New Zealand Ventilation Products Market Future Prospects

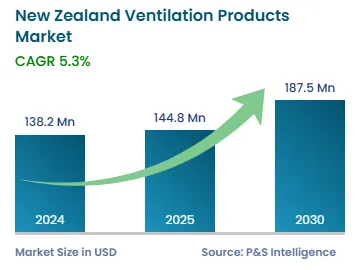

The New Zealand ventilation products market size will stand at an estimated USD 138.2 million in 2024, which is projected to advance at a CAGR of 5.3% during 2025–2030, reaching USD 187.5 million by 2030.

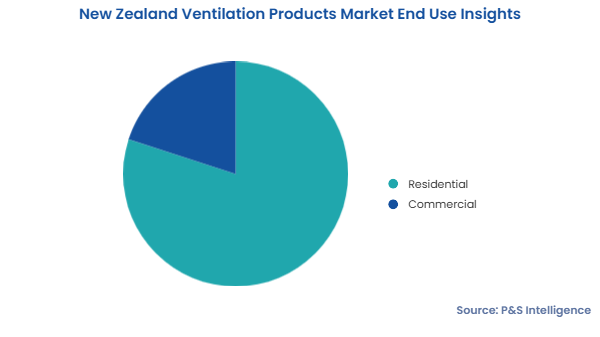

The growth of the industry is primarily attributed to the surging awareness of the health and environmental effects of polluted air, the increasing preference for decentralized ventilation, and the rising number of residential and commercial projects.

Ventilation products assist in the creation of a healthy home environment by eliminating excess moisture and odor. Chemical fumes and other pollutants that can be harmful if inhaled can be reduced with the use of such solutions. Thus, the demand for these products in the residential and commercial sectors is likely to increase in the coming years.

Moreover, the market is fueled by several reasons, including increased construction activities and strong government regulations aimed at promoting energy efficiency across the country. Also, the rising average temperature is aiding growth prospects for ventilation goods in New Zealand.