Report Code: 12836 | Available Format: PDF | Pages: 290

Mounted Bearing Market Share Analysis by Product (Ball, Roller), Housing (Plummer Block, Flanged Block, Take-Up Block), Equipment (Ball Mill Drivers, Fans & Blowers, Gearboxes & Transmissions, Conveyors, Crushers, Mixer Drivers), Material (Chrome Steel, Stainless Steel, Carbon-Alloy Steel, Plastic & Non-Metallic Materials, Babbitt Material, Cast Iron, Aluminum Alloys), End User (Food & Beverages, Agriculture, Construction & Mining, Automotive & Transportation, Chemical & Pharmaceutical, Energy, General Industrial & Machinery, Pulp & Paper), Sales Channel (OEMs, Aftermarket) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12836

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

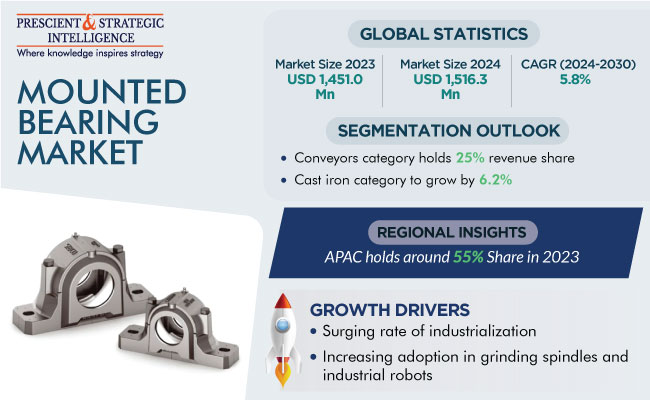

The global size of the mounted bearing market stands at an estimated USD 1,451.0 million in 2023, and it is forecast to grow at a compound annual growth rate of 5.8% between 2024 and 2030, to reach USD 2,122.1 million by 2030. The major factors attributed to the growth in the usage of mounted bearings in various industries include the increasing demand for specialized bearings for the optimization of cost, which they provide with their long life, higher efficiency, and less maintenance requirement.

Moreover, the development and use of internet of things sensor-based bearing units continue to make industries smart. Additionally, manufacturers are working on improving the designs of these products for making them more energy-efficient, increasing performance, and achieving other operational improvements. Thus, their cages, raceways, redesigned raceway profiles, and rolling elements are being made of better materials. Further, the technological advancements in sealing as well as lubrication technologies are generating huge prospects for manufacturers and thus, contributing toward the demand for these components.

Surging Usage of Mounted Bearing in Numerous Industries Drives Market Growth

There has been a significant surge in the usage of these installations in various major industries, such as mining, food & beverages, aerospace, automotive, pulp, agriculture & fishery, chemicals, and pharmaceuticals.

As per the U.S. Department of Agriculture (USDA), food & beverage plants accounted for 16.8% of the sales of manufactured goods and 15.4% of the employment in the country in 2021. Within this expansive ecosystem, the meat processing industry held a 26.2% sales share, dairy industry 12.8%, beverages 11.3%, other food products 12.4%, and grains and oilseeds another 10.4%.

The improving economy as well as the surging consumption power is likely to boost the demand for machinery for food processing, thereby increasing the demand for mounted bearings. To overcome this demand, investments in food processing and packaging equipment are being augmented to boost output, cut costs, and reduce wastage, while adhering to all of the FDA and other agencies’ hygiene and sanitation-related regulations.

By choosing the appropriate mounted bearing, the desired goals can be achieved. Ball bearings are used in a variety of industrial machinery, but they are most essential to the systems and machinery utilized in the food & beverages sector. These devices are particularly manufactured from food-grade stainless steel to maintain their safety for usage even in cases where there is no contact with the consumable items.

Additionally, various pieces of equipment utilized in the medical industry need these components to offer the reliable transmission of mechanical power and provide smooth operations. Miniature mounted bearings are required for the rotating assemblies of numerous electrical hand tools and devices utilized in the medical field. For instance, they are used in high-speed dental drills, surgical handpieces for accurate and controlled cutting, suturing, and other surgical procedures.

Moreover, these components need to meet a certain criterion in order to be approved for medical use. The requirements include low friction, minimal noise, high speed, low maintenance, resilience to chemicals and harsh conditions, great dependability, and extended service life. Hence, the healthcare infrastructure expansion in developing countries is providing growth opportunities to market players.

Adoption of Advanced Sensor Units Offering Lucrative Opportunity

In recent times, smart technologies and digitalization have emerged in mounted bearings, which is offering lucrative opportunities to market players. AI-based sensors and IoT help monitor the status of these devices at all times, in an easy way. The sensors can perceive these components’ rotational direction, speed, temperature, and vibrations, helping end customers monitor their condition and avoid costly breakdowns.

Industrial internet of things (IIoT) sensors are a formidable hybrid of hardware and software. They are extensively utilized for predictive maintenance in the oil & gas and power generation sectors, remote monitoring and diagnosis of wind turbines, offshore platforms, and agricultural machinery, as well as performance optimization of paper mills, mining equipment, and construction equipment. These sensors are able to gather and elucidate data and make decisions, in addition to distributing it to the relevant personnel and databases. This functionality saves a lot of time and money for engineers, which ultimately helps reduce the production cost for end-use industries.

Additionally, as a result of the comprehensive research and development by the leading companies, the industry is witnessing the launch of various sensor-based, connected, self-aligning, and self-lubricating mounted bearings. For instance, in June 2022, NTN Corporation launched the Talking Bearing, which incorporates sensors, power generation units, and wireless devices into the bearing and wirelessly transmits information on temperature, vibrations, and rotational speed. Being integrated into the bearing itself, the sensors enable more-advanced condition monitoring and earlier abnormality detection than if they were attached to the larger machine on its outside.

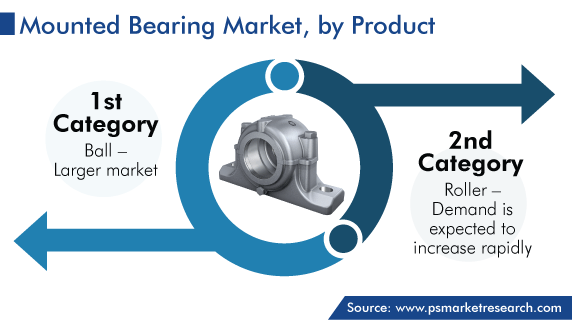

Ball Bearings Hold Larger Share

Based on product, ball variants are the prime preference of industries, which is why this category holds the largest share, of around 65%, in the mounted bearing industry in 2023 and will further maintain its dominance in the future. This is attributed to their affordability, versatility, improved sealing shielding against lubricant leakage and the entry of other foreign particles in the casing, performance improvement of the motor, and easy maintenance. These variants are widely utilized in rotary applications to provide low friction and smooth motion.

A ball bearing is type of rolling-element bearing, which carries loads, reduces friction, and allows movements, by positioning the moving machine parts. In addition, they make use of separate bearing rings to lower the contact area of the surface and reduce the friction between moving planes. Moreover, their growing usage in automated equipment is expected to drive the growth of the industry, as will the rising demand for electric vehicles across the globe.

Conveyor Are Most-Common Equipment Type to Utilize Ball Bearings

The conveyor category holds the largest market share, of 25%, in 2023, based on equipment type. This is attributed to the wide usage of conveyors in numerous industries, including manufacturing, construction, automotive, paper, and mineral & mining. The machines used in such industries carry and transfer bulky material with the help of mechanical or pneumatic methods. The conveyors used in all these industries need various types of bearings, which essentially fuels the growth of this category in the market.

In addition, the increasing need of manufacturers for efficient and reliable material handling systems, to enhance their productivity and lower the production cost, propels the market. Conveyors are also used for automation in manufacturing and logistics facilities, being integrated into automated mechanical handling apparatus for quickly, efficiently, and safely carrying heavy loads. Nowadays, automation is common in the manufacturing and logistics sectors as it decreases the potential for human error, lowers the safety risk at workplaces, and reduces labor costs. Hence, the demand for mounted bearings is expected to rise in the coming years as more industries automate their manufacturing and material handling operations.

Cast Iron is Most Extensively Used Material for Mounted Bearing

The cast iron category is expected to witness a CAGR of 6.2% during the forecast timeline due to the inexpensiveness of this material than the others used for manufacturing mounted bearings. In addition, cast iron is relatively strong, resistant to wear, durable, and easy to machine, which makes it an excellent choice for mass production. Cast iron mounted bearing are extensively used in agricultural, food processing, construction, mining, material handling, papermaking, textile weaving, transportation (automobiles), and other kinds of equipment.

The other materials used for producing these components include ductile iron, stainless steel, and thermoplastics. Ductile iron is a more-ductile and stronger form of cast iron and is most often utilized in applications where there is need for more load capacity and impact resistance. Similarly, stainless steel is a corrosion-resistant material, so it is used where the mounted bearing is exposed to moisture and chemicals. Essentially, the material used depends on numerous factors, such as load capacity, working environment, and budget.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,451.0 Million |

Market Size in 2024 |

USD 1,516.3 Million |

Revenue Forecast in 2030 |

USD 2,122.1 Million |

Growth Rate |

5.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Housing; By Equipment; By Material; By End User; By Sales Channel; By Region |

Explore more about this report - Request free sample

APAC Is Principal Revenue Contributor

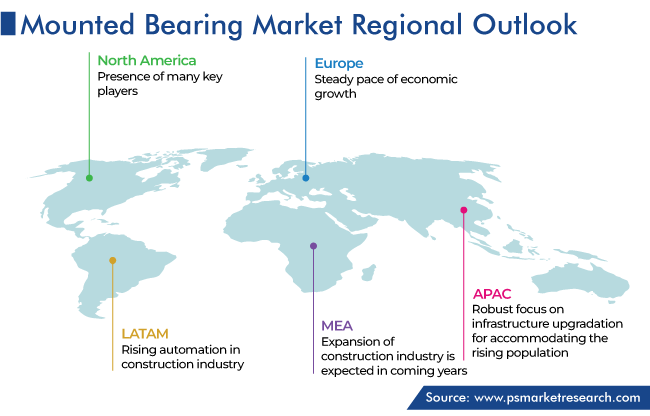

In 2023, APAC accounts for the largest mounted bearing market revenue share, of around 55%. This is attributed to the robust focus on infrastructure upgradation for accommodating the rising population and the creation of a positive economic climate for steel, cement, as well as metallic product manufacturers. The increasing demand for these machine parts in the mining field in countries including China, India, and Japan is essentially contributing toward the growth in market revenue. Additionally, the rising adoption of automation technology for manufacturing and construction in this region is driving the market. The APAC region is also witnessing a rapid expansion in industrial machinery and motor vehicle production.

Furthermore, North America is expected to account for a significant portion of the market for mounted bearings in the coming years. This is owing to the presence of many key players and advancements in manufacturing, material handling, and other industrially relevant technologies, as well as in mounted bearings themselves. For instance, in September 2021, SKF launched a new series of spherical roller bearings in North America, which designed to increase uptime, lower production costs, and reduce the impact of slab, bloom, and billet continuous-casting operations on the environment.

OEM Bifurcation Dominates Industry

The OEM bifurcation holds the larger revenue share in 2023 in the sales channel segment, as most of the high-volume orders for such pieces of machinery are received by OEMs. In addition, the demand for mounted bearings often depends upon the needs of the clients of equipment manufacturers. For instance, the majority of the manufacturers of food & beverage machinery are medium-sized firms, and they develop machines as per the needs of their customers. Moreover, at present, manufacturers of equipment are focusing on offering additional features as standard in machinery, together with post-sales services. This product differentiation strategy is likely to boost the mounted bearing market growth in the OEM category in the coming years.

Top Manufacturers of Mounted Bearings Are:

- ABB Ltd.

- AB SKF

- The Timken Company

- NSK Ltd.

- Schaeffler AG

- NTN Corporation

- Regal Rexnord Corporation

- P.T. International

- Jones Bearing Company

- FYH Co. Ltd.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the mounted bearing market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Product

- Ball

- Roller

Based on Housing

- Plummer Block

- Flanged Block

- Take-Up Block

Based on Equipment

- Ball Mill Drivers

- Fans & Blowers

- Gearboxes & Transmissions

- Conveyors

- Crushers

- Mixer Drivers

Based on Material

- Chrome Steel

- Stainless Steel

- Carbon-Alloy Steel

- Plastic & Non-Metallic Materials

- Babbitt Material

- Cast Iron

- Aluminum Alloys

Based on End User

- Food & Beverages

- Agriculture

- Construction & Mining

- Automotive & Transportation

- Chemical & Pharmaceutical

- Energy

- General Industrial & Machinery

- Pulp & Paper

Based on Sales Channel

- OEMs

- Aftermarket

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for mounted bearings values USD 1,451.0 million in 2023.

The mounted bearing industry is witnessing a CAGR of 5.8%.

Electromechanical systems and IoT sensors are trending in the market for mounted bearings.

The ball category dominates the mounted bearing industry based on product type.

The market for mounted bearings is growing because of the rising usage of these components in almost every industry.

OEMs hold the larger mounted bearing industry share.

APAC is the biggest market for mounted bearings, and Europe offers the most-lucrative opportunities.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws