Report Code: 12029 | Available Format: PDF | Pages: 173

Microdisplay Market Research Report: By Technology (LCD, LCOS, OLED, DLP), Product Type (Near-To-Eye Device, HUD, Projector), Brightness (<500 Nits, 500-1,000 Nits, >1,000 Nits), End User (Consumer Electronics, Industrial, Automotive, Military & Defense, Sports & Entertainment, Retail & Hospitality, Medical Devices) - Global Industry Analysis and Competitive Landscape to 2030

- Report Code: 12029

- Available Format: PDF

- Pages: 173

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

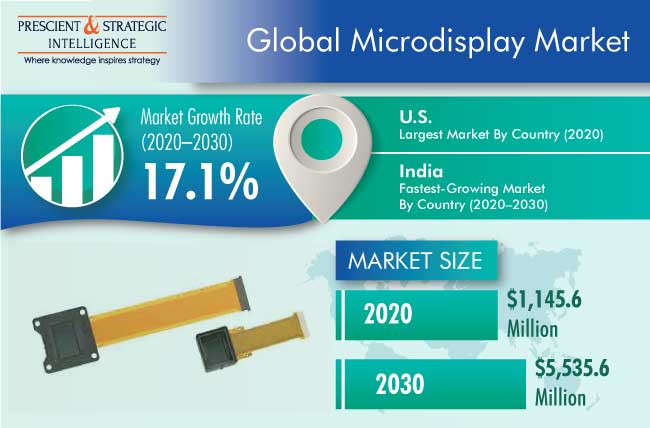

The global microdisplay market revenue stood at $1,145.6 million in 2020, and it is expected to grow at a CAGR of 17.1% during 2020–2030. The key factors responsible for the growth of the market include the rising adoption of head-up display (HUD)-integrated advanced driver assistance systems (ADAS) and increasing number of near-to-eye (NTE) applications.

During the COVID-19 pandemic, the production of all kinds of display screens was halted, and even the end products faced a reduced demand due to the closing of academic centers, corporate houses, and hospitality sector. Additionally, shops selling the end products have faced huge losses as they were also shut down for a considerable period. This, in turn, led to slower growth of the market for microdisplay in 2020 compared to earlier.

Liquid Crystal Displays (LCDs) and Projectors Accounted for Dominating Shares

The LCD category held the dominating share in the microdisplay market in 2020, based on technology. This is majorly attributed to the fact that these displays account for a lower power consumption, compact size, and low price. As a result, using LCDs, manufacturers have been able to reduce the size of these components over time. LCD displays are currently being used in head-mounted displays (HMDs), HUDs, electronic viewfinders (EVFs), thermal imaging glasses, and wearables.

Projectors held the largest share in the market in 2020, based on product type. This is attributed to the rising adoption of data projectors in the education and business sectors. Moreover, the government initiatives for increasing the adoption of digital technologies are one of the prime reasons for the growing demand for projectors.

Microdisplays with Brightness of <1,000 Nits and Automotive End Users To Witness Fastest Growth

The more than 1,000 nits category is projected to be the fastest-growing category in the microdisplay market during the forecast period (2021–2030), on the basis of brightness. This can be majorly attributed to the growing demand for HMDs owing to the increasing adoption of augmented reality/virtual reality (AR/VR) devices. The screens with high-brightness are used in HMDs in industries such as medical devices, military & defense, and aerospace to obtain a clear view of an image or object. Moreover, these offers a better viewing experience to users, which results in their increasing popularity for high-brightness display devices.

The automotive category is projected to witness the fastest growth in the market for microdisplay, during the forecast period, under segmentation by end user. This is attributed to the growing adoption of ADAS, especially those integrated with HUDs, in automobiles. Further, the sports & entertainment category is expected to register considerable growth during the forecast period owing to the increasing adoption of VR gaming headsets.

Asia-Pacific (APAC) Region Dominated Market

Geographically, the APAC region held the largest share in the global microdisplay market in 2020, and it is further expected to lead the market during the forecast period. Moreover, the APAC region is expected to be the fastest-growing market during the forecast period. This can be attributed to the presence of a substantial number of manufacturers in the region, which has led to a decrease in the prices of these products and an increase in the penetration of microdisplay-based devices.

Moreover, the increasing urbanization rate, coupled with the growing automotive and consumer electronics industries, is driving the demand for these screens in the region. China and Japan are among the major hubs for the consumer electronics and automotive industries in the world.

Usage of Organic Light-Emitting Diode (OLED) Microdisplays in Consumer Electronics Is Key Trend

A key trend being observed in the microdisplay market is the use of OLED microdisplays in consumer electronics. These components offer a compact size with a high pixel density and resolution, thus resulting in a better picture quality. These components are being increasingly used in consumer electronic products, especially VR headsets, which are themselves witnessing a rise in adoption. Youngsters are swiftly adopting VR headsets compatible with smartphones and other devices for an improved gaming experience. Smartphone manufacturers, such as Samsung Electronics Co. Ltd. and One Plus Technology Co. Ltd., offer VR headsets with new smartphones.

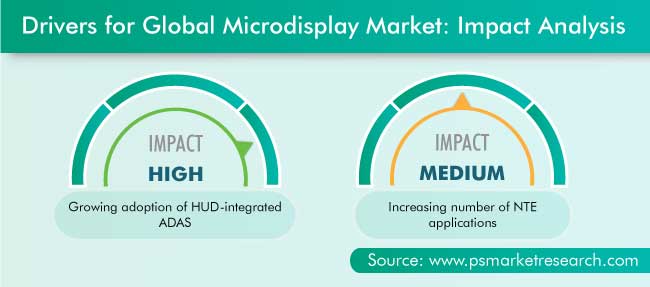

Adoption of HUD-integrated ADAs and NTE Devices Is Driving Market Growth

The growing adoption of advanced ADAS, coupled with the surging demand for HUDs, is a key factor driving the microdisplay market. The demand for ADAS is increasing at a rapid pace, especially in the U.S., Japan, and China. As per the Federal Motor Carrier Safety Administration (FMCSA), in 2019, the U.S. started a project on the adoption of ADAS in the trucking industry because of ADAS’ demonstrated potential in reducing fatalities, injuries, and crashes. The project received a total funding of $0.65 million from the government, and it is expected to be completed by the end of 2021.

The rising demand for microdisplays in NTE applications is another major factor driving the market for microdisplay. These screens are increasingly finding usage in NTE devices, such as AR/VR headsets, HMDs, personal electronics, such as mobile phones and cameras; as well as full-color projection devices. Among these, AR/VR devices and HMDs are its major applications. The increasing demand for AR and VR devices from the media & entertainment and gaming industries strengthens the prospects for these products.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$1,145.6 Million |

Market Size Forecast in 2030 |

$5,535.6 Million |

Forecast Period CAGR |

17.1% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Technology; By Product Type; By Brightness; By End User; By Region |

Market Size of Geographies |

U.S.; Canada; Germany; France; U.K.; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; Turkey; Saudi Arabia; South Africa |

Secondary Sources and References (Partial List) |

American Automobile Association; China Shopping Center Development Association; Digital Signage Federation; International Council of Shopping Centers; International Sign Association; National Automobile Dealers Association; National Retail Federation; Shop and Display Equipment Association; State Retail Associations; Society of Information Display; Video Electronics Standards Association; World Bank |

Explore more about this report - Request free sample

Market Players Involved in Product Launches to Gain Significant Position

The global microdisplay industry is highly competitive in nature with the presence of numerous global players. In recent years, players in the industry have been involved in product launches in order to attain a significant position. For instance:

- In January 2021, LG Display Co. Ltd. unveiled its next-generation OLED TV display. The new 77-inch OLED display shows significant progress in the picture quality through the addition of a layer to the display, thereby improving its efficiency by around 20%. A higher efficiency means improved brightness to show more-vivid images.

- In January 2020, Himax Imaging Inc., a subsidiary of Himax Technologies Inc., announced the commercial availability of HM0360, an ultra-low-power and low-latency back-illuminated complementary metal-oxide semiconductor (CMOS) image sensor with autonomous modes of operations for ‘always on’ and intelligent visual sensing features, such as human presence detection and tracking, gaze detection, behavioral analysis, and pose estimation, for growing markets, such as smart homes & buildings, healthcare, smartphones, and AR/VR.

Key Players in Global Microdisplay Market Are:

- eMagin Corporation

- Himax Technologies Inc.

- Jasper Display Corp.

- Yunnan OLiGHTEK Opto-Electronic Technology Co. Ltd.

- WiseChip Semiconductor Inc.

- Micron Technology Inc.

- Seiko Epson Corporation

- Kopin Corporation

- Microtips Technology Inc.

- LG Display Co. Ltd.

- Universal Display Corporation

- Sony Corporation

Market Size Breakdown by Segments

The global microdisplay market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Technology

- Liquid Crystal Display (LCD)

- Liquid Crystal on Silicon (LCOS)

- Organic Light-Emitting Diode (OLED)

- Digital Light Processing (DLP)

Based on Product Type

- Near-To-Eye (NTE) Device

- Electronic viewfinder (EVF)

- Head-mounted display (HMD)

- Augmented reality (AR)

- Virtual reality (VR)

- Heads-Up Display (HUD)

- Projector

- Pico projector

- Data projector

Based on Brightness

- <500 Nits

- 500–1,000 Nits

- >1,000 Nits

Based on End-User

- Consumer Electronics

- Industrial

- Automotive

- Military & Defense

- Sports & Entertainment

- Retail & Hospitality

- Medical Devices

Geographical Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Turkey

- Saudi Arabia

- South Africa

The market for microdisplays valued $1,145.6 million in 2020.

Based on technology, the microdisplay industry is led by the LCD category.

APAC is the largest market for microdisplays.

The growing automotive sector is driving the microdisplay industry by leading to the rising demand for ADAS integrated with HUDs.

Most players in the market for microdisplays are launching new products.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws