Next-Generation Antibody Therapeutics Market Analysis

Explore In-Depth Next-Generation Antibody Therapeutics Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 10246

Explore In-Depth Next-Generation Antibody Therapeutics Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

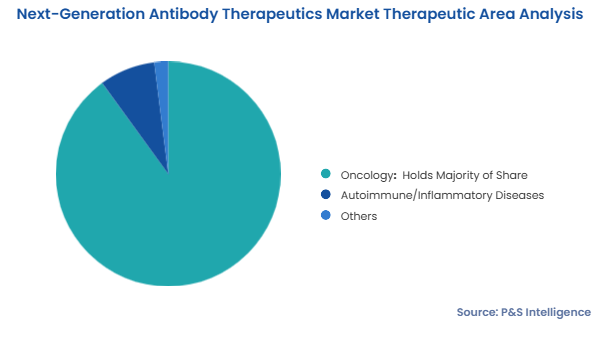

The oncology category accounts for the largest revenue share, of approximately 90%, in 2024, and it is expected to showcase the highest CAGR, of around 8%, in the forecast period. This is because of the rising incidence of breast cancer, colorectal cancer, prostate cancer, brain cancer, and lung cancer, where antibody therapeutics offer benefits throughout the therapies.

These treatments provide enhanced efficiency by targeting cancer cells and ensuring optimal damage is caused to healthy tissues, resulting in better results and fewer side-effects. In addition, the availability of various next-generation antibody therapeutics, such as Kadcyla, ADCETRIS, and Poteligeo, for the treatment of cancers including breast cancer, lymphoma, and melanoma has intensified the domain revenue.

The therapeutic areas analyzed here are:

The ADC category dominates the market in 2024, and the same category is set to register the highest CAGR, of around 10%, in the forecast period. The category growth is mainly due to the high demand for antibody-based cancer therapy, coupled with the rising incidence of breast cancer, technological advancements, and a rapid increase in the number of these conjugates under clinical trials.

Additionally, the adoption of the cleavable linker technology is expected to provide significant growth opportunities to the eponymous category, due to its high stability in the bloodstream for a prolonged duration and effective release of cytotoxins from ADCs at the targeted tumor site. In developing countries, such as China, the technology is extensively being used for the treatment of relapsing systemic anaplastic large-cell lymphoma and relapsing Hodgkin's lymphoma.

Several key players, such as Janssen Pharmaceutical Companies, ADC Therapeutics, Seagen Inc., and AstraZeneca plc, are actively involved in collaborations, to enhance their revenue and customer base. For instance, in April 2024, the therapeutic research branch of Caris Life Sciences, Caris Discovery signed an agreement with Merck KGaA to facilitate the detection and development of ADCs against cancer. Under this agreement, USD 1.4 billion has been allocated for research funding and an international license to Merck to manufacture ADC therapies and provide an orthogonal multi-omics approach to eliminate tumors.

Furthermore, the increase in pharma funding by both private as well as public organizations, for the production of novel ADCs, is expected to drive the next-generation antibody therapeutics market growth in the forecast period. In recent years, there has been a swift increase in the incidence of multiple myeloma all over the world, which is driving the demand for ADCs. Additionally, the several initiatives taken by federal agencies in support of these therapeutic candidates are expected to boost the revenue for pharma and biopharma firms.

The technologies analyzed here are:

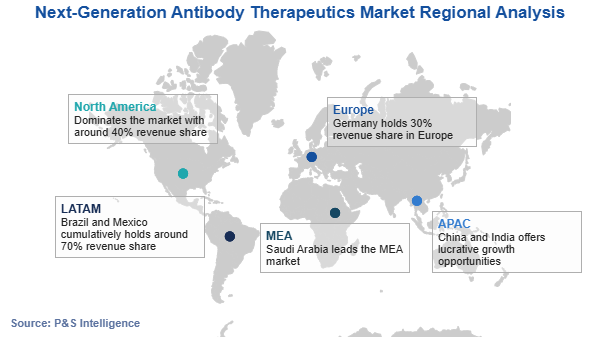

North America dominates the market in 2024 with a value of around USD 1.1 billion, primarily ascribed to the surge in the funds for R&D by government as well as non-government organizations. In addition, the escalation in the prevalence of chronic diseases in the region is driving the sector size. In the region, the U.S., followed by Canada, is expected to dominate the regional market during the forecast period, propelled by the increasing per capita healthcare expenditure.

Furthermore, the presence of prominent key players in the region, the surge in the approval of next-generation antibody therapeutics, and the existence of well-established research facilities drive the market growth.

APAC is set to register the highest CAGR, of around 9%, in the forecast period, primarily attributed to the rising number of strategic partnerships among the prominent players in the region. In addition, the accelerating R&D activities in the field of next-generation antibodies in China, India, and Japan are driving the regional sector development. Furthermore, the increase in government support for drug R&D and for establishing pharma manufacturing facilities in the region are snowballing the market growth.

Europe is another significant market, driven by the increasing investments in biotechnology in the region. This has led to the high acceptance of next-generation antibody therapeutics for chronic inflammatory and autoimmune diseases. In addition, the rising number of drug approvals in the region intensifies the sector development. Moreover, in the European market, the oncology category held the largest share in 2021, owing to the extensive product innovations, which have raised their utility for treating a diversity of malignant tumors.

The geographical breakdown of the market is as follows:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages