configured connected enterprise displays improved efficiency and decreased operating costs. Although the idea of the connected enterprise is relatively new, it has appeared in every other industry to some level, including logistics, manufacturing, and transportation.

The major players in this space include Cisco Systems, IBM, Rockwell Automation, PTC, Microsoft, Honeywell, GE, and Bosch. They are constantly growing through modernization and engaging in partnerships, collaborations, and M&A. For organizations with larger investment capabilities, the concept of the traditional IT infrastructure is rapidly giving way to the concept of the connected enterprise.

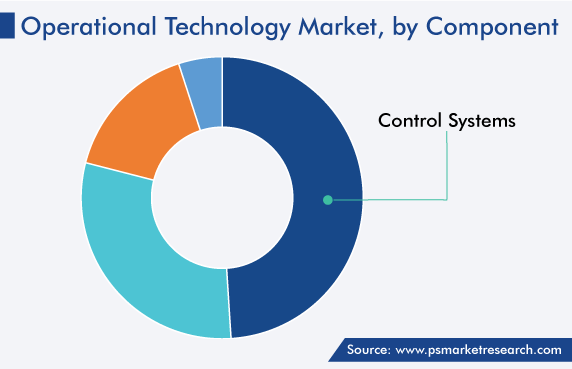

Control systems held the largest share, of around 48%, in 2022. This is attributed to the surge in the adoption of SCADA for collecting real-time data from remote locations and controlling different devices. For industrial organizations, SCADA systems are vital as they aid in sustaining efficiency, processing data for smarter decisions, and communicating system issues to help in easing downtimes.

For instance, with this system, operators are informed quickly if a set of products is displaying a high incidence of errors. The operation is then paused, and the operator assesses the SCADA system’s data via an HMI, to determine the source of the issue. The operator reviews the data and determines which machine is malfunctioning. This way, the SCADA system’s capability to alert the operator of an issue helps resolve it and prevent a further loss of production.

Moreover, due to the rise in the demand for distributed control systems, this category is growing. This is credited to the increase in the adoption of process automation and control solutions in industrial plants. With industrial automation and control, enterprises work smarter and quicker, while reducing wastage and operating costs. If process automation is not efficient, plant operators need to monitor performance values and the quality of the output manually, to find the appropriate operational setting for the production equipment, which is not only tedious but also prone to error.

The wireless category held the larger share in 2022. This is mainly because wireless connectivity provides wider area coverage and faster communication, via WLAN. Today, most of the networks are operating on the wireless mode, because wireless LANs use high-frequency radio signals, infrared beams, or lasers to connect workstations, file servers, or hubs. Various devices are connected through wireless technologies to form an area network.

Moreover, ISA 100 is a type of wireless connectivity that operates in the 2.4-MHz frequency range and can support up to 15 channels. It is a plant-wide wireless networking technology that is purpose-built for every industry. It simplifies wireless operations, advances wireless performance, and lessens operative expenses.

ZIGBEE is also a type of wireless technology that offers easy network expansion, low power consumption, good coverage area, and network stability. It has a mesh type of network, which provides a greater range and more-stable coverage compared to Wi-Fi. It has a network the transmission range of which can be extended. It also delivers improved stability over a single router. The content is scalable since the individual nodes in this act as repeaters or wireless routers, and since the technology supports numerous nodes, it is easier to expand the network.

Process industries held the larger operational technology market share in 2022, because OT is increasingly being adopted in the oil & gas industry. This provides new opportunities to enhance the overall business performance with the help of improved asset reliability. For end users, the incorporation of analytics, IIoT, and other prescriptive and predictive technologies helps in bringing performance to an advanced level. The SCADA system can be designed for quickly and efficiently meeting the requirements of companies operating oil & gas pipelines.

In the same vein, in the pharmaceutical industry, the use of operational technology can lower the chance of human error, through its capability to consistently accomplish repetitive tasks. Pharmaceutical companies are continuously integrating automation into specific processes, such as serialization, anti-counterfeiting, and drug development. For instance, in manufacturing, automation has become important in processes including machine tending, sorting, kit assembly, and packaging.

Additionally, with time, the food & beverage industry is deploying digital solutions to improve the quality of the products and the speed at which it delivers them to consumers. As this industry is adopting Industry 4.0 processes quickly, the integration of OT solutions is growing to screen and control the manufacturing activity.

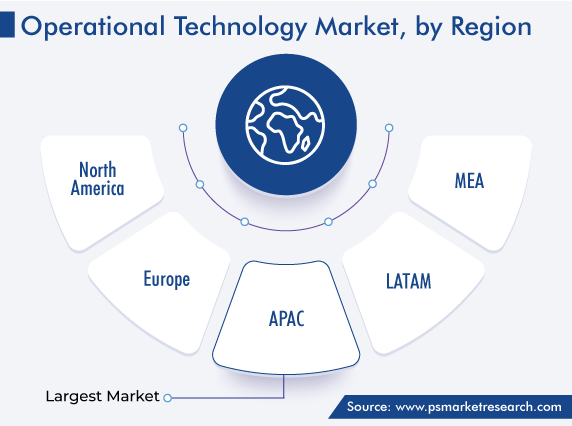

Drive strategic growth with comprehensive market analysis

APAC held the largest share, of around 48%, in 2022, mainly due to the growing adoption of technologies such as IoT and IIoT, to realize the concept of smart factories. The region is extremely diverse, with localized characteristics ranging from low-cost and low-productivity countries to technologically advanced and high-manufacturing-cost countries. Due to these factors, countries such as China, Japan, South Korea, Taiwan, and Singapore can be classified as developed manufacturing countries, while India, Thailand, Vietnam, Malaysia, and Indonesia are still considered developing manufacturing countries.

Moreover, in APAC, one of the key drivers of the economy is manufacturing. With the initiation of the Industry 4.0 revolution, the region’s major manufacturers are undergoing a significant evolution, as connectivity becomes the key pillar of next-generation factories, where AI, machine learning, IoT, and cloud computing are being embraced to enable smart manufacturing.

Globally, South Korea was one of the first to launch 5G services. Moreover, being an economy that depends strongly on manufacturing, it has revealed a plan to leverage AI and 5G to roll out smart factory solutions, engaging telecom providers for it, for the country’s small and mid-size industrial facilities. By 2025, the country aims to have 30,000 factories.

Similarly, in Japan, the semiconductor & electronics industry is creating growth opportunities for the market. Japan accounts for around 10% of the global semiconductor production. In 2021, Tokyo approved an around USD-6.0-billion package for investment in semiconductor manufacturing, including around USD 3.0 billion for Taiwan Semiconductor Manufacturing Company’s (TSMC) new foundry in Kumamoto prefecture.

Further, in China, the market is booming with the increasing count of government initiatives for the development of the automotive industry. China continues to be the largest vehicle market globally, with the Chinese government expecting that automobile yields will reach 35 million by 2025. New-energy vehicles (NEVs) are one of 10 focus areas of the Made in China 2025 program, a government initiative to advance the country’s industry from low-cost mass production to higher-value-added advanced manufacturing. Moreover, in 2025, the country is planning to sell 3 million domestically branded NEVs and for them to occupy a minimum of 80% of the country’s NEV market share.

The report analyzes the impact of the major drivers and restraints on the operational technology industry, to offer accurate market estimations for 2019–2030.

Based on Component

Based on Connectivity

Based on Industry

Based on Technology

Geographical Analysis

In 2024, the market for operational technologies valued USD 175.3 billion.

The operational technology industry is driven by the rampant digitization and automation of the industrial sector.

The market for operational technologies is segmented by component, technology, connectivity, industry, and region.

The highest operational technology industry revenue comes from control systems.

Asia-Pacific dominates the market for operational technologies.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages