Ocular Implants Market Analysis

Explore In-Depth Ocular Implants Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 12366

Explore In-Depth Ocular Implants Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Glaucoma implants dominate the market with 40% share. This can be ascribed to the introduction of innovative glaucoma-implanted devices, such as micro-invasive glaucoma surgery (MIGS), and the initiatives of government and private organizations to raise glaucoma awareness. The World Glaucoma Association (WGA) organizes World Glaucoma Week each year to increase awareness about the risk and prevalence of glaucoma. Glaukos Corporation, as a sponsor, has developed a global education and awareness campaign and is cooperating with eye care institutions to provide free glaucoma screenings.

The intraocular lenses category will have the highest CAGR, of 5%, during 2024–2030 in the market. This is because of the extensive usage of intraocular lenses in the treatment of nearsightedness, farsightedness, and presbyopia. The overall number of patients receiving cataract surgery has more than tripled in a decade, which has also boosted the demand for these lenses. Furthermore, technological developments and increased awareness in developing countries are also expected to drive the market in this category.

These products are covered in the report:

Glaucoma is the largest category in the market, with 40% share. This is attributed to the increasing number of people with this disease and their rising awareness of it. As per the American Academy of Ophthalmology, 111.8 million people around the world will have this eye condition by 2040. Several agencies globally are working to raise awareness of this disease, which can cause blindness by damaging the optical nerve.

The AMD category is expected to witness the highest CAGR during the forecast period. The biggest reason for it is the growing geriatric population as it is highly susceptible to this disease. As per studies, compared to 196 million in 2021, 288 million people worldwide will have this condition by 2040. Further, according to Johns Hopkins Medicine, the most-common cause of loss of vision among people aged 50 and more is AMD. With the WHO forecasting the global population of people in the age group of 65 and above to grow by 400 million between 2020 and 2050, the demand for AMD treatment will continues to rise.

We have analyzed the following applications:

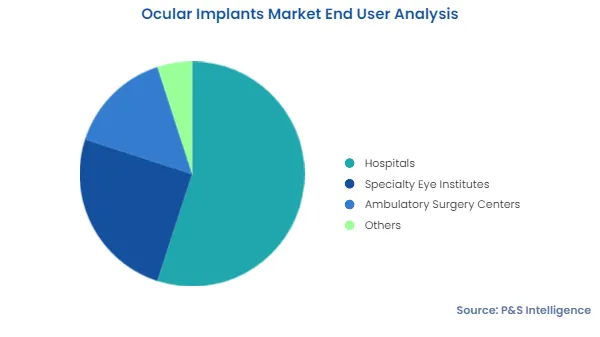

Hospitals are the largest end users with 55% share in 2024. This is because hospitals are large healthcare organizations that provide a variety of specialist treatments under one roof, and they have skilled ocular practitioners and witnessed increased patient footfall.

Ambulatory surgery centers are expected to witness the highest CAGR, of 7%, over this decade. This is because of the increasingly commonness of glaucoma and cataracts, which raises the footfall at hospitals. The lengthening waiting times compels many people to visit ASCs, which also offer cost-effective treatments. Further, cataract surgeries are not as technically demanding, which is why they can be performed on an outpatient basis.

The report contains analysis on the below-mentioned end users:

The non-biodegradable bifurcation dominates the market with a share of 70%. This is because non-biodegradable ocular implants were invented before biodegradable ones, and they have proved reliable and strong enough to last a long time. The materials most commonly used to make ocular implants are silicone, acrylic, polymethyl methacrylate, aluminum oxide, and even titanium.

The biodegradable bifurcation is the faster-growing category throughout the forecast period. This is attributed to the side-effects of synthetic ocular implants and the extensive R&D underway to develop materials that are more compatible with the body. Moreover, synthetic implants can have side-effects and complications. As per the U.S. Food and Drug Administration (FDA), they can include vision loss, need for additional ophthalmic surgeries, less effectiveness of the initial procedure, cloudiness in the cornea, cataracts, detached retina, bleeding, infection, or inflammation. Therefore, biodegradable implants are being developed as they have a lower chance of such complications since they are made form materials that mimic those the body is made of.

The segment is bifurcated as below:

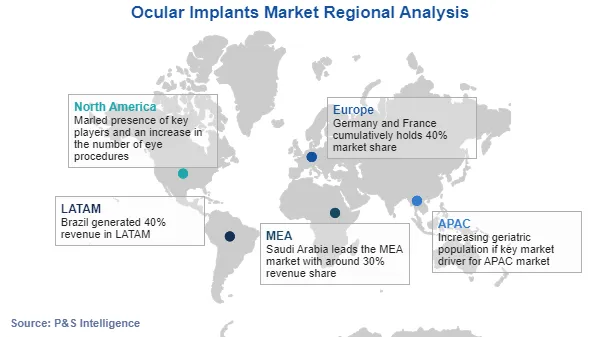

Moreover, the North American market will generate the highest revenue in 2024, of USD 6.5 billion. This is due to the presence of key players and an increase in the number of eye procedures in the region. Moreover, regional companies are concentrating their efforts on both developing and developed regions, in order to take advantage of all unexplored prospects.

The U.S. leads the North American market. Key players in the country are focusing on product approvals and launches of advanced ocular implants. For example, Alcon, a global leader in eye care, introduced the Clareon family of intraocular lenses (IOLs) in the U.S. in March 2022. Clareon uses Alcon's most modern IOL material to provide consistent visual outcomes and long-lasting clarity.

The APAC ocular implants market is projected to register the highest CAGR, of 8% during 2024–2030. There is a large pool of old population in APAC countries who are sensitive to chronic diseases like diabetes and are at a high risk of acquiring severe eye ailments. Also, vision loss can occur as a result of ocular illnesses. Moreover, due to the increase in healthcare infrastructure, surge in acceptance of technologically advanced products, and favorable patient demographics, the demand for ocular implants is rising rapidly in the region.

Below is the regional breakdown of the market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages