Network Attached Storage Market Outlook

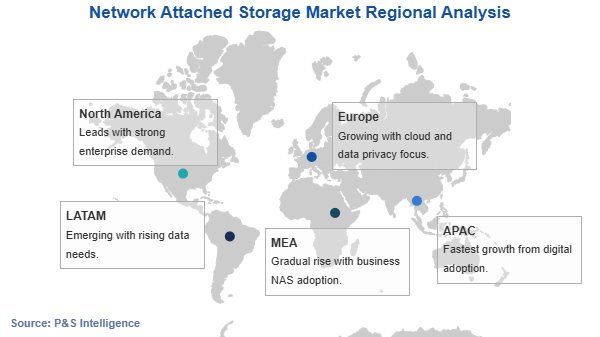

The network-attached storage (NAS) market size stood at USD 26.8 billion in 2024, and it is expected to grow at a compound annual growth rate of 15.4% during 2025–2032, to reach USD 83.4 billion by 2032.

The market for NAS is driven by the surge in the usage of smart devices, the internet of things (IoT), and 5G networks, which leads to the generation of huge volumes of unstructured data, such as photographic, audio, video, and text files. By 2025, around 80% of the world’s digital information will be unstructured. As such information needs to be stored and secured, the demand for network-attached storage will increase around the world.

Earlier, enterprises and personal desktops were the primary sources of digital information. But, with technological advancements, data generation has taken a major shift toward smart devices, such as mobile phones, laptops, and tablets, which are now used by the majority of the population around the world. Hence, with the increasing dependence of people on these digital devices, the volume of digital information is increasing at a high rate, which will lead to exponential growth in the NAS industry. Also, with the increasing demand for new technologies such as machine learning and artificial intelligence, the volume is rising at a high rate. Machine information is being stored from sensors in different areas such as smart homes, autonomous vehicles, weather tracking devices and more. This will lead to a rise in the demand for scalable network-attached storage.

The market has witnessed a positive impact of COVID-19 due to the growing adoption of hybrid working models by enterprises, which raises the requirement for remote access to enterprise software, programs, applications, and information logs for employees. NAS provides 24/7 and remote data availability, which is apt when the team is dispersed and there are remote users, a situation that was experienced by all enterprises during the COVID-19 pandemic.

The usage of mobile healthcare devices, such as fitness trackers, sleep trackers, and vital sign trackers, also surged because of the pandemic. This has increased the generation of data from these devices, due to which the demand for network-attached storage has risen significantly.