Report Code: 11562 | Available Format: PDF | Pages: 364

Negative Pressure Wound Therapy Devices Market (NPWT) Research Report: By Product (Conventional, Single-Use, Accessories), Wound Type (Chronic, Acute), End User (Hospitals, Home-Care Settings) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 11562

- Available Format: PDF

- Pages: 364

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

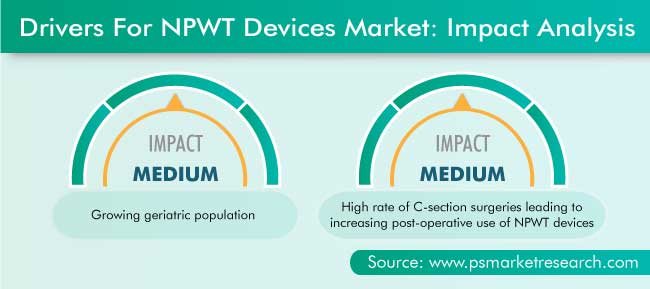

The global negative-pressure wound therapy (NPWT) devices market generated $2,248.1 million revenue in 2020, and it is expected to grow at a CAGR of 7.7% during 2020–2030. The key factors responsible for the growth of the market include the increasing cases of burns, rising prevalence of diabetes, growing geriatric population, and high rate of C-section surgeries leading to the increasing post-operative use of NPWT devices.

During the COVID-19 pandemic, the implementation of lockdowns and partial factory closures disrupted the market for NPWT devices across the world in the first two quarters of 2020. This and the reduced demand, impacted monthly income of individuals, and constraints in the handling of goods at ports led to the reduced trade of NPWT devices.

Chronic Wound Is Expected To Progress Faster due to Growing Geriatric Population

The chronic wound category is expected to witness the faster growth during the forecast period (2021–2030), based on wound type. This is majorly attributed to the surging incidence of diseases such as chronic venous insufficiency, peripheral arterial occlusive disease, and diabetes mellitus. Since elderly people are more prone to such medical conditions, they generate a considerable demand for wound care products.

Conventional NPWT Devices Are Expected To Lead Market due to Their Wide Acceptability

The conventional category led the market for NPWT devices in the historical period (2015–2020), and it is expected to maintain the same trend during the forecast period, based on product. This can be attributed to the wide acceptability of these devices, especially in developing countries with a large population, such as India and China.

Increasing Accessibility of Hospitals and Clinics Is Credited for Their Largest Revenue Share

Hospitals and clinics have emerged as the highest-revenue-generating end users in the NPWT devices market. This is mainly due to the greater footfall of patients and increasing accessibility of hospitals to people of all income levels.

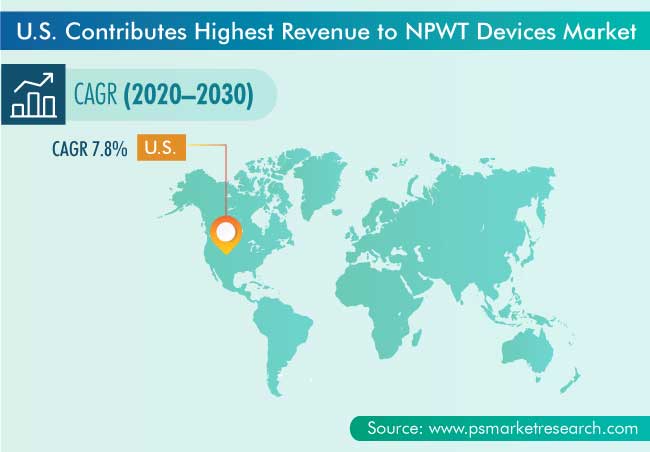

Due to Presence of Key Players, North America Leads Market

Geographically, North America will account for the major share in the market for NPWT devices throughout the forecast period. This can be attributed to the greater presence of market players, higher healthcare expenditure, and increasing research and development (R&D) activities in the region.

The Asia-Pacific (APAC) market is expected to witness the fastest growth during the forecast period owing to the booming geriatric population, surging number of cases of burns and traumatic wounds, and large population in the region.

Shift in Preference toward Advanced Wound Therapies Is Key Trend

Globally, the preference of patients is shifting toward advanced wound therapies from traditional wound therapies, thus making the former a major trend in the NPWT devices market. Advanced wound care therapies offer quick patient recovery by accelerating the healing process. Besides, a number of articles suggest that NPWT is better than traditional wound therapies. According to an article published in InfotechOpen, NPWT is a beneficial wound management and therapy system as it enhances protein and collagen production, diminishes bacterial colonization in patients, and reduces surgical site infection (SSIs) and wound dehiscence by 50% in high-risk patients.

Increasing Cases of Burns Are Driving Market

The increasing cases of burns are a key factor propelling the growth of the market for NPWT devices globally. According to the statistics published by the World Health Organization (WHO) in 2018, an estimated 180,000 deaths due to burns were being reported every year, the majority in low- and middle-income countries (LMICs). Besides, burns are one of the leading causes of disability-adjusted life years (DALY). According to the WHO, in 2020, over 96% of the fatal fire-related burns occurred in LMICs, which is leading to the rising demand for NPWT devices.

Rising Prevalence of Diabetes another Strong Market Driver

The number of diabetic patients is increasing rapidly, which is leading to the growth of the NPWT devices market. Diabetic foot ulcer is a chronic complication of diabetes mellitus that requires frequent dressing. Additionally, in diabetic patients, wounds heal more slowly and develop quickly. According to the Centers for Disease Control and Prevention (CDC), in 2020, more than 34.2 million people had diabetes in the U.S. and 34.5% of the adult population had prediabetes. Moreover, newly diagnosed cases of type 1 and type 2 diabetes have increased among the young population of the country.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2020-2030 |

Base Year (2020) Market Size |

$2,248.1 Million |

Market Size Forecast in 2030 |

$4,698.4 Million |

Forecast Period CAGR |

7.7% |

Report Coverage |

Market Trends, Drivers, Restraints, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Impact of COVID-19, Companies’ Strategic Developments, Company Profiling |

Market Size by Segments |

By Product, By Wound Type, By End User, By Region |

Market Size of Geographies |

U.S, Canada, Germany, France, U.K., Italy, Spain, Russia, Switzerland, Sweden, Denmark, Norway, Poland, Japan, China, India, Australia, South Korea, Indonesia, Sri Lanka, Malaysia, Singapore, Thailand, Brazil, Mexico, Argentina, Chile, Colombia, Ecuador, Saudi Arabia, South Africa, Israel, U.A.E., Egypt, Kuwait |

Secondary Sources and References (Partial List) |

American Board of Wound Management, Academy of Physicians in Wound Healing, Alliance of Wound Care Stakeholders, American Physical Therapy Association, Association for the Advancement of Wound Care, Blue Cross and Blue Shield of North Carolina, Centers for Disease Control and Prevention, Central Drugs Standard Control Organisation, European Free Trade Association, European Pressure Ulcer Advisory Panel, International Diabetes Federation |

Explore more about this report - Request free sample

Market Players Involved in Mergers and Acquisitions to Gain Significant Position

In recent years, players in the NPWT devices industry have been involved in mergers and acquisitions in order to attain significant position. For instance:

- In April 2019, Rehab Medical Inc., a national complex rehab technology (CRT) company, merged with Cork Medical LLC. The merger generated two divisions within the new company Rehab Medical, which focuses on custom advanced medical equipment, and Cork Medical LLC, which focuses on wound care products.

- In April 2019, Lohmann & Rauscher GmbH & Co. KG acquired the assets of French compression company Médical Textile Ariégeois. This acquisition of the medical stockings’ division expanded and complement the former company’s compression product portfolio.

Key Players in NPWT Devices Market Include:

-

Alleva Medical Ltd.

-

DeRoyal Industries Inc.

-

ConvaTec Group plc

-

Smith & Nephew plc

-

Mölnlycke Health Care AB

-

Acelity L.P. Inc.

-

ATMOS MedizinTechnik GmbH & Co. KG

-

Talley Group Limited

-

Cardinal Health Inc.

-

Medela AG

-

Lohmann & Rauscher GmbH & Co. KG

-

Carilex Medical GmbH

-

Triage Meditech Pvt. Ltd.

-

Shandong Weigao Xinsheng Medical Devices Co. Ltd.

-

B. Braun Melsungen AG

-

Genadyne Biotechnologies Inc.

-

BSN medical GmbH

-

Cork Medical LLC.

-

Baxter International Inc.

Market Size Breakdown by Segment

The global negative-pressure wound therapy (NPWT) devices market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Product

- Conventional

- Single-Use

- Accessories

Based on Wound Type

- Chronic

- Venous ulcers

- Diabetic foot ulcers

- Pressure ulcers

- Acute

- Surgical

- Burns

Based on End User

- Hospitals

- In-patient

- Out-patient

- Home-Care Settings

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Italy

- Russia

- Switzerland

- Sweden

- Denmark

- Norway

- Poland

- Asia-Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Indonesia

- Sri Lanka

- Malaysia

- Singapore

- Thailand

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Ecuador

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- Israel, U.A.E

- Egypt

- Kuwait

The market for NPWT devices will value $4,698.4 million in 2030.

The NPWT devices industry report has four segments: product, wound type, end user, and region.

Advanced wound management products are trending in the market for NPWT devices.

The competitive landscape of the NPWT devices industry is fragmented.

Players in the market for NPWT devices are engaging in mergers, acquisitions, and partnerships.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws