Market Statistics

| Study Period | 2019 - 2030 |

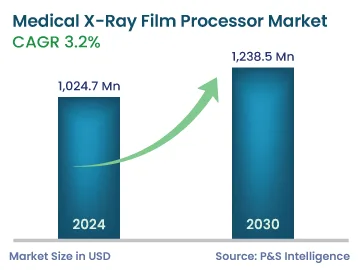

| 2024 Market Size | 1,024.7 Million |

| 2030 Forecast | 1,238.5 Million |

| Growth Rate(CAGR) | 3.2% |

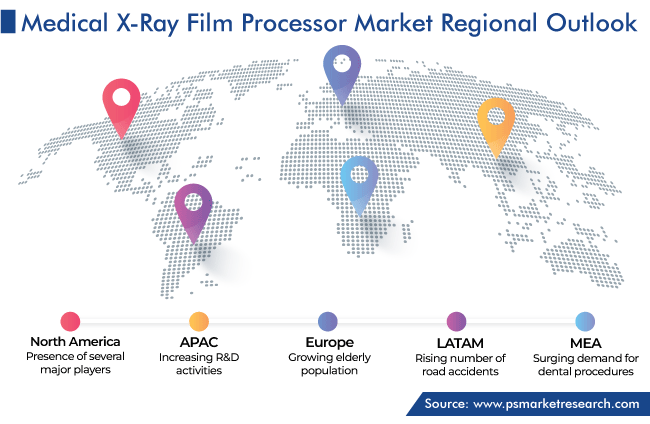

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12793

Get a Comprehensive Overview of the Medical X-Ray Film Processor Market Report Prepared by P&S Intelligence, Segmented by Type (Semi-Automatic Film Processor, Fully Automatic Film Processor), Application (Dental, Mammography, Orthopedic), End User (Hospitals & Clinics, Diagnostic Centers, Research and Educational Institutions), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 1,024.7 Million |

| 2030 Forecast | 1,238.5 Million |

| Growth Rate(CAGR) | 3.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global medical X-ray film processor market is projected to generate USD 1,238.5 million revenue by 2030, advancing at a CAGR of 3.2% during 2024–2030, growing substantially from USD 1,024.7 million in 2024. This is ascribed to the rising incidence of cancer, orthopedic diseases (including arthritis), dental problems, and cardiac diseases, along with the increasing number of X-ray imaging procedures, rising awareness of early diagnosis, and surging healthcare expenditure.

In 2021, approximately 1.2 million heart surgeries were performed across the globe. Similarly, in the U.S., around 850,000 knee replacements are done annually, as the geriatric population often requires this procedure. This shows that the demand for X-ray systems has increased for accurate diagnosis due to the rising incidence of cardiovascular and orthopedic diseases across the globe.

Moreover, the launch of new products is expected to generate opportunities for the market players to grow. For instance, in March 2022, Konica Minolta launched a cassette-type digital X-ray system, named AeroDR 3 1417HL, which captures high-quality images.

X-ray imaging has led to improvements in the early diagnosis and treatment of various conditions, such as injuries to the bone, tumors, dental problems, and pneumonia. This has led to the widespread adoption of X-ray imaging systems, and, subsequently, X-ray films and film processors. Thus, with the rising prevalence of the above-mentioned and numerous other diseases, the volume of X-ray imaging, to diagnose them, is increasing. In addition, the booming number of collaborations between hospitals and market players to acquire high-quality images propels the demand for advanced radiographs. This will, in turn, boost the demand for films and film processors over the forecast period.

Moreover, the rising number of hospitals leads to an increase in the number of dental and orthopedic surgeries, itself due to the increasing number of patients across the globe. According to a government source, the healthcare sector in India is one of the most promising, with projections for it to grow to over USD 370 billion by 2023.

The fully automatic film processor dominated the market, with a share of 60%, in 2023, due to the high image quality of these variants. Moreover, as they require less processing time than the manual ones, more films can be processed in a given period. Moreover, the automated variant reduces the variability in the film quality better in comparison to manually processed films, because the processing time, solution temperature, and chemical replenishment are controlled automatically.

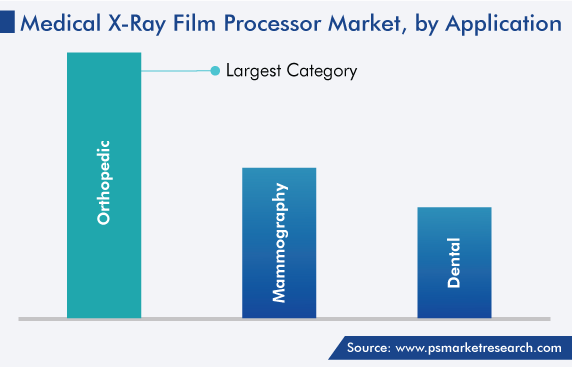

The orthopedic category held the largest market share, based on application. This is due to the extensive usage of X-rays in many orthopedic practices to diagnose and monitor bone and joint conditions, such as fractures, dislocation, and arthritis. X-ray film processors are used to develop X-ray films needed to produce diagnostic images, which help healthcare professionals detect the condition and treat the patient accordingly.

Thus, the increasing number of orthopedic cases is expected to drive the market growth. For instance, in the U.S., approximately 7 million orthopedic surgeries were performed in 2021, which reflects a substantial volume of X-ray scans for diagnosis.

The demand for X-ray film processors at diagnostic centers is increasing rapidly in developing countries. This is due to the rise in the number of diagnostic centers, their easy accessibility, and less-expensive nature than full-fledged hospitals. As per UnitedHealth Group, on average, hospitals charge 175% more for a test than a diagnostic center.

The growing aging population across the globe has created a positive impact on the market, as they are not as financially strong, thus find diagnostic centers more affordable than hospitals. As such people are more prone to cancer and cardiac diseases, the volume of X-rays is predicted to increase, thus propelling the sale of film processors. In this regard, the surging awareness of early disease diagnosis is expected to boost the market growth. Moreover, the rising government investment in the healthcare sector will result in an increase in medical diagnostic equipment and associated consumable shipments.

Market players have grown over the historical period by adding new products to their portfolios and increasing the frequency of acquisitions and collaborations. In addition, these strategic alliances and product launches lead to a competitive edge.

For instance, in March 2021, Fujifilm Corporation announced that it has entered into an agreement with Hitachi Ltd. to acquire Hitachi’s diagnostic imaging business, in order to expand its healthcare business.

Drive strategic growth with comprehensive market analysis

With the increase in the incidence of chronic diseases and the rise in the aging population, the demand for X-ray imaging procedures has risen in North America. Furthermore, the market is driven by the presence of several major players, availability of technologically advanced products, and rising awareness of the early diagnosis of diseases. In addition, in the U.S., the number of hospitals is increasing, with around 8,000 of these functioning as of 2023.

The increasing burden of orthopedic and other chronic ailments is the biggest driver for the demand for radiography film processors. In the U.S., as per the Centers for Disease Control and Prevention, chronic diseases are one of the prime causes of disability and death. Additionally, over 15 million people across the U.S. are suffering from chronic obstructive pulmonary disease (COPD). Such patients are mainly prescribed X-rays of the chest in the case of any difficulty in breathing.

Further, the increasing government funding has propelled the awareness of early detection and cure, which is further expected to augment the X-ray film processor industry across the North American region.

Asia-Pacific is expected to witness the fastest growth during the forecast period. This is mainly attributed to the increasing R&D activities, huge patient pool, government initiatives to promote early and effective diagnosis and treatment as well as improve healthcare infrastructure, and rising demand for advanced medical imaging devices. In addition to this, the rapid growth of the economy and development of the healthcare system in Japan, China, and India are expected to stimulate this expansion.

Moreover, hospitals play an important role in medical diagnostics. In China, the total number of hospitals has risen from roughly 21,000 in 2010 to 38,000 in 2021.

This fully customizable report gives a detailed analysis of the medical X-ray film processor market, based on all the relevant segments and geographies.

Based on Type

Based on Application

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages