Nigeria Diesel Genset Market Analysis

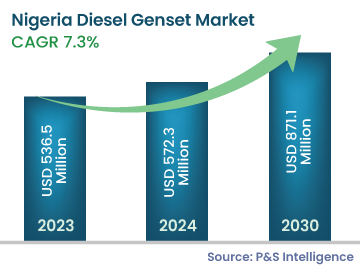

The Nigerian diesel genset market size was USD 536.5 million in 2023, which is expected to witness a CAGR of 7.3% during the forecast period 2024–2030, to reach USD 871.1 million in 2030. The key factors responsible for the growth of the market include the surging demand for power in different industries and substantial base power deficit and power transmission losses in the country.

The demand for diesel gensets in Nigeria is poised to grow on account of their increasing usage in several industries, such as oil and gas, telecom, and construction. They are used in the oil and gas industry to assist in upstream operations. Furthermore, oil and gas fields are generally located in remote locations and, on most occasions, lack grid connectivity, thereby exerting heavy dependence on diesel gensets for power supply.

Furthermore, telecom towers need an uninterrupted power supply, which the power generation industry in Nigeria is unable to provide currently. Additionally, according to the Nigerian Communications Commission (NCC), in 2023, the number of mobile subscriptions rose to 226.8 million from 225.8 million in 2022. The rising adoption of mobile phones, along with the increasing investments in the telecom industry, is projected to fuel the demand for diesel gensets in the country. Diesel gensets are also employed in the construction industry for powering construction equipment, lighting systems, and facilities on a large scale.

The Government of Nigeria (GON) is strongly focusing on improving the country’s infrastructure through heavy spending, as part of a 30-year infrastructure plan (National Integrated Infrastructure Master Plan) with a target of 2043. With the help of multilateral development banks (MDBs), bilateral creditors, public–private partnerships (PPPs), and financial incentives, the government is launching infrastructure development projects for roads, bridges, dredged waterways and ports, and railways.