Report Code: 10621 | Available Format: PDF

Nanoporous Material Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 10621

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

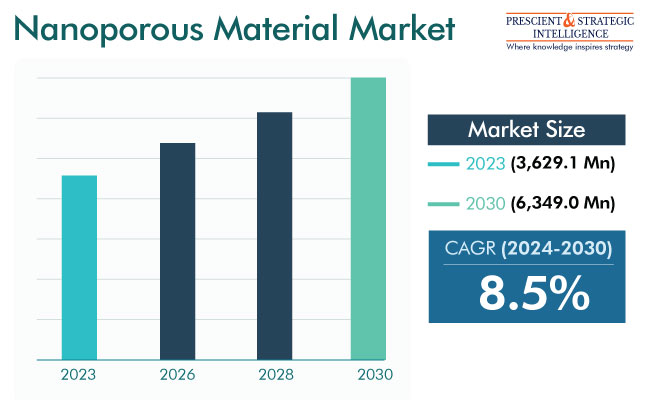

The global nanoporous materials market size is expected to advance from USD 3,629.1 Million (E) in 2023 to USD 6,349.0 Million in 2030, at 8.5 % compound annual growth rate between 2024 and 2030.

Nanoporous materials have a size of 100 nanometers or less. They consist of a regular organic or inorganic framework, which supports a porous structure.

The growth of this industry can be ascribed to the stringent water safety regulations, as well as the surging requirement for adsorbents. Moreover, the high requirement for this material in magnetic and electronic devices will support in the progress of the industry. Furthermore, the increasing acceptance of zeolites as a high-end catalyst is likely to boost the demand for them throughout this decade. In addition, the surging research and development activities will drive the growth of this industry.

The market is essentially driven by the fact that these materials have various applications, including as catalysts, absorbents, and ion exchange agents. They are also essential in low-dielectric-constant mediation, guest–host interactions, and nanoreactors.

Surging Adoption of Nanoporous Materials in Biomedical Industry

Biomedical companies are increasingly using nanoporous materials in sorting, isolating, releasing, and sensing biological molecules. Moreover, they are used in immune-isolation and dialysis devices, scanning electron microscopes, and X-ray diffraction. The biomedical industry continues to advance with an aging population and one afflicted with a host of chronic and infectious diseases.

Here, electron scanning microscopes, in many ways, form the backbone of diagnostic departments, being used to see pathogens and diseased cells and tissues. Moreover, a key reason for drugs not having the desired effect is the reduced bioavailability of the API by the time it reaches the body part it is meant for. This creates a high demand for targeted drug delivery systems, which prevent the API from being released into the bloodstream before it reaches the desired area of effect.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,629.1 Million (E) |

Revenue Forecast in 2030 |

USD 6,349.0 Million |

Growth Rate |

8.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Extensive Use of Nanoporous Membranes in Water Treatment Is Key Driver

Absorption is a key process in water treatment, and the popularity of zeolites is increasing for this application over multi-walled carbon nanotubes. This is because of the exclusive adsorption properties of zeolite membranes, as they filter out different metallic ions, salts, organic molecules, and microbes. Zeolite is more effective than various other traditional sources of filtration because of its enhanced absorption and filtration abilities, owing to its larger surface area than various other granular materials.

As per the International Trade Administration, the National Transformation Program and Government of Saudi Arabia aim to enhance the number of citizens and cities receiving sewerage and water services. Between 2022 and 2023, the kingdom announced desalination and wastewater treatment projects worth over USD 14.58 billion. Such a heavy investment for water treatment from different nations across the globe is expected to boost the progress of this industry.

Zeolites Category Is Leading Market

The zeolites category, based on type, is the largest contributor to the global nanoporous materials industry. This is because of the robust acid strength and excellent flexibility of this material in almost all kinds of catalysts.

Moreover, they provide greater performance over carbon and sand filters, including higher throughput and cleaner water with a reduced need for maintenance of the filtration systems. Zeolites can also promote different catalytic reactions, such as metal-induced and acid–base reactions.

Additionally, zeolites can be used as an acid catalyst and a support for reagents or active metals. They are essentially used for the absorption of various materials and, therefore, find application in purification, separation, and drying.

Petroleum Refining To Account for a Significant Growth

The petroleum refining category, based on end use, accounts for a significant share of the industry. This is mainly because of the surging utilization of nanoporous materials in the oil & gas industry for petroleum refining.

The effectiveness of numerous conversion procedures enhances with the usage of materials with nanometer-scale dimensions. This is because greater material properties emerge as the size of the particle decreases. The large surface area exposure for the reaction is the major advantage of using nanoporous materials in catalysis, thus resulting in decreased possibilities of adverse reactions.

Additionally, the desire for a better catalyst with a low deactivation rate, low coke formation, and high activity, to meet the surging need for fuels and chemicals, will boost the adoption of this material for petroleum refining throughout this decade.

Nanoporous Materials Top Producers Are:

- CPH Chemie + Papier Holding AG

- Mineral Technologies Inc.

- Kuraray Chemical Co. Ltd.

- Albemarle Corporation

- Exxon Mobil Corporation

- Kuraray Co. Ltd.

- BASF SE

- Zeolyst International

- Clariant AG

- Zeochem AG

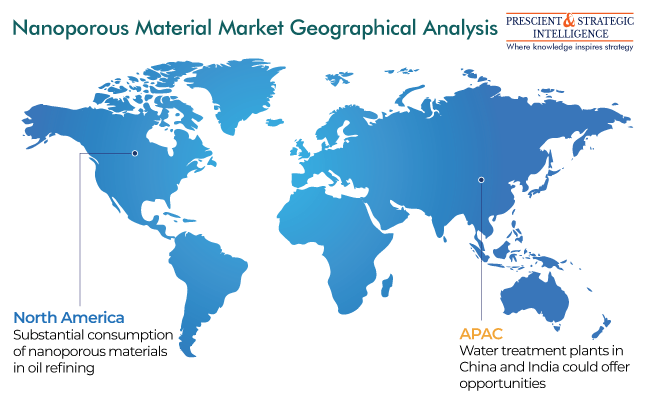

APAC Will Advance at a Significant Rate

The North American nanoporous materials industry accounts for a significant share. This is primarily because of the development of new biomedical technologies, as well as the fast-growing chemical sector in the continent.

Moreover, as per the U.S. Energy Information Administration, in 2022, the U.S. was the largest oil producer across the globe, producing 20.30 million barrels every day. Furthermore, the increasing funding by the government for research and development activities in the healthcare sector will drive the progress of the industry in the region during the projection period.

The APAC nanoporous materials industry has been the largest till now, and it is expected to propel at a significant rate during the projection period. This will be mainly because of the rise in the compliance with the international rules for the safety of the environment. Here, these materials are widely used or could be used for CCUS, water treatment, environmental remediation, and removal of hazardous particles.

Additionally, the booming oil & gas and chemical industries will lead to a surge in the requirement for this material in APAC. China and India are the world’s largest chemical producers and now making a name in the E&P sector as well, boosted by the growing domestic demand and rising exports. Moreover, China is the region’s largest producer of nanoporous materials. Here, they are extensively used in several petroleum refining processes, such as oxidative dehydrogenation of alkanes, catalytic cracking, and desulfurization.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws