Report Code: 12794 | Available Format: PDF | Pages: 250

Multiplex Assays Market Size and Share Analysis by Product (Consumables, Instruments, Software), Type (Protein-Based, Nucleic Acid, Cell-Based), Technology (Flow Cytometry, Fluorescence Detection, Luminescence, Multiplex Real-Time PCR) - Global Industry Demand Forecast to 2030

- Report Code: 12794

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Multiplex Assays Market Size & Share

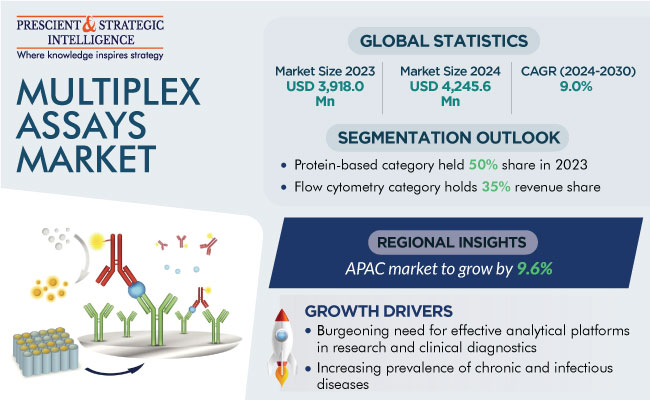

The global multiplex assays market generated USD 3,918.0 million revenue in 2023, and it is projected to witness a CAGR of 9.0% during 2024–2030, reaching USD 7,103.5 million by 2030. The key factor driving the industry is the increasing prevalence of chronic diseases and infectious diseases. Moreover, the burgeoning need for effective analytical platforms in research and clinical diagnostics, to reduce the costs for healthcare providers, researchers, and patients, is a strong contributor.

COVID-19 has also positively impacted the growth of the market, by driving a massive increase in R&D for the development of advanced solutions for the detection of the coronavirus. Major players are strongly focused on innovations and investments for developing devices and panels for the multiplexed detection of the virus.

Moreover, the rise in the geriatric population and prevalence of autoimmune diseases, human immunodeficiency virus, and cancer are expected to boost the market size in the coming years. The advantage of the multiplex method over the conventional ones is that instead of producing a single signal measurement, the former produces multiple signal measurements.

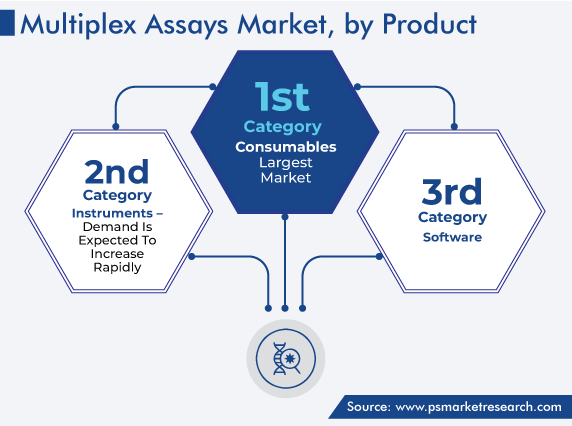

Consumables Category Accounts for Largest Revenue Share

Based on product, the consumables category accounted for the largest share, of 45%, in 2023. It was due to the rise in the number of diagnostic tests and increase in research activities by life sciences companies. For instance, in January 2023, Novo Nordisk, a pharmaceutical company, announced a USD 6-million grant for Durham Technical Community College, to support the latter’s life sciences program and set up a new training center with an area of 35,000 square feet.

Companies are also engaging in partnerships for the distribution of immunometric assays. For instance, in July 2022, DIESSE Diagnostica Senese and Menarini Silicon Biosystems signed an agreement to market the Chorus TRIO immunometric assay system in the U.S. A single-test multiparametric system, CHORUS TRIO incorporates small instruments and a range of consumables for carrying out immunometric assays.

Moreover, in October 2022, Oxford Nanopore Technologies and 10x Genomics announced a collaboration to create a streamlined workflow for full-length transcripts sequencing in a single read on the devices of Oxford Nanopore. The collaboration allows for the addition of Oxford’s Promethlon devices and sample preparation on 10x Genomics devices, as well as selected consumables.

Moreover, companies are providing advanced consumables after acquiring similar firms. For instance, in July 2022, ARCHIMED completed the acquisition of Natus Medical Incorporated in a USD 1.1-billion take-private deal. Natus Medical Incorporated provides advanced hardware, software, algorithms, and consumables.

Protein-Based Multiplex Assays Account for Largest Share

The protein-based category dominated the market, with a share of 50%, in 2023, because of the increasing applications of such products in proteomics studies. Moreover, protein-based assays are widely used in research to identify the concentration of protein, cell biology, electrophoresis, and other analytes.

Nucleic acid assays are projected to be the fastest-growing category over the forecast years, due to the expansion of proteomics portfolios. For instance, in May 2022, CellCarta Biosciences Inc., a provider of precision medicine laboratory services, announced the acquisition of the commercial rights to the antibody panels and assays from Precision Assays, which offers next-generation targeted proteomics testing solutions. The acquisition of Precision Assays’ portfolio of assays strengthens CellCarta’s plans to become a leading provider of precision medicine services and extend the application of its proteomics portfolio from discovery to clinical settings.

Flow Cytometry Category Accounted for Largest Share

The flow cytometry category held the largest share in 2023, due to the various applications of this technology in the detection and measurement of proteins and RNA and in cell health assessment. For example, the Flow Cytometry Unit, Life Sciences Core Facilities, Weizmann Institute of Science’s is using imaging flow analyzers that combine the high-throughput quantification of flow cytometry with microscopy and help in the study of post-translational modifications and protein–protein interactions in diverse contexts.

Moreover, in April 2022, Sysmex Europe SE, a provider of automated workflow solutions, announced the launch of its flow cytometer, XF-1600, which has received the CE marking, indicating its compliance with the European IVD regulation. XF-1600 offers clinical flow cytometry laboratories high-performance 10-color analysis for efficient and reliable data collection, for immunophenotyping.

In the same way, in March 2022, Beckman Coulter Life Science and Danaher Corporation introduced the CellMek SPS to help lab technicians tackle manual sample preparation and data management bottlenecks in clinical flow cytometry. In addition, this fully automated system offers on-demand processing for various sample types.

The multiplex real-time PCR category is expected to witness the highest CAGR, of 9.4%, during 2022–2030, because of the rapid launch of several types of PCR systems. For instance, in November 2022, Sentinel Diagnostics launched SentiNat 200 for the quantitative detection of several types of viruses.

Moreover, Ubiquitome Limited’s next-generation real-time PCR device system, the Liberty16 Pro, was given the Emergency Use Authorization by the U.S. FDA in December 2022.

Similarly, in June 2022, Bio-Rad Laboratories Inc. unveiled the CFX Opus Deepwell real-time PCR system to help researchers creating assays for nucleic acid detection.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,918.0 Million |

Market Size in 2024 |

USD 4,245.6 Million |

Revenue Forecast in 2030 |

USD 7,103.5 Million |

Growth Rate |

9.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Type; By Technology; By Application; By End User; By Region |

Explore more about this report - Request free sample

Multiplex Assays Has Major Application in Research and Development

Research and development accounts for the largest share of the global market. This is due to the wide applications of multiple assays in research & development. At R&D centers, they are used for drug discovery and the clinical and preclinical stages, to evaluate the effectiveness, toxicity, and response of drugs.

The clinical diagnostics category will witness the highest growth rate from 2022 to 2030. Owing to the increasing prevalence of cancer, infectious diseases, cardiovascular diseases, and autoimmune diseases, companies are focusing on offering advanced diagnosis solutions. For instance, in January 2023, Agilent Technologies Inc. signed a partnership agreement with Akoya Biosciences Inc. to create multiplex immunohistochemistry solutions for tissue analysis and market workflow solutions for multiplex assays to clinical researchers. This will create a single commercial workflow from end to end, including reagents, imaging, staining, and analysis.

North America Was Largest Market

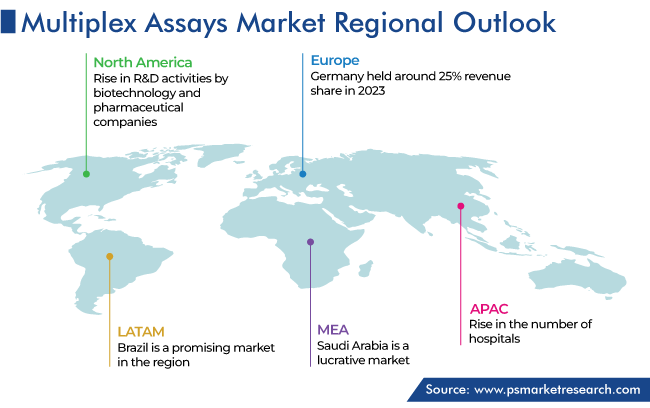

North America held the largest share, of 55%, in 2023, and it is expected to grow at a significant CAGR, due to the rise in the R&D activities by biotechnology and pharmaceutical companies for the development of novel drugs and diagnostic solutions. For instance, in January 2023, PharmaEssentia Corporation announced plans for a new PharmaEssentia Innovation Research Center (PIRC) in Greater Boston, Massachusetts.

Similarly, in October 2022, Lineage Cell Therapeutics Inc. announced the opening of a new R&D facility in California and the expansion of its GMP-compliant facility in Israel. Lineage’s new facility in California will broaden its R&D capabilities in the U.S. and support the development of current and future allogeneic cell transplant programs.

Essentially, the increasing incidence of chronic conditions, especially cancer; and the rising investments by the players are expected to drive the growth of the industry in this region. For instance, in January 2023, NextPoint Therapeutics announced the receipt of USD 80 million in a Series B financing round co-led by Leaps by Bayer AG and Sanofi. The investment will enable NextPoint to deploy two of its precision immuno-oncology programs in clinics. The programs are concerned with activating anti-tumor immune responses by targeting the newly discovered HHLA2 pathway.

APAC is the fastest-growing region due to a rise in the number of hospitals, high demand for advanced healthcare infrastructure, and increase in the value of investments in the industry. In APAC, China is the fastest-growing country in this region, because the Government of China is strongly focused on their healthcare system. “Healthy China” is the agenda of the Chinese government for the development of a healthy China.

Some of the Key Players in the Market Are:

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- Bio-Rad Laboratories Inc.

- Qiagen N.V.

- Abcam plc

- Becton, Dickinson and Company

- Merck KGaA

- Agilent Technologies Inc.

- Meso Scale Diagnostics LLC

Market Size Breakdown by Segment

This report offers deep insights into the multiplex assays market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

- Consumables

- Instruments

- Software

Based on Type

- Protein-Based

- Nucleic Acid

- Cell-Based

Based on Technology

- Flow Cytometry

- Fluorescence Detection

- Luminescence

- Multiplex Real-Time PCR

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

In 2030, the market for multiplex assays will reach USD 7,103.5 million.

The multiplex assays industry is growing due to the rising incidence of infectious and chronic diseases.

Consumables dominate the market for multiplex assays.

Flow cytometry is the largest technology category, while multiplex real-time PCR will witness the highest multiplex assays industry CAGR.

The fastest-growing market for multiplex assays is APAC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws