Report Code: 12845 | Available Format: PDF | Pages: 290

Molded Pulp Packaging Market Size and Share Analysis by Source (Wood Pulp, Non-Wood Pulp), Molded Type (Thick Wall, Transfer, Thermoformed Fiber, Processed), Product (Trays, Clamshells, Cups, Plates, Bowls), Application (Food Packaging, Food Services Disposables, Healthcare, Electronics) - Global Industry Demand Forecast to 2030

- Report Code: 12845

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Molded Pulp Packaging Market Size & Share

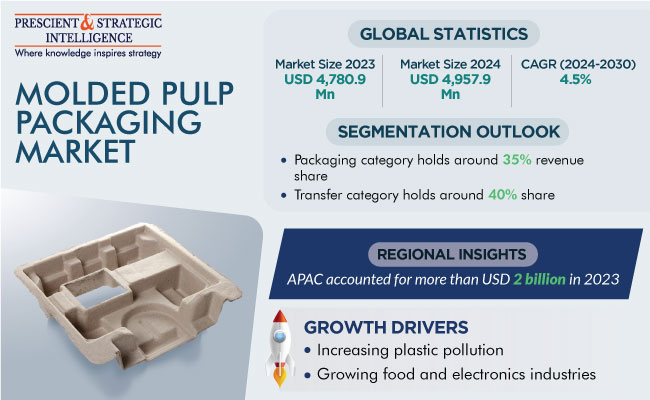

The global molded pulp packaging market generated an estimated revenue of USD 4,780.9 million revenue in 2023, and it is projected to witness a CAGR of 4.5% during 2024–2030, reaching USD 6,469.3 million by 2030. This is attributed to the increasing demand for molded pulp packaging with the rising efforts for reducing the usage of plastic.

This packaging is eco-friendly as the pulp is made from recycled paper, natural plant fibers, and cardboard, which are all biodegradable. This advantage is leading to the increasing demand for pulp packaging in the healthcare, food packaging, food services, electronics, and many other industries.

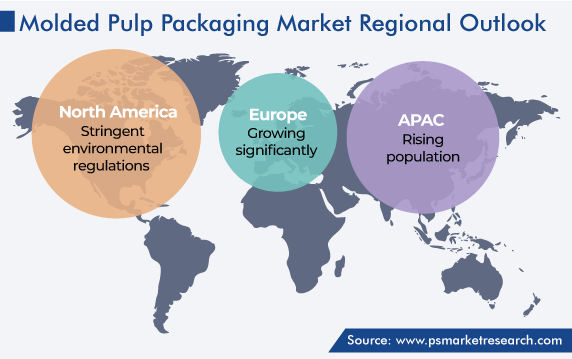

The growth of the molded pulp packaging market is essentially due to the increasing emphasis on sustainable packaging solutions and rising awareness about environmental conservation. Additionally, the demand is fueled by the versatility, cost-effectiveness, and protective qualities of molded pulp. Moreover, the government initiatives and regulations promoting the use of sustainable packaging further stimulate the advance of the market. As nations worldwide commit to reducing their carbon footprint, the packaging industry seeks viable solutions, and molded pulp emerges as a frontrunner.

Additionally, consumer awareness and preferences are evolving, with a growing segment actively seeking products packaged in environment-friendly materials. This shift in consumer behavior acts as a catalyst prompting businesses to adopt molded pulp packaging to meet market expectations and enhance brand image.

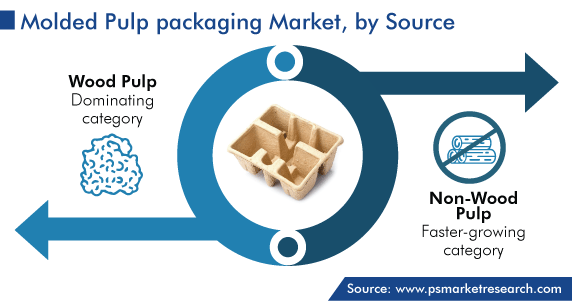

Wood Category Holds Largest Share

By source, the wood category accounts for the largest share in the market because molded pulp is majorly made by breaking down the fibrous parts of trees, mainly the woody part. Moreover, it is easily available, cheaper, and customizable to different shapes and sizes, which makes it a good choice for food packaging. Other industries that use wood pulp molded packaging are electronics and healthcare.

Non-wood pulp is the fastest-growing category, being an important source in regions where forest resources are limited. Moreover, the growing concern for the environment and the increasing rate of deforestation are driving the consumption of pulp made from sources other than wood.

The non-wood plant fibers play a pivotal role in driving the growth of the molded pulp packaging market. Their increasing popularity is attributed to their sustainability, reduced environmental impact, and fast growth of the source crop. This source can provide a lucrative opportunity to market players in countries where wood is limited in availability, such as Nigeria. According to the Food and Agriculture Organization, Nigeria has the highest rate of deforestation, having lost more than half its primary forest in the last five years.

Transfer Category Generates Highest Revenue

By molded type, the transfer category held the largest share, of 40%, in 2023, due to the increasing demand for environment-friendly packaging. Moreover, the rise in the volume of non-biodegradable packing waste encourages the usage of biodegradable and recyclable materials.

Transfer molded pulp is used for various applications, such as in food packaging and semiconductor packaging. This type of packaging is commonly used for eggs, fruits & vegetables, beverage bottles, as well as electronic products and furniture, to protect them from damage during shipping.

The thick-walled category is expected to be the fastest-growing category in the market. These variants usually have walls with a thickness of up to 6 mm, which is why they are used primarily to support the primary packaging. This kind of packaging is used for the transportation of heavy products, such as furniture and flowerpots.

The thermoformed category is also expected to grow with a high rate over the forecast period. Thermoformed molded pulp can be easily molded, customized, and engineered not once, but multiple times, which makes it popular and increases the demand for it.

Trays Contribute Highest Revenue due to Their Wide Application in Food Industry

By product, trays account for the largest share in the market as they are used for various types of items, such as fruits, vegetables, and eggs, in the food service industry. This is because they are light in weight and have appreciable shock absorbing capability. They are also used in the pharmaceutical industry for the packaging of medical devices and surgical equipment. In addition, pulp trays are an excellent green packaging option as they are made from recycled paper.

The clamshells category is expected to grow with the highest CAGR during the forecast period because molded pulp clamshells are extensively used for the packaging of eggs.

Moreover, cups, plates, and bowls hold significant shares because if made from molded pulp, these materials are easily decomposed by microorganisms. Moreover, they create less pollution upon being burned than those made from plastics.

Increasing Plastic Pollution Is Driving Molded Pulp Packaging Usage

The increasing plastic pollution and waste across the globe are the key driving factors for the market. Plastics are cheap, durable, and suitable for different uses; as a result, manufacturers choose them over other materials. However, they are not decomposable, and most of the waste ends up in landfills, where it can take up to a thousand years for it to degrade. Meanwhile, they leach toxic chemicals into the water and soil, which negatively affects plants and marine ecosystems.

Hence, with the increasing concern over plastic pollution, governments have taken numerous initiatives to ban plastic. Moreover, packaging made from molded pulp saves energy and raw materials during production, and it is easily recyclable.

| Report Attribute | Details |

Market Size in 2023 |

USD 4,780.9 Million |

Market Size in 2024 |

USD 4,957.9 Million |

Revenue Forecast in 2030 |

USD 6,469.3 Million |

Growth Rate |

4.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Source; By Molded Type; By Product; By Application; By Region |

Explore more about this report - Request free sample

Packaging of Vegetables, Fruits, and Eggs Is Major Application

By application, food packaging dominates the molded pulp packaging market with a share of 35%. Molded pulp packaging is used for eggs, fruits, and vegetables to provide support and prevent damage to them during transportation and storage. Further, it allows air to come inside, so that these perishable items remain fresh.

The electronics category is set to grow with a significant rate during the forecast period, attributed to the increasing production of electronic gadgets and their high sensitivity to shock. The growing emphasis on sustainable packaging solutions and the rising environmental consciousness are the key drivers for the adoption of molded pulp packaging in the electronics industry. Additionally, its ability to provide effective protection to electronic products during transit contributes to its popularity.

Similarly, in the healthcare sector, this material is used for fragile products and those that are sensitive in nature. This packaging protects products from contamination and physical damage. The increasing demand for surgical equipment and other kinds of medical devices is expected to propel the growth of the market in the healthcare category.

APAC Accounts for Largest Share

Geographically, APAC dominates the market with a share of 45%. This is attributed to the increasing level of urbanization, growing food & beverage industry, rising population, and booming economies of developing countries. In addition, countries such as India, China, and Indonesia contribute significantly to plastic pollution in the oceans, which has stirred consciousness regarding sustainable polymer substitutes.

Thus, governments have taken numerous initiatives to ban the use of plastics, to protect the environment and human health. For instance, in India, the Ministry of Environment, Forest and Climate Change has amended its Plastic Waste Management Rules to ban single-use plastics from July 2022. The items the ban applies to include plates, glasses, cups, cutlery, straws, trays, spoons, wrapping or packing films, invitation cards, cigarette packets, banners less than 100 microns in height, and stirrers.

This step of the government could provide the key market players with a lucrative opportunity to increase their market presence. Additionally, many fast-moving consumer goods (FMCG), food & beverage, and dairy companies that use Tetra packs have shifted from plastic to paper straws.

Key Players in Molded Pulp Packaging Market Are:

- Brødrene Hartmann A/S

- Genpack LLC

- Huhtamäki Oyj

- Sabert Corporation

- Pro-Pac Packaging Limited

- James Cropper Plc

- Henry Molded Products Inc.

Market Size Breakdown by Segment

The study uncovers the biggest trends and opportunities in the molded pulp packaging market, along with offering segmentation analysis at the granular level for the period 2017 to 2030.

Based on Source

- Wood Pulp

- Non-Wood Pulp

Based on Molded Type

- Thick Wall

- Transfer

- Thermoformed Fiber

- Processed

Based on Product

- Trays

- Clamshells

- Cups

- Plates

- Bowls

Based on Application

- Food Packaging

- Food Services Disposables

- Healthcare

- Electronics

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The 2023 revenue of the market for molded pulp packaging was USD 4,780.9 million.

The molded pulp packaging industry will reach USD 6,469.3 million in 2030.

Wood holds the largest share in the market for molded pulp packaging.

The molded pulp packaging industry is propelled by the growing end-use industries and rising worries related to plastic pollution.

Food packaging application generates the highest revenue in the market for molded pulp packaging.

Trays dominate the molded pulp packaging industry, and clamshells are growing the fastest.

APAC has the largest market for molded pulp packaging.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws