Report Code: 12891 | Available Format: PDF | Pages: 250

Mining Machinery Market Size and Share Analysis by Machine Category (Crushing, Pulverizing, and Screening, Mineral Processing, Surface Mining, Underground Mining), Application (Metals, Minerals, Coal), Propulsion (Diesel, CNG/LNG/RNG, Electric), Power Output (Less than 500 hp, 500 to 2,000 hp, More than 2000 hp) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12891

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

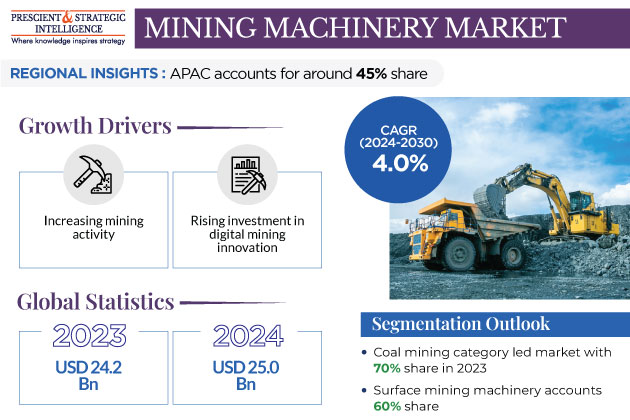

The global mining machinery market valued USD 24.2 billion in 2023, and it is projected to register a CAGR of 4.0% during 2024–2030, reaching USD 31.6 billion by 2030. It is attributed to the increasing mining activity, ultimately to construct roads, bridges, hospitals, and houses, manufacture automobiles, computers, and satellites, generate electricity, and provide the various other goods imperative in modern life. In addition, the advancements in the mining machinery drive the market.

- The increasing investment in digital mining innovation, with the support of governments, is set to boost the demand for advanced mining equipment during the forecast period.

- The innovations in mining technologies have allowed for the extraction of improved grades of ores of various minerals, thus enabling older mines to remain in operation longer.

- Mining is the first step in the conversion of minerals to goods that are essential for maintaining and improving the standards of living.

Moreover, mining is economically important because it offers dividends, employment, and taxes, which allow governments to invest in schools, hospitals, and other public facilities. It also yields foreign exchange and, thus, accounts for a significant portion of the gross domestic product in many countries. Additionally, the activity stimulates many other associated activities, for instance, manufacturing and provision of engineering services.

- Companies in the market are receiving major orders for mining machines, many with advanced battery-electric propulsion, which is expected to drive the market and make the overall metallurgy industry more sustainable.

- For instance, in March 2023, Sandvik AB received an order from Canadian mining company Torex Gold Resources to supply mining equipment for its project in Mexico.

- The value of order is around SEK 650 million.

Surface Mining Held Largest Share in Market

Surface mining machinery accounted for the largest share, of 60%, in the mining machinery market in 2023, and it is expected to showcase a significant growth rate during the forecast period. This is attributed to the increasing demand for coal (for thermal power plants), iron (for building materials and automobiles), and all kinds of other essential raw materials.

- More than 95% of the earth’s crust consists of oxygen, aluminum, silicon, sodium, calcium, magnesium, and potassium.

- The remainder is made of elements such as hydrogen, phosphorous, titanium, manganese, sulfur, nickel, and carbon.

- Additionally, the burgeoning demand for diamonds and chromium in emerging economies will open new opportunities for surface mining equipment manufacturers.

- The diamond industry currently contributes significantly toward the GDP of countries as diamonds are not only prized jewels but also an important industrial material, especially in drilling applications.

Further, many companies offer cost-effective and eco-friendly surface mining equipment that crushes, cuts, and loads rock in a single operation. Many of these machines also load the material directly on to trucks. Further, these machines remove the process of drilling, blasting, and primary crushing, hence eliminating their associated environmental hazards.

Underground mining machinery also holds a significant share in the market, and it is assumed to grow with a good pace during the forecast period.

- This is due to the increasing underground mining activity for natural resources, including gold, iron, silver, copper, nickel, zinc, lead, and tin.

- Moreover, developed underground mining technology has enhanced working circumstances, by enabling underground communication, quick emergency responses, and other functionalities.

- Further, various kinds of machines are available for underground mining, such as crane lifts, continuous miners, drones, jumbo drills, loaders & haulers, longwall mining machines, personnel vehicles, and refuge chambers.

Underground mining is used to extract ore from the earth economically, safely, and with as little waste as possible. Therefore, the increasing demand for minerals that require deeper mining, drives the demand for the associated equipment. The specialized machinery available for the purpose can efficiently and safely operate in challenging underground environments and accident-prone areas.

| Report Attribute | Details |

Market Size in 2023 |

USD 24.2 Billion |

Market Size in 2024 |

USD 25.0 Billion |

Revenue Forecast in 2030 |

USD 31.6 Billion |

Growth Rate |

4.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Machine Category; By Application; By Propulsion; By Power Output; By Region |

Explore more about this report - Request free sample

Coal Mining Category Accounts for Largest Share

By application, the coal mining category led the market with a 70% share of the global revenue in 2023, and it is on path to growing rapidly over this decade.

- The growth of the coal mining industry is attributed to the increasing demand for electricity.

- Thermal power plants produce electricity by burning coal in a boiler to produce steam.

- That steam rotates a turbine, which finally generates electricity in a Megawatt-scale alternator.

Apart from thermal power plants, the cement and steel industries utilize this fossil fuel for the extraction of iron from its ore and for cement production. Mining at a scale large enough to fulfill the global demand for this raw material requires heavy equipment, such as trucks, draglines, hydraulic jacks, conveyors, and shearers. The key coal-producing countries and thus, significant markets for coal mining machinery, in the world are Indonesia, China, India, the U.S., and Australia.

The metal mining category is likely to expand at a significant rate throughout the forecast period. This is attributed to rising demand for precious as well as everyday use metals, such as gold, silver, copper, iron, and aluminum.

Growing Demand for Coal to Meet Rising Demand for Electricity

The increasing demand for electricity is one of the strongest driving forces for the market.

- As the consumption of electricity is increasing day by day due to the rapid urbanization and construction, the electricity demand continues to boom.

- Still, most of the demand for electricity is fulfilled by thermal power plants.

- According to the Ministry of Coal, more than 75% of the total power generation in happens in thermal power plants. Thereby, more deep mining is required for more coal, hence increasing the demand need of mining equipment.

Electrically Powered Machinery Is Trending over Machines with Diesel Engines

The replacement of diesel engines in these machines with pure- and hybrid-electric propulsions is the biggest trend in the market. Such machines create less noise, heat, and pollution compared to those with diesel engines, which is especially helpful in underground mining, where breathing space is limited and ventilation is often challenging. So, the adoption of electric mining equipment provides safer working conditions.

- The lower operational costs of electrical equipment make it even more feasible for companies engaged in extracting minerals from the earth.

- Even in the toughest mining conditions, which are mostly found underground, operator can remain comfortable with safe and easy access to all the service points within the machine cabin.

- All this can improve the operator’s health and satisfaction with a job considered among the most dangerous and prone to accidents and death in the world.

Diesel Accounted for the Largest Share

By propulsion, diesel held the largest share in 2023, and it is expected to grow with a significant growth rate during the forecast period. when the prices of fuel are increasing day by day, the diesel engine has proved to be extremely efficient and cost-effective. Diesel is costlier than gasoline, but it is also denser in terms of energy, which means burning it yields more energy than many other fuels. Therefore, diesel provides higher mileage, which makes it perfect for heavy-duty offroad and on-road equipment. This fuel also has an oilier texture and higher molecular weight than gasoline, and it boils at a higher temperature compared to water. Additionally, diesel engines are more efficient and cheaper than those that use gasoline, which continues to make them popular.

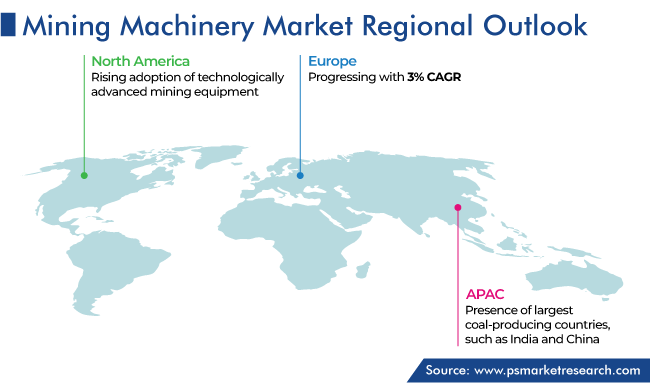

APAC Holds Major Revenue Share

Geographically, APAC is the highest revenue contributor, with a share of 45% in 2023, and it is expected to remain the largest throughout the forecast period.

- This is due to the presence of the largest-coal-producing countries, such as India and China.

- China was the largest-coal-producing country in 2022.

- India and China account for approximately half the coal production globally.

Further, Korba, a district of Chhattisgarh, produces more than 130 million tons of coal every year, which accounts around 20% of India’s total coal production. Similarly, Odisha is one of the most-mineral-rich states in India. Key minerals found in the state are iron, bauxite, coal, manganese, chromite, nickel, limestone, graphite, dolomite, decorative stones, and tin.

- Odisha has emerged as the key state with regard to mineral and metal-based industries.

- In 2019–20, Odisha held the largest share (43.0%) of mineral production (by value) in India.

- The value of the minerals produced in the state reached USD 4.03 billion (INR 299.19 billion) in 2020–21.

In a similar way, Jharkhand has vast reserves of coal, copper, iron, mica, uranium, bauxite, limestone, granite, graphite, silver, and dolomite. Since the state has around 40% of the country's mineral wealth, it becomes especially lucrative for investments in the mining, metals, and related sectors.

The North American region is likely to expand at a significant CAGR over this decade.

- The increasing mining activity, rising adoption of technologically advanced mining equipment, and government initiatives to reduce the dependence on China and other countries for its mineral needs drive the market.

- In addition, the shift from traditional underground mining to the cost-effective open-pit mining is expected to drive the demand for these products during the forecast period.

Top Global Providers of Mining Machinery Are:

- Caterpillar Inc.

- Komatsu Ltd.

- Sandvik AB

- Epiroc AB

- Liebherr-International Deutschland GmbH

- Hitachi Construction Machinery Co. Ltd.

- Henan Baichy Machinery Equipment Co. Ltd.

- Doosan Enerbility Co. Ltd.

- AB Volvo

- SANY Group

Market Size Breakdown by Segment

This report offers deep insights into the mining machinery market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Machine Category

- Crushing, Pulverizing, and Screening

- Mineral Processing

- Surface Mining

- Underground Mining

Based on Application

- Metals

- Minerals

- Coal

Based on Propulsion

- Diesel

- CNG/LNG/RNG

- Electric

Based on Power Output

- Less than 500 hp

- 500 to 2,000 hp

- More than 2000 hp

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The worldwide mining machinery industry will touch USD 31.6 billion by the end of the decade.

The market is projected to advance at a CAGR of 4.0% in the coming years.

The growing need for raw materials like coal, iron, and minerals, propelled by infrastructure projects, technical improvements, and power generation requirements, is the key driver behind the development of the mining machinery industry.

A notable trend is the rising adoption of digital mining innovations and advanced equipment, supported by governmental investments, enhancing operational efficiency and extending the lifespan of mines.

The APAC region dominates the market, contributing 45% of the revenue.

The key driver is the substantial coal production in countries like India and China, with China being the largest coal producer, along with significant contributions from regions like Chhattisgarh, India, which produces millions of tons of coal annually.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws