Market Statistics

| Study Period | 2019 - 2030 |

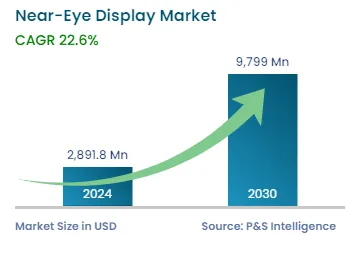

| 2024 Market Size | USD 2,891.8 Million |

| 2030 Forecast | USD 9,799 Million |

| Growth Rate(CAGR) | 22.6% |

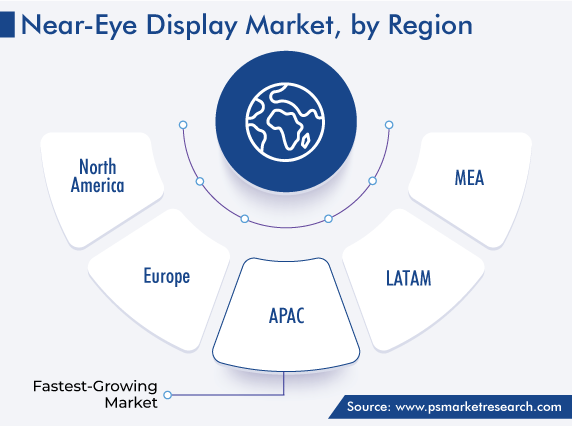

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12597

Get a Comprehensive Overview of the Near-Eye Display Market Report Prepared by P&S Intelligence, Segmented by Component (Image generators, Optical combiners, Imaging optics), Device Type (AR, VR), Technology (TFT LCD, OLEDs, LCOs, Micro-LED, AMOLED, DLP, Laser beam scanning), End User (Consumer, Medical, Aerospace & Defense, Automotive), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,891.8 Million |

| 2030 Forecast | USD 9,799 Million |

| Growth Rate(CAGR) | 22.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The near-eye display market size stood at USD 2,891.8 million in 2024, and it is expected to grow at a compound annual growth rate of 22.6% between 2024 and 2030, to reach USD 9,799 million by 2030. This is attributed to the rapid developments in display technologies such as OLED, LED, and LCD; the increasing demand for high-quality displays in a wide range of applications; and the surging popularity of VR and AR devices, which require high-quality displays to provide an immersive experience.

The near-eye display (NED) technologies are designed to be viewed in proximity to the user's eyes, typically within a few inches. These displays are often used in wearable devices such as virtual reality (VR)and augmented reality (AR) headsets, smart glasses, and other forms of head-mounted displays (HMDs).

The demand for VR systems has witnessed significant growth over the past few years. This technology has the potential to change lives and the way people socialize their work. VR is a fully immersive computer-generated environment with realistic scenes and objects that makes the users feel they are immersed in their surroundings. For instance, in 2022, there are more than 169 million users of VR technology at the global level.

The budding culture of gaming is gaining popularity among the millennials and Gen Z is consequently creating a demand for VR technology, particularly in gaming products and events. Several gaming events are using NED technology in order to deliver a better experience to the audience and participants. Besides the gaming industry, VR technology is being increasingly used in the entertainment industry for creating different content, which, in turn, will accelerate the growth of the near-eye display market in the coming years.

Thin-film transistor liquid crystal display (TFT LCD) technology accounts for the largest revenue share in 2022. This is because it is commonly used in HMDs and wearable displays such as immersive and see-through glasses, due to its ability to provide high-resolution displays that can exhibit detailed images and videos with excellent color accuracy. Also, the technology makes it possible to create high-quality, immersive visual experiences for a range of applications, from gaming and entertainment to training and education.

However, the use of OLED is becoming a popular choice for HMDs, and the category is expected to grow significantly in the coming years. This is attributed to its advanced benefits such as high contrast ratios, deep blacks, and vibrant colors. Additionally, OLEDs have faster response times than LCDs, which can help reduce blurs and latency in fast-paced games.

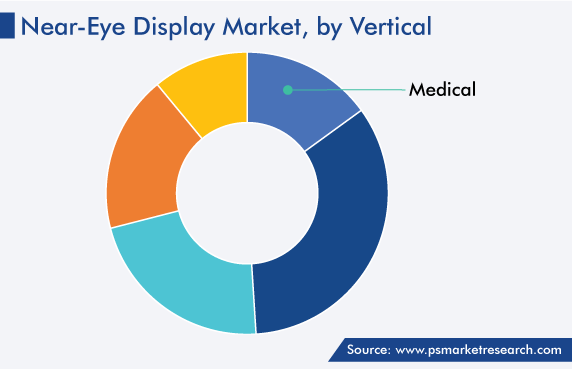

HMDs have been increasingly used in medical applications for a variety of purposes, including surgical training orthopedic procedures, preoperative planning, and patient education. Thus, in 2022, the medical category captured a revenue of USD 256 million, and it is expected to grow at a CAGR, of around 24.2%, in the market. The technology has continued to improve, and AR/VR is becoming more prevalent within orthopedic surgical education. As per the research paper published in Sage Journals in 2019, image guidance and AR/VR were the most reported applications of wearable displays. Also, see-through HMDs witnessed higher usage in urology and neurosurgery.

Moreover, HMDs can help surgeons visualize the patient's anatomy in 3D, allowing them to plan surgical procedures more accurately. This technology can also be used to simulate different scenarios and help surgeons decide on the best course of action. Further, HMDs have the potential to educate patients about their medical conditions and the procedures they will undergo. This technology can provide a virtual tour of the patient's body, showing them where the surgery will take place and how it will be performed. This can help reduce patient anxiety and increase their understanding of the procedure. Therefore, the surging use of HMDs for medical applications boosts the demand for near-eye displays.

After healthcare, eye-worn wearable devices have various applications in the education sector such as on-site report preparation, documentation of lectures, evaluation of trainees, recording lectures, telementoring, understanding the listener's experience and nature, and student concentration evaluation.

The near-eye display market has the potential of being greatly influenced by the introduction of the metaverse as well as increased investments and advancements from leading technology companies. For instance, OLED on silicon (OLEDoS) tiny displays are becoming increasingly popular as a result of their improved characteristics, which include higher contrast, quicker response times, lower weight, compact size, and minor image blurring characteristics.

In addition, they are outperforming conventional LCDs and liquid crystal on silicon (LCoS) tiny display technologies because they are widely used in EVFs and HMDs. Meta, Decentraland, NVidia, Google, Niantic, Microsoft, Appinventiv, Valve, Roblox, Apple, and various other key companies are making huge investments in the space sector and also developing advanced technologies, which are projected to shape the metaverse’s future.

The pandemic encouraged the adoption of advanced technologies, as most businesses started working remotely. During the pre-pandemic times, many companies were interested in AR and VR, but a lot of them began to actively utilize VR collaboration platforms post-pandemic.

AR/VR technologies have become popular in the retail sector in this era, as retailers have observed the potential of the technology and started utilizing it to its full extent and at a decent pace. For instance, virtual clothes-fitting creates a 3D model of a buyer and then uses this model to fit simulated clothes. Many retailers have also offered similar applications that customers can use products virtually before buying them, thus enhancing customer experience. So, the high adoption of technology, as a result of the pandemic, has boosted the demand for AR/VR systems and hence supported the near-eye display market.

Drive strategic growth with comprehensive market analysis

In 2022, APAC accounted for a significant market share in the global market. This is due to the technological progression, wide adoption of AR and VR in the gaming and entertainment industries, and the presence of several big producers, in the region. Moreover, the growing inclination of a large number of millennials and Gen Z toward the gaming culture is increasing the popularity of this technology in APAC.

Based on country, China is a major producer of AR and VR devices. This is due to the presence of key players in the country and the government initiatives to boost the production of AR/VR devices. The first national-level policy statement for the development of metaverse-related technologies, such as VR, AR, and mixed reality (MR), was published in China. According to this, the country aims to ship 25 million VR devices by 2026.

Moreover, the goal of the Development Action Plan for the Integration of Virtual Reality and Industrial Applications (2022–2026), which was published in November 2022, is to combine VR with industrial applications. Thus, for instance, the VR market in China, which covers software, hardware, and applications, is expected to exceed USD 48.56 billion by 2026.

The government-backed plan's main objectives include producing strong achievements in integrating AR/VR technology with present applications, consistently boosting the industry ecosystem, and considerably strengthening innovation capacity.

Along with government support, Chinese OLED companies and startups are supporting the market. For instance, BOE and Seeya are already shipping panels and offer very high-quality displays. Similarly, SidTek is offering microLED technology and has a microLED microdisplay R&D line. There are several other players in the country that are offering OLED microdisplays, such as OLiGHTEK, Lakeside Optoelectronics, BCDTEK, INT-Tech, and Nanijng Guozhao Optoelectronics.

Based on Component

Based on Device type

Based on Technology

Based on End user

Geographical Analysis

The near-eye display market size stood at USD 2,891.8 million in 2024.

During 2024–2030, the growth rate of the near-eye display market will be around 22.6%.

Consumer is the largest vertical in the near-eye display market.

The major drivers of the near-eye display market include the increasing demand for head-mounted displays (HMDs) in various applications, rapid developments in display technologies, and the surging popularity of VR and AR devices.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages