Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 22.4 Billion |

| 2030 Forecast | 27.4 Billion |

| Growth Rate(CAGR) | 3.4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12763

Get a Comprehensive Overview of the Metal Fabrication Market Report Prepared by P&S Intelligence, Segmented by Metal Type (Aluminum, Steel, Copper, Magnesium), Service Type (Cutting, Casting, Forging, Machining, Welding), End User (Aerospace, Automotive, Construction, Electronics, Manufacturing, Power & Utilities), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 22.4 Billion |

| 2030 Forecast | 27.4 Billion |

| Growth Rate(CAGR) | 3.4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The metal fabrication market estimated revenue is USD 22.4 billion in 2024, and it is expected to witness a compound annual growth rate of 3.4% during 2024–2030, to reach USD 27.4 billion by 2030.

The adoption of automated fabrication procedures as well as the rapid pace of infrastructure development activities are some of the major factors enabling the market expansion.

Metals are fabricated to create or form the required structure by putting them through one or more processes, including casting, cutting, forging, welding, and machining. This way, a customized object can be created that is strong, durable, and would usually last a long time. It would not get damaged easily, as metallic elements are mostly able to maintain high temperature resistance and are cost-effective as well.

The final products are utilized in various ways depending on the specific metal, process used, and their structure. The most-common applications for them are bolts, screws, cutlery, and pipes & fittings.

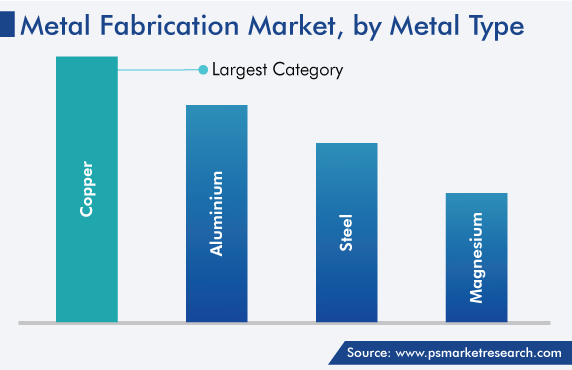

The copper metal type category holds the largest market share in 2023, and it is expected to grow at a CAGR of 3.2% during the projection period. This is owing to the numerous applications of copper products in different industries.

Copper has great electrical conductivity, thermal conductivity, and ductility, and it does not corrode easily. Hence, it is suitable for various uses, such as electrical wiring, heating systems (such as radiators), circuit boards, and water pipes & fittings. Apart from electrical wiring, where it is used as a conductor, it is also used as a roofing material, on door handles, railings, faucets, and cookware. It is also used in oil coolers, sculptures, musical instruments, and jewelry. Additionally, due to its antimicrobial properties, it is well-suited for the equipment used in the food processing industry.

Aluminum is also a commonly fabricated metal. Apart from its application in the aerospace industry, it is now commonly used in high-rise apartments and buildings and in the production of electronic devices and other equipment. This is because it offers advantages in terms of weight, cost, and durability. It weighs less than iron and steel, can be molded with much ease, tends to corrode less, has appreciable electrical as well as thermal conductivity, and can withstand different types of finishes, such as paints and powder coatings.

The welding service type category holds a significant market share. This can be attributed to the various applications of welding in the manufacturing of light as well as heavy equipment, machinery, and automotive parts and at construction sites.

Welding is a process that involves the precise joining of two or more pieces of metal together. The process aids in making a useful product, part, component, or equipment with a good finish that is strong and can hold its shape or form. There are various types of welding, such as arc welding, friction-stir welding, forge welding, and oxy-fuel welding. Although, it is a simple process, all necessary safety guidelines must be followed, and it must be carried out by skilled laborers to ensure the safety of the worksite and the quality of the finished object.

Furthermore, since it is widely used in the aerospace, manufacturing, and related industrial applications, along with the construction industry, the rapid pace of both industrialization and urbanization would escalate its usage.

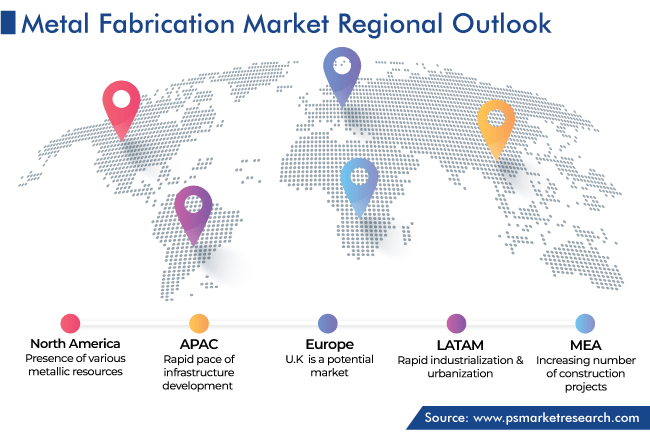

The Asia-Pacific region dominates the market, and it is expected to grow at a CAGR of 3.6% during the projection period, to maintain its dominance. The growth and dominance can be attributed to the rapid pace of infrastructure development in the region and the government initiatives to promote manufacturing in the respective countries.

China and India are the two countries that are likely to lead the overall growth in the region. According to data from a government organization, the Indian government has taken several initiatives to boost manufacturing, including a reduction in corporate tax, FDI policy reforms, and introduction of the Goods and Services Tax. Additionally, the Phased Manufacturing Programme was implemented in 2022 for promoting the manufacturing of electric vehicles and their different parts. Apart from these, the Make in India, National Industrial Corridor Development Programme, and Production Linked Incentive scheme drive the demand for fabricated metal products in India.

In the same way, China is undertaking large-scale projects to propel industrialization. According to reports, currently, it is able to produce approximately 1 billion tons of crude steel yearly. Additionally, it is one of the largest producers of aluminum, the production of which reached about 6.7 million tons in the initial months of 2023. All these factors, i.e., the easy availability of metals for fabrication, along with the rising rate of industrialization, are indicative of its current and potential contribution to the market growth.

Moreover, an increase in both exports as well as domestic consumption is leading to economic growth in the countries in the APAC region. Consumption is rising due to a vast population, generation of employment opportunities, and increase in wages. Thus, overall, the demand of people for more facilities, goods and services, and infrastructure is rising in the region, thereby promoting industrialization and urbanization at a fast pace.

The presence of various manufacturing units and metallic elements, in addition to the growing number of construction projects, will drive the metal fabrication market in the coming years.

Based on Metal Type

Based on Service Type

Based on End User

Geographical Analysis

Drive strategic growth with comprehensive market analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages